First, the bottom line

• Holiday shopping season sales are expected to top $1 trillion this year — a huge number, but one that still reflects a softer spending environment for consumers than has generally been the case since 2020.

• The go-go days of goods consumption have seemingly passed, as consumers have tightened their belts to a degree, limited by lower wage growth, depletion of excess savings, and credit card balances that have surged in recent years.

• The economy still appears to be on a stable footing and continues to grow at a solid clip. Consumers are still spending, although more of their incremental dollars are being directed toward services, where inflation remains elevated.

• Goods retailers are undoubtedly feeling the impact of service-sector inflation, as many consumers place a renewed emphasis on hunting for bargains where they can. That’s raised the stakes for retailers who may have to sacrifice some profitability to maintain market share and move product.

By the numbers

• Consumers opened their wallets in November as the traditional holiday retail season got off to a solid, if unspectacular, start. Auto sales led the way, while other retail sectors experienced mixed results.

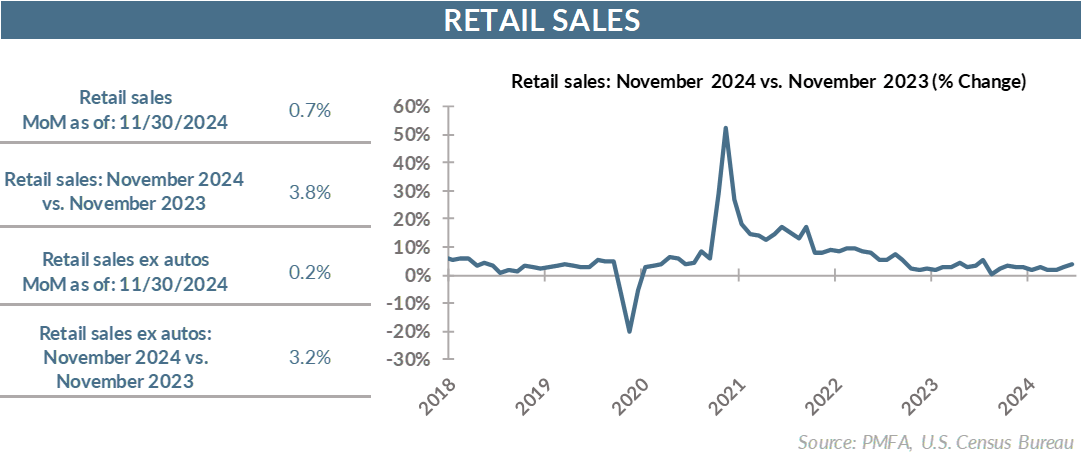

• Retail sales rose by 0.7% in November, modestly topping forecasts, while also accelerating from the revised 0.5% increase in October.

• Top-line sales were juiced by a very strong month for vehicle sales, which increased by 2.8%, a byproduct of dealer incentives offered to prospective buyers to clear excess inventory.

• Gas station sales were virtually unchanged in November, posting a fractional 0.1% gain for the month. Sales remain lower than a year ago, having fallen by nearly 4% over that time frame, as gas prices have retreated over the past year.

• Core retail sales, excluding automobile and gasoline sales, rose by a modest 0.2% in November for the second consecutive month.

Broad thoughts

• The headline gain for retail sales suggests a stronger month for the sector than the underlying details reveal, having been skewed to the upside by price concessions by auto dealers geared toward moving excess inventory before year-end.

• The underlying 0.2% gain for core sales is much more pedestrian and reflected a mixed picture within the retail space.

• Consumers spent a bit more freely on electronics and home furnishings and opened their wallets even more freely in spending on sporting goods, books, and at other hobby-related retailers.

• With the holiday shopping season now in full swing, online retailers also posted strong monthly results. Nonstore retailers — a segment dominated by online commerce — saw sales gains of 1.8% for the month and nearly 10% over the past year. That continues the long-term trend toward consumers turning toward their phones rather than driving to the local mall to shop.

• Bricks-and-mortar stores have struggled to keep pace, perhaps most notably reflected in the 0.6% sales drop for department stores last month. That’s an ominous sign for a segment that has struggled in recent years, coming at a time in which they’d otherwise hope to buttress both their top- and bottom-line results for the year.

• The impact of high prices remains a challenge to many households that have traded down and reverted to a more bargain-oriented mindset to stretch their spending dollars.

• Inflation has fallen considerably, but high prices aren’t receding. Consumers are finding ways to continue to adapt to that reality. Many retailers will also need to adapt to thrive — and in some cases, survive — against that backdrop.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.