The role of bonds, particularly high-quality bonds, is to act as a relative safety net for portfolios over time — providing a consistent income stream, enhancing diversification, and reducing portfolio risk. While those benefits have been consistently demonstrated over the long term, even bonds can be susceptible to short-term volatility, as we’ve seen over the last few weeks.

Since April, interest rate volatility has heightened. The 10-year Treasury yield started the month at 4.25%, closed below 4% in the first week before moving as high as 4.5% in the following week— the biggest one-week increase since 2001. Since then, yields have retreated to roughly where they began the month. Although Treasury market volatility also rippled through all other fixed income sectors, most remain in positive territory year to date. Municipal bonds have been the exception, as they’ve faced other headwinds over this period.

What were the catalysts?

For the Treasury market, there have been a range of potential explanations for the volatility. One simple explanation was that investors were selling Treasuries to adjust their risk exposures. Others pointed to rising inflation expectations, an unwinding of hedge fund positions to meet liquidity needs, potential foreign sellers reducing U.S. dollar exposure, and even some loss of conviction in Treasuries’ safe-haven status. In the end, the selling pressure on Treasuries was likely a combination of some, or all, of these factors. For now, it also appears to have been relatively short-lived. Fed policymakers are acutely aware of the critical role that Treasuries play within financial markets and are likely to intervene (as they have in the past) if liquidity were to become significantly impaired. In the recent period of rate volatility, there was no indication, though, that the Treasury market wasn’t clearing or that liquidity was strained — a very good sign for the stability of one of the world’s most liquid markets.

For municipal bonds, the story extends further to the supply and demand dynamics of the tax-exempt space. Since the start of the year, the muni market has seen a surge in new issue supply. At the same time, we’ve seen weakened demand amid recent interest rate volatility and concerns over potential legislative changes — specifically municipal bond tax exemptions and Medicaid cuts. Further, it happened during a period in which munis, which are overwhelmingly dominated by retail investors, are often sold to fund April 15 tax liabilities. According to JPMorgan, municipal ETFs saw their largest outflows over the week of April 4 since reporting began in 2006. While these supply-demand dynamics have led to higher yields, municipal credit spreads have stayed relatively stable throughout, suggesting little concern about overall credit quality. Looking ahead, we expect these technical factors to improve, as supply moderates and demand picks up amid attractive yields and an expectation for greater clarity on the legislative front. Meanwhile, solid credit fundamentals, coupled with favorable valuations, continue to support a constructive outlook for the tax-exempt bonds.

Portfolio implications for a bond investor

In recent days, we’ve seen greater stability in both the Treasury and muni markets. Treasury auctions have continued to perform in-line with expectations, yield volatility has moderated, and current rates remain an attractive entry point for investors seeking yield.

Zooming out from recent events, the 10-year Treasury yield is near 4.4% today, just below where it started 2025. While the recent ups and downs in interest rates created some short-term volatility in pricing, the income proposition for bonds hasn’t really changed. Notably, bonds remain attractive from a longer-term perspective based on the current yield environment, particularly compared to most of the last 15 years. Despite recent volatility, the Bloomberg U.S. Aggregate Index is up 6.1% over the last 12 months. As we noted in a previous report, starting yield is the primary driver of long-term bond returns. Indeed, over 95% of a bond (or bond portfolio’s) return is determined by its yield over a longer-term investment horizon, assuming no defaults. The default rate for high-quality taxable bonds has been exceptionally low for decades; the same can be said for high-quality muni bonds to an even greater degree.

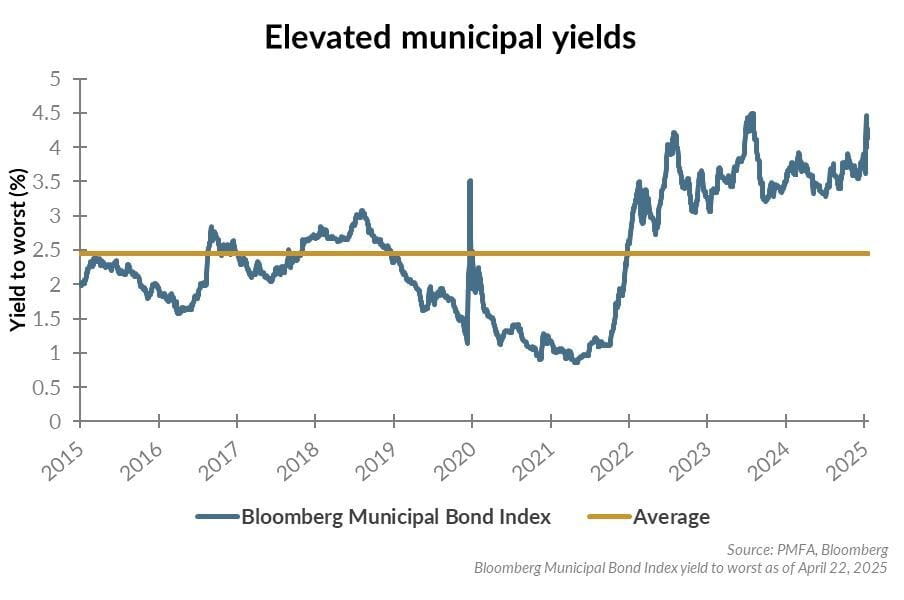

This viewpoint is relevant to the municipal market as well. The Bloomberg Municipal Bond Index yield to worst has settled around 4.3% as of April 22. That translates to over 7% on a tax-equivalent basis for high tax-bracket investors — a very attractive starting yield in the context of the municipal market’s overall high credit-quality nature and near the highest levels we’ve seen over much of the last 18 years.

We acknowledge that interest rate volatility can be disconcerting, but believe that fixed income investors should maintain their exposure to high-quality fixed income assets as part of a broadly diversified portfolio. We continue to recommend a diversified, high-quality approach to bond portfolio positioning, with added flexibility to take advantage of opportunities that can arise due to short-term dislocations. Times like these can present opportunities for active managers to take advantage of high-quality assets that have been subject to indiscriminate selling at more attractive yields. Staying diversified across sectors and the maturity spectrum, and being opportunistic when risk is rewarded, a bond investor can benefit over the long term. While bouts of rate volatility can lead to short-term periods of negative performance, it doesn’t change the timing or amount of cashflows associated with the investment if held to maturity. In that regard, the holding period return for a bond (or bond portfolio) doesn’t change.

As always, we’ll continue to monitor developments and market conditions and consider what changes, if any, may be appropriate in portfolio positioning. Please don’t hesitate to reach out to your PMFA relationship manager with any questions or concerns.Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.