Please note that the information provided herein reflects current perspectives on tariff-related developments, which are subject to change or become quickly outdated due to the fluid nature of news flow and policy adjustments.

With trade policy and import tariffs dominating news headlines, investors are closely monitoring the situation. Import tariffs have real implications for both importing and exporting countries, directly impacting inflation and real GDP to varying degrees. They also influence consumption decisions, interest rates, and domestic industry incentives. Its directional impact on each of these variables is far from formulaic though, as we discussed in a recent market commentary.

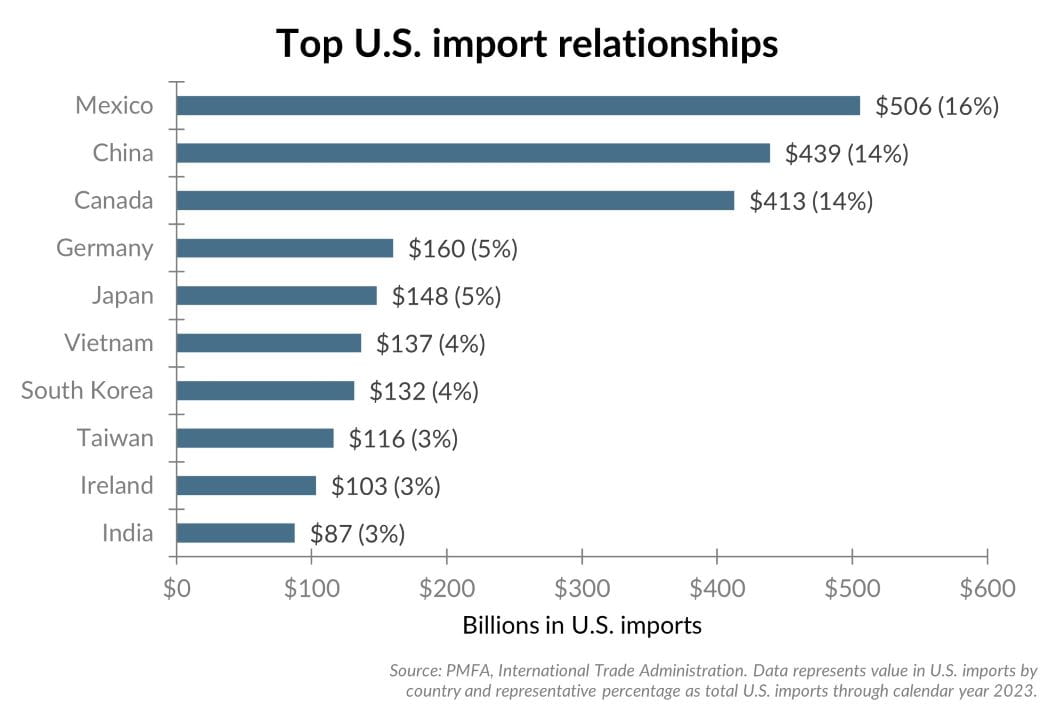

The visual above portrays the top 10 countries by dollar value of imports into the United States. Those countries that have been most heavily involved in recent tariff announcements — Mexico, China, and Canada — sit squarely atop the list, accounting for over 40% of all U.S. imports.

Suffice it to say, imposed tariffs on these countries could have significant influence on the nature of U.S. international trade relations, although the magnitude and duration of what’s imposed will matter. Tariffs are also being utilized as negotiating leverage related to nontrade-related matters, most notably border security, drug trafficking, and immigration. With this in mind, both the near-term impact of higher import costs and future relationships with historically important trading partners remains a primary focus for business leaders and investors, requiring a potential rethink of supply chains and capital expenditures.

Our accompanying piece addresses this further, focusing on trade dependency and relative economic impact.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.