First, the bottom line? Policy uncertainty rattles confidence

- The consumer mood has dimmed further in recent weeks — not surprisingly given growing concerns about the potential impact of a flurry of policy developments coming out of Washington, D.C.

- Whether the whirlwind of executive orders ultimately prove successful in achieving the administration’s stated goals has mattered little to consumers. The more immediate effect has been to raise more questions about what it all means for the jobs market, for inflation, and more broadly the near-term economic outlook.

By the numbers: The consumer mood continues to slump

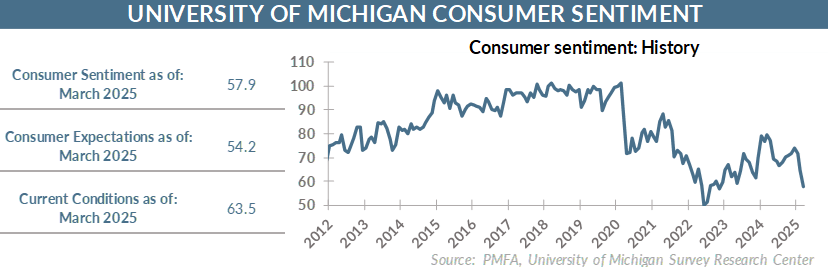

- Consumer sentiment soured in March, as illustrated by the sharp decline in the University of Michigan’s Index of Consumer Sentiment slipped for the third consecutive month. The index reading of 57.9 was its lowest since November 2022, when inflation was still north of 7% and the stock and bond market were under pressure, weighing on household financial positions.

- Consumers were more restrained in their assessment of current economic conditions in March, but the more significant slippage was clearly visible in expectations for the coming year and beyond. That component dropped sharply from 64.0 in February to 54.2 this month — a considerable drop over just a few weeks. It’s also about 30% lower than its 77.4 reading a year ago.

- While few economists publish a forecast for consumer sentiment, the actual reading was not only well below the consensus expectation of 63.1, but below even the most cautious estimate in the range.

- Consumers are also showing an increasing wariness over the inflation outlook. The one-year forward expectation rose to 4.9%, with the five-year expectation rose sharply to 3.9%.

Broad thoughts

- Ironically, the March survey drops on a morning that the stock market is in positive territory after a difficult week for the markets.

- There’s been a sea change in tone from the typical post-election bump that helped to lift stocks and embolden strong consumer spending through the end of the year. More recently, economic data has pointed to consumers that have been a bit more tight-fisted in their spending and a stock market that’s recalibrating expectations in response to the changing outlook.

- Notably, the slide in consumer sentiment doesn’t appear to break cleanly across several of the lines that sometimes come into play. A more cautious tone was struck across all groups, without regard to age, financial position, education level, and political affiliation. The decline doesn’t reflect a harsher assessment of conditions by a particular group, but a much more cautious consumer base in general.

- Moreover, the survey was completed before the some of the recent skid in the stock market, which could continue to bleed into weaker results in the next iteration if it continues.

- Beyond the erosion in confidence, the sustained increase in inflation expectations in recent months is as notable as it was predicable given the daily drip of tariff announcements on top of inflation gauges that remain elevated even before the potentially inflationary impact of tariffs are factored in.

- For consumers, resurgent inflation risk may already be apparent in a recent shift in consumption patterns as households look to trade down to more budget-friendly options. It may also help to reinforce a more broad-based slowdown in spending, particularly on discretionary goods and services.

- Growth estimates have been lowered, although there are few calling for a near-term recession. Some are pointing to the growing risk of stagflation — a backdrop defined by a growth slowdown and rising inflation. The implementation of tariffs on a wide range of imported goods would be expected to exacerbate that potential risk.

- A stagflationary outcome would also muddy the waters for Fed policymakers, who will have to weigh the relative risks in guiding interest rate policy. The Fed is expected to stand pat next week, but investors and economists will be listening closely to Fed Chair Jay Powell’s comments and flyspecking the central bank’s updated projections for clues about what may be in store for interest rates for the rest of the year.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.