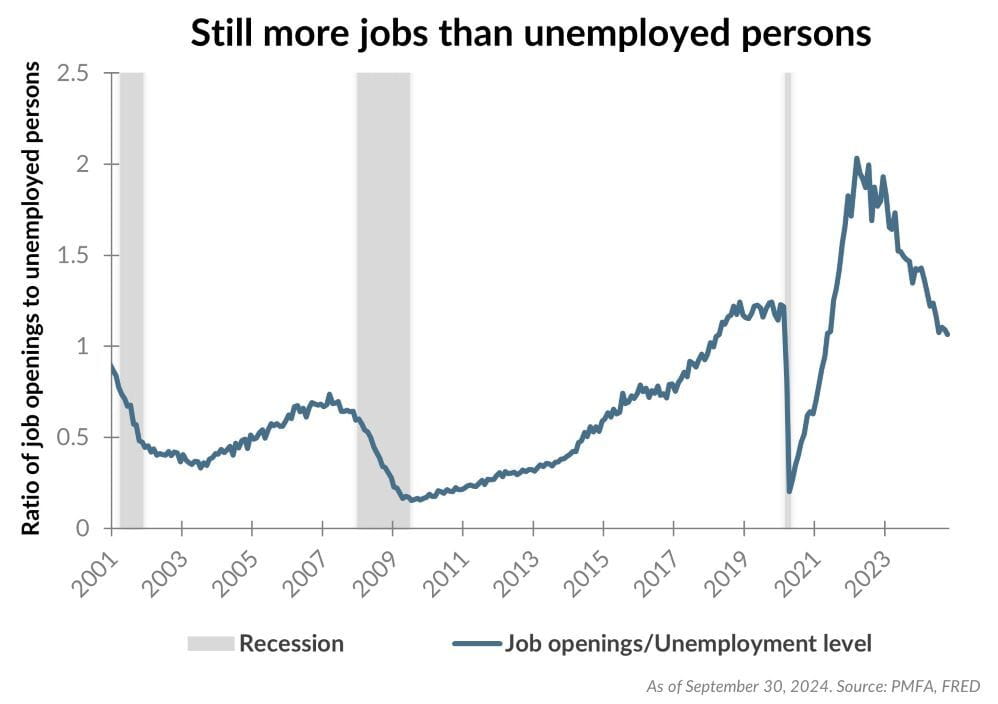

Over the past year, the U.S. labor market has cooled notably by virtually any measure. Job creation has slowed considerably, unemployment has ticked upward, and the number of job openings has declined materially. However, it’s important to view the data in its historical context, not just the recent trend.

As shown above, the ratio of job openings to unemployed individuals has declined considerably since 2022. Even so, aside from the last few years, the current balance is still among the most constructive for those seeking employment over the past 25 years.

A cooldown in labor market conditions was no accident, but rather a targeted effect of the Fed’s aggressive rate hikes over the past two years. A more balanced labor market has helped to put a damper on wage growth, in turn alleviating one source of inflationary pressure. However, the Fed’s policy maneuvering is a balancing act. Excessive tightening would create the risk of derailing the economy rather than just slowing it, leading to growing job losses and a more pronounced rise in unemployment. Striking that balance is a tall order for policymakers, but a necessary one to curtail inflation without derailing growth. So far, it’s a balance that the Fed has seemingly been able to strike.

Today, the labor market appears to be relatively healthy despite the cooling trend. Employers are still hiring, but with a much better balance between the number of openings and potential workers to fill them. Continued demand for workers, low unemployment, and ongoing job creation all point to a resilient labor market that should continue to underpin household finances, consumer spending, and economic growth.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.