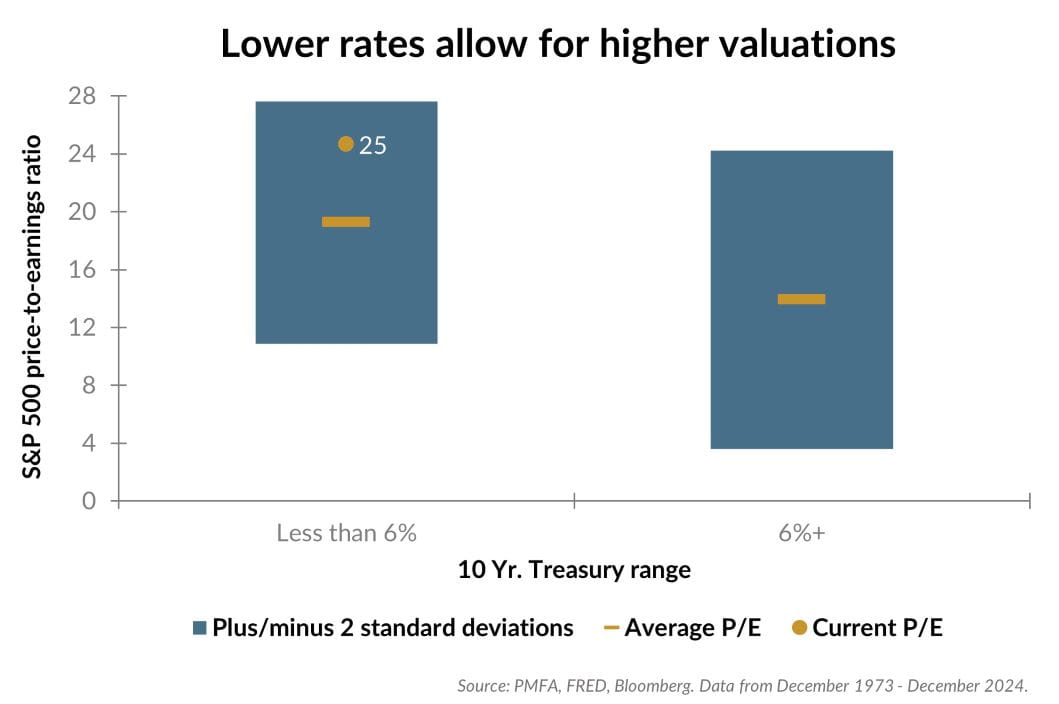

Equity markets have been on a rapid upward trajectory over the past two years, lifting index-level price/earnings (P/E) multiples (and other valuation metrics) to a range unseen in over two decades. However, a low-rate environment has typically justified higher stock market valuations than when rates have been unusually high.

While the valuation range has been broad, the average P/E ratio for the S&P 500 index has been near 20 when 10-year Treasury yields have been below 6% over the past 50 years. In contrast, when rates have been above the 6% threshold, that average has been considerably lower — around 14 times earnings. This dynamic intuitively makes sense, as lower rates make it easier and less expensive for businesses to borrow and raise capital, while higher rates tend to restrict business activity. In addition, higher interest rates incentivize investors to demand higher expected returns from stocks to justify taking on the additional risk that accompanies moving beyond bonds to stocks, pushing their valuations lower.

Treasury yields have risen sharply in recent years, but still aren’t unusually high relative to history. U.S. large-cap equity valuations are elevated, but the rate environment helps to justify index-level price multiples that are higher than their long-term average. In addition, as we discuss in our accompanying piece, the interest rate environment isn’t the only factor supporting higher valuation multiples, but it’s one that shouldn’t be overlooked.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.