First, the bottom line

- 2024 wasn’t one for the record books for the economy, but as the last data for the year rolls in, the overarching growth narrative remains positive.

- The economy appears to have sustained its momentum at a solid pace into the end of the year, with consumers playing a critical role in its underpinning, having demonstrated both the willingness and ability to continue to spend heading into the end of the year.

- That was generally good news for retailers, although to varying degrees. Brisk spending on furniture, furnishings, apparel, and food were offset by comparative weakness for restaurants and department stores, among others.

By the numbers: Retail growth slowed in 2024, but not alarmingly so

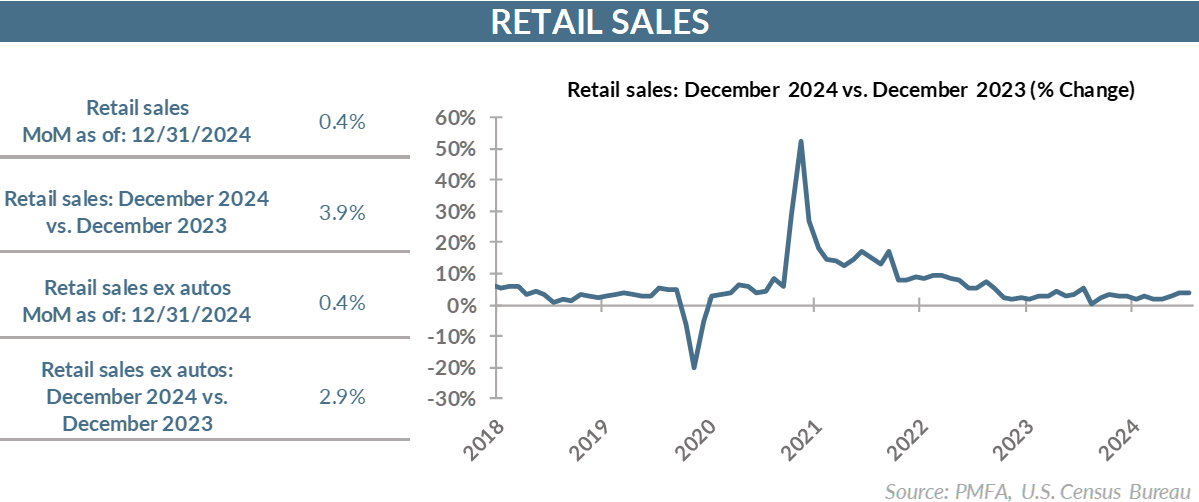

- Retail sales rose in December by 0.4% month over month, falling short of a more optimistic consensus expectation for a 0.6% gain.

- The impact of that shortfall relative to forecasts was mitigated by an upward revision to November, where the monthly gain was lifted to 0.8% from the previously reported 0.7% increase.

- Strong auto sales provided a boost, while higher gasoline prices and holiday travel lifted gas station sales by 1.5% in December. Excluding autos and gas, retailers posted a somewhat more pedestrian 0.3% increase for the month.

- For the year, sales rose by 3.9% — a solidly positive outcome, but one that fell well short of 2023’s 5.5% pace of growth. That wasn’t a surprise and, if anything, the economy continued to surprise to the upside as recession fears subsided.

Broad thoughts: Measured positivity

- Despite the lingering impact of higher prices, consumers as a group still appear to be well positioned both financially and psychologically to spend.

- Solid labor market conditions and wage growth remain key props underneath spending, while household balance sheets have benefited from rising home prices and strong equity markets of the past few years.

- That’s not to say that many consumers aren’t feeling the pinch of higher prices even as the pace of inflation recedes. In particular, the higher cost of housing and food remain pinch points for lower-income households, providing limited leeway for discretionary spending. Those consumers remain firmly focused on finding way to stretch their dollars, seeking out bargains when they’re available.

- Those who were counting on a continuation of Fed cuts throughout 2025 may be disappointed as policymakers attempt to tap the brakes on expectations and acknowledge the growing possibility that rates may need to stay higher for longer.

- Higher rates will remain a headwind for borrowers broadly and could delay a more pronounced rebound in housing, also limiting refinancing activity that could otherwise provide a bit more flexibility in household budgets.

- Further, questions about the potential economic impact of President-elect Trump’s expected immigration and trade policy priorities are expected to further constrain the Fed’s willingness to trim rates in the near term.

- All things considered, the economy is carrying solid momentum into 2025. That’s good news for workers and those seeking jobs. Still, the combination of above-trend growth and sticky, elevated inflation has raised a growing chorus of doubts about the near-term path for interest rates. Consumers appear upbeat, but not universally so and certainly not without acknowledging a degree of caution about the economic questions that remain unanswered.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.