The bottom line? Tariff uncertainty creates doubt

- On a backward-looking basis, inflation’s step down was an unexpected, positive development that provides a modest sense of relief, as the economy braces for the full impact of tariffs in the near term.

- Moreover, the fact that the decline didn’t hinge on a big decline in food or energy prices alone suggest that the easing in price pressures was relatively broad based.

- What the report doesn’t reveal is what’s yet to come. Consumers are bracing for imminent increases in the prices on a range of imported goods as a direct result of a flurry of import tariff announcements out of Washington, D.C.

- Tariffs are widely expected to provide a fresh blast of oxygen for the inflation fire, but the magnitude of the impact remains to be seen. They remain a moving target by virtually any measure. The timing of tariff implementation remains fluid, as does their target, breadth, and magnitude.

- The uncertainty concerning tariffs remains a huge source of angst for investors, consumers, and businesses alike. Understanding that the rules of the game are changing is one thing; understanding what those rules will be and when they’ll be clearly defined are another thing entirely.

- That uncertainty — and the whipsaw of expectations — has loomed over the stock market in recent weeks. One report isn’t likely to change that narrative or swing investors back into a risk-on mood, but it has provided at least a temporary reprieve in early trading today.

- The backward-looking data was better than expected, providing a rare source for optimism against a recent flurry of soft economic data. That doesn’t fundamentally change the backdrop for where the economy is headed though — and that’s where very real, significant questions remain unanswered.

By the numbers: Better news on shelter, other services

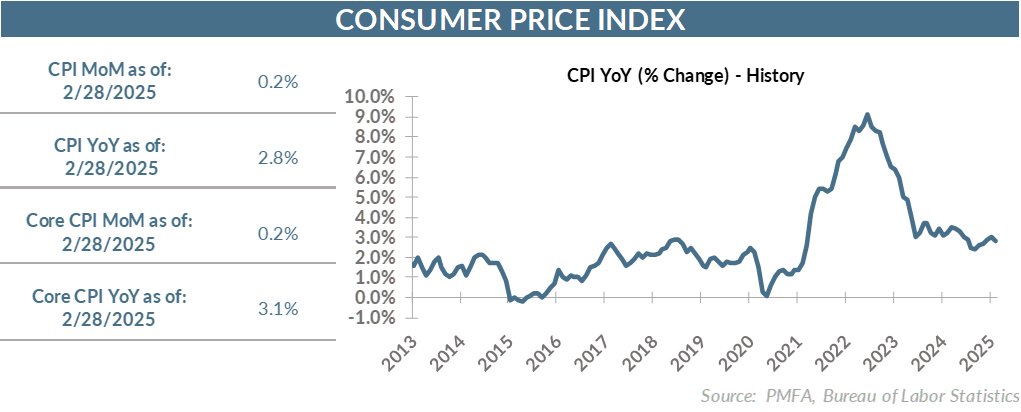

- The consumer price index edged higher in February, rising by 0.2% — fractionally better than the consensus forecast of 0.3%. The 0.2% increase was the lightest since last October.

- Core inflation, which excludes more volatile food and energy prices, also rose by 0.2% for the month, coming in better than the 0.3% expectation.

- Among the most volatile parts of the consumer spending basket, the news was relatively good. Grocery inflation has reverted to around 2%, while energy prices were essentially flat over the past year.

- Of particular note is service-sector inflation, which rose by 0.3% in February. While still elevated, inflation in the service sector has continued to gradually ease over the past year. The 4.1% reading for the year ended in February was the lowest in three years.

Continued progress toward shelter cost stability

- Surging housing costs remain a major challenge for households, particularly for renters and those looking to buy a home. Like the broader services benchmark, shelter prices continue to retrench.

- Shelter inflation remains a significant driver behind elevated inflation, in part due to its significant representation within the consumer price index, making it a critical component of bringing inflation back to the Fed’s 2% target.

- The bad news is that rental rates and home prices aren’t going to decline en masse, particularly given the underinvestment in single-family homes in the post-housing bust era. Higher prices are likely here to stay. The good news is that shelter inflation has fallen by nearly half from 8.2% nearly two years ago to 4.2% over the past year. That’s a considerable, persistent decline to date, with further runway to return to the pre-COVID-19 era norm.

- Lower shelter inflation won’t alleviate the pain of higher prices, but greater price stability should provide some relief about future rent increases for many households. Increasingly stable home prices should also help potential buyers finally cross the threshold of a purchase rather than chasing rising prices that keep that purchase just out of reach.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.