Please note that the information provided herein reflects current perspectives on tariff-related developments, which are subject to change or become quickly outdated due to the fluid nature of news flow and policy adjustments.

About a month ago, the proposed 25% import tariff on Canada and Mexico dominated headlines. Initially, capital markets were volatile but stabilized after a 30-day delay was negotiated. That delay expired this week, prompting a return of market volatility and further negotiations that have recently led to temporary extensions for at least a portion of goods impacted.

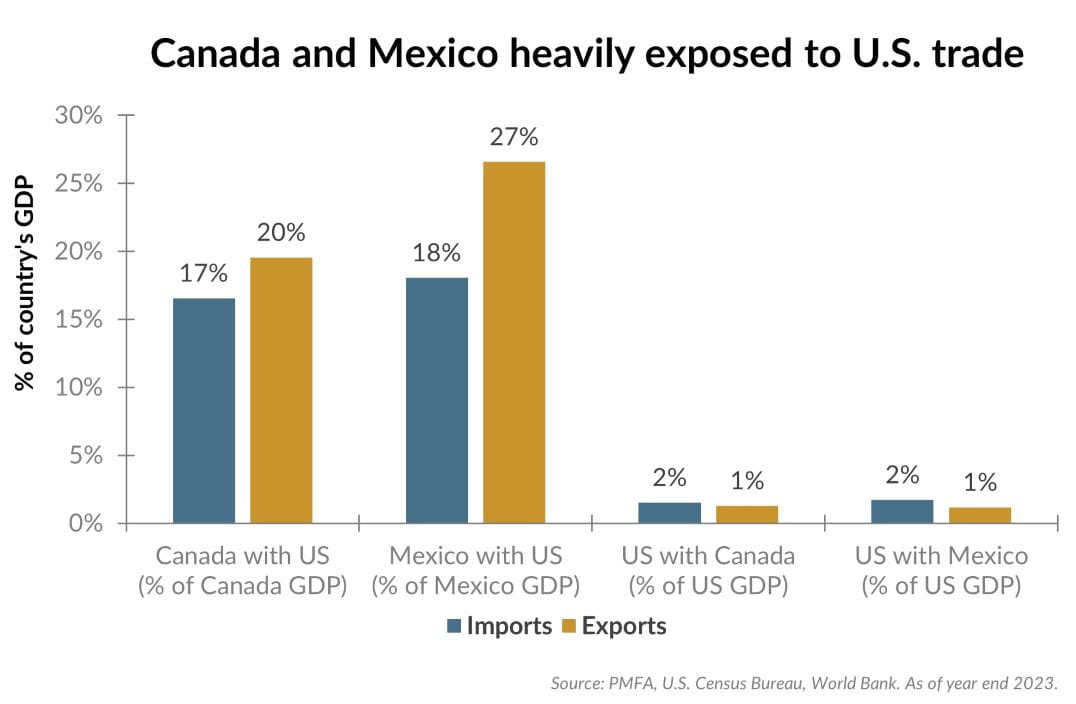

Policies influencing trade flows between Mexico, Canada, and the United States can be viewed quite differently from the perspective of each country. This is particularly evident given that the U.S. economy is 12 times larger than Canada’s and 15 times larger than Mexico’s. As shown in the visual above, those economies are heavily reliant on trade with the United States, as exports to the U.S. account for a sizeable percentage of each country’s GDP. Mexico’s exports to the United States, specifically, represent nearly 30% of its GDP. By comparison, the value of U.S. exports to Mexico and Canada combined accounts for less than 3% of U.S. GDP.

The combination of tariffs imposed by the United States and the response from our trade partners could prompt a broader reassessment of global trade and further steps toward deglobalization. However, it’s important to remember that the situation remains quite fluid. For now, ongoing trade policy uncertainty could continue to be a source of capital market volatility. Against that backdrop, investors will be well served to remain broadly diversified and positioned for a wide range of outcomes, while ensuring that one’s portfolio is appropriately aligned with desired investment goals and objectives, risk tolerance, and time horizon.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.