First, the bottom line

- By most measures, the economy wrapped up last year with solid momentum. That was further validated by today’s GDP report.

- Top-line growth fell short of forecasts but was solid, masking the underlying strength of the consumer sector, which spent at a robust clip late last year.

- The 2024 economy wasn’t one for the record books, but a continuation of above-trend growth was an outcome that most would have gladly signed on for just a few years ago, when the twin concerns of recession and inflation were dominating expectations.

- Recession risk has seemingly dissipated for now, and inflation — while still elevated and frustratingly sticky — has receded considerably. In large part, it’s the strength of the consumer sector that has provided that lift, despite the headwind of higher prices.

By the numbers: Consumers deliver again

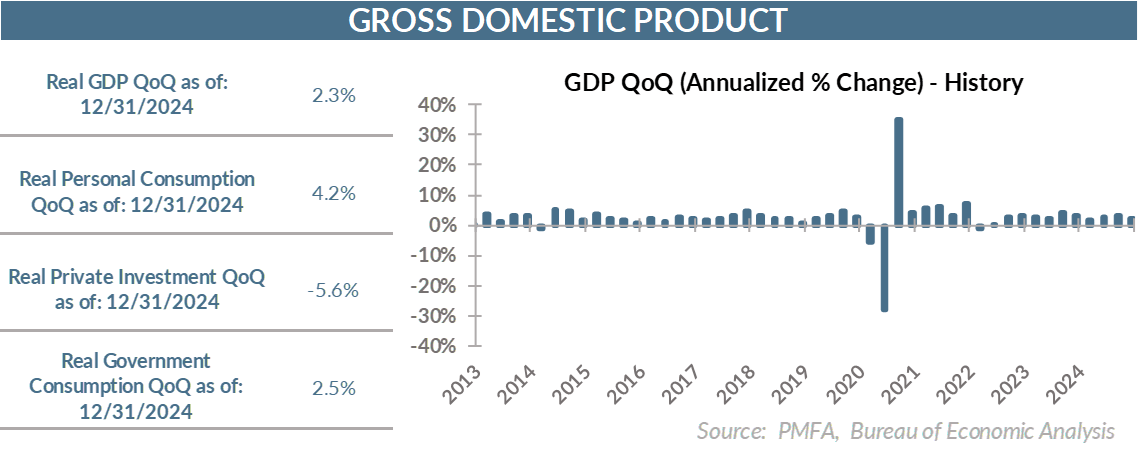

- The U.S. economy grew by 2.3% in Q4, according to the advance release, which provided the first formal look at the strength of the economy at the end of last year.

- That was a modest disappointment relative to forecasts that had projected a 2.7% growth pace for the quarter.

- The softer top-line number masked the underlying strength of consumption, which expanded at a strong 4.2% pace, the strongest quarterly advance since Q1 2023.

- Private investment plunged in Q4, its 5.6% decline largely attributable to a considerable decrease in the contribution from business inventories during the quarter, a decline that shaved 0.9% off top-line growth.

Consumption is normalizing

- Consumers spent at a brisk pace in Q4, backed by improving sentiment and generally solid household financial positions.

- Solid wage growth, low unemployment, and the positive wealth effect of higher home prices and a strong stock market provided both the fuel and the mood to spend.

- The surge in spending on durable goods was particularly noteworthy; its 12.1% gain was the strongest in nearly two years. Strong car sales and spending on recreational vehicles accounted for much of that lift. How much of that was a proactive effort to take the plunge on some big purchases in advance of potential price hikes from threatened tariffs? That’s hard to say, but it undoubtedly played a role.

- Consumers had been exceptionally limited in their willingness and ability to spend on services in the early stages of the recovery, as lockdowns and social distancing measures limited mobility. As restrictions were lifted and life began to return to normal, consumption shifted hard in the direction of services, while the goods economy stumbled.

- Today, it appears that consumers have rebalanced their spending and both the goods and services economy are benefiting.

A muddy outlook for the Fed

- At the Fed’s meeting yesterday, the message was largely one of “wait-and-see” data dependency. That’s not new. What has changed is the tone of the data; the unexpected strength of the economy and stickiness of inflation has forced Fed policymakers to take a step back and recalibrate their expectations.

- The seeming stabilization in the labor markets in recent months reduced the near-term risk of an economy falling below full employment.

- Conversely, strong growth and elevated inflation have both muddied the water for the Fed, which had previously forecast both to ease to a greater degree by now. Further, the potential for a round of new tariffs — the extent of which remains a question mark — could exacerbate the near-term outlook for inflation, further delaying the Fed’s willingness and ability to trim rates further.

- That doesn’t mean that the Fed will need to do an about-face and start hiking rates again, but it does mean that further easing may take longer than widely expected a year ago, when inflation was rapidly falling, and the labor market was softening considerably.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.