The bottom line first

• Inflation certainly isn’t the worry that it was not long ago, but stickiness in shelter and services inflation is making a return to the Fed’s 2% target difficult.

• The November inflation report likely contained the last big data points that might color the Fed’s imminent rate decision. In that regard, the report contained little that’s likely to dissuade policymakers from trimming by another quarter point next week. The real questions relate to what comes next.

• The path for 2025 is less clear, but a course correction by the Fed toward holding rates a bit higher for longer appears increasingly probable.

By the numbers: Little change

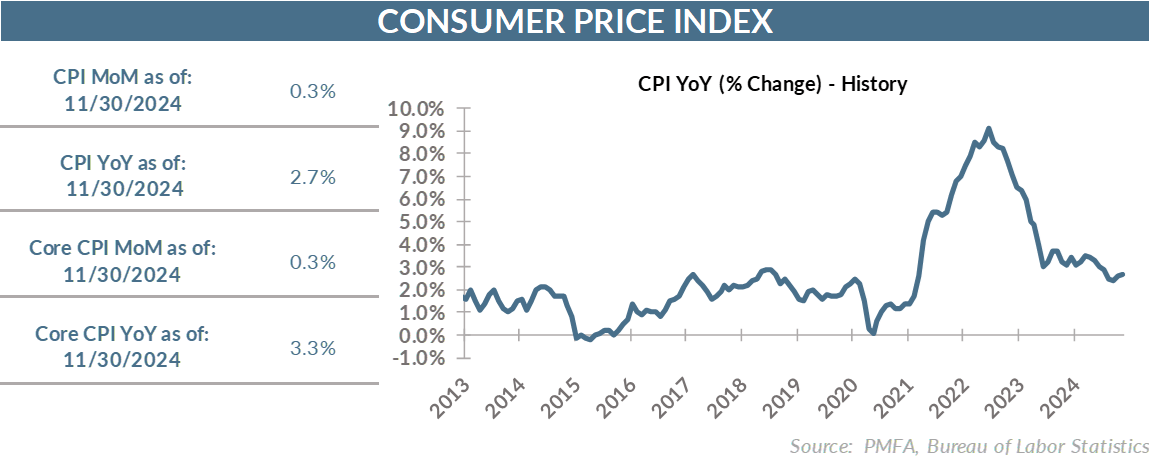

• The consumer price index edged higher in November, rising by 0.3% — a result that was in line with economist’s expectations of 0.3%.

• Excluding more volatile food and energy prices, core CPI also rose by 0.3% for the month, also in line with forecasts.

• Stepping back from the month-on-month gain, the 12-month trailing numbers proved to once again be frustratingly sticky, showing no additional progress toward the Fed’s stated 2% target.

• On a one-year basis, the index ticked up from 2.6% to 2.7% in November, while core inflation held steady at 3.3% for the third consecutive month, having been tightly anchored around that level since June.

Broad thoughts

• Today’s release is one of the last major economic releases before the FOMC’s policy decision next week. Policymakers will be parsing its contents closely as they filter through the data for evidence of progress toward the central bank’s price stability goal.

• The analysis of recent data provides a mixed view on inflation: price pressures have eased considerably, but every passing month provides further evidence of a stickiness to inflation that will challenge the current forecasts for interest rate cuts next year.

• The good news is that there’s little evidence of a considerable resurgence in inflation in the November report, despite a modest uptick in the 12-month number. The bad news is that there’s also little to indicate progress in further reining it in.

• At a 4.7% gain over the past year, shelter inflation remains a major challenge in further retracement toward a more normalized inflation environment. A combination of higher mortgage rates and soaring home prices since 2020 has dampened housing demand, but limited availability remains a challenge for buyers across much of the country.

• An extended period of underinvestment in the housing stock in the aftermath of the housing bubble is a major driver of that supply/demand imbalance. Low household formation in the years following the global financial crisis curtailed demand in the decade that followed, limiting the impact. Demand is expected to continue to firm given the growth in the potential homebuying population, further enhanced by the surge in immigration to the United States in recent years.

• It’s not just shelter that poses a risk, as service sector inflation broadly saw price hikes of 4.6% over the past year, in part a byproduct of strong wage gains but also lifted by outsized price hikes across a smattering of categories.

• That contrasts sharply with goods prices, which have largely flattened out over the past year.

The Fed will be doing some serious mulling

• Inflation continues to run well above the Fed’s target, raising considerable doubt about the need or ability of the Fed to trim its benchmark rate as outlined most recently in its September projections.

• Even so, a quarter-point cut from the Fed next week still appears to be a high probability. However, it also appears increasingly likely that the tone of Fed Chair Jerome Powell’s post-meeting press conference may be a bit more restrained with a shift toward reining in expectations regarding the pace an extent of further easing in 2025.

• The resiliency of growth and the stickiness of inflation pressures appear increasingly likely to nudge the Fed toward pausing sooner than previously forecast, holding rates a bit higher for longer than had been anticipated.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.