The bottom line first

- Although collective consumer mood improved modestly in the aftermath of the election, the underlying story isn’t so simple. Political polarization across the country not only set the tone for the election but is apparent in consumers views about the economy — particularly expectations around its near-term prospects.

- Broadly, consumers expect moderate improvement in the economy over the next six months, but there was a more nuanced shift in sentiment that tended to track with political affiliation and individual respondents’ view on the election’s outcome.

- Self-identified Republicans hold a more upbeat outlook as President-elect Trump prepares to return to the White House, with a Republican majority in Congress. Conversely, the views of self-identified Democrats were less enthusiastic.

- In boxing terms, call it a split decision for now. What will matter much more next year will be the actual policies pursued and the resulting impact on trade, growth, inflation, and the jobs market.

By the numbers: Better or worse? It depends

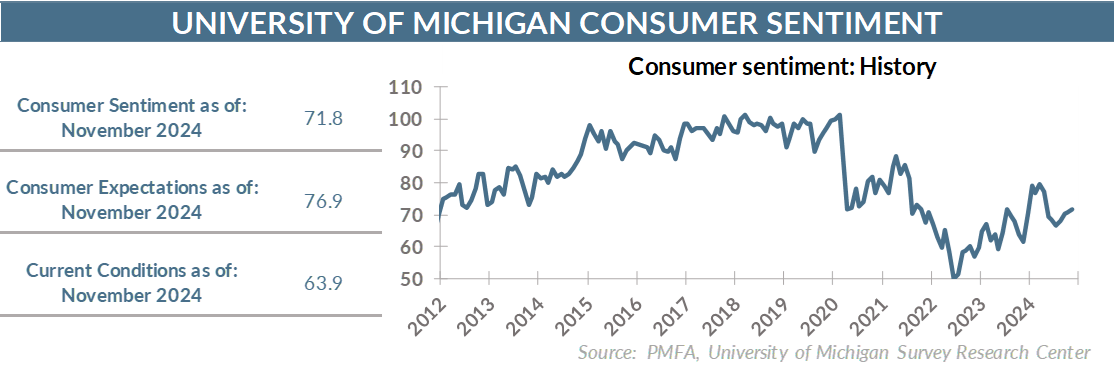

- The University of Michigan’s Index of Consumer Sentiment edged up to 71.8 in November — modestly better than October’s reading of 70.5, but a touch below the preliminary November reading.

- The results in the two subindexes were split. Consumers’ views on current conditions edged down from 64.9 to 63.9 over the past month, while the expectations component rose from 74.1 to 76.9.

- Inflation expectations for a year out continue to edge lower, down to 2.6%, although longer-term expectations moved up to 3.2% from 3.0% in October. The latter suggests that while consumers recognize that inflation has receded significantly, there’s less certainty that the Fed’s ability to hold inflation near its 2% target over the long term.

Was it the election or the Fed that mattered to consumers? Probably both

- The initial November report reflected results of the survey that was conducted before Election Day, but it’s unclear how much the election alone accounted for the modest step back in sentiment.

- The survey was also conducted after the most recent Fed meeting. Policymakers delivered another quarter-point rate cut as widely expected, but Fed Chair Jay Powell’s press conference comments struck a cautionary note for anyone expecting the path to even lower rates to be locked in. Investors heard that message and reacted accordingly.

- Economic growth was strong in Q3, and Powell acknowledged the potential that growth could be even stronger in 2025. Coupled with the potential inflationary effects of significant tariffs on imported goods promised as part of Trump’s proposed trade and economic agenda, it likely will and should give Fed policymakers reason to think twice about how aggressively they can or should cut rates in the coming year.

- To that end, Powell’s cautionary warning was that the Fed would remain data-dependent in the execution of policy, maintaining the flexibility to adjust course as needed, regardless of what the market might expect or what the Fed’s previously released projections outlined.

- Stronger growth or higher inflation might not lead to an immediate about-face on rate policy and near-term hikes, but it could easily slow the pace of further trimming or result in a terminal rate that’s higher than consensus forecasts have called for.

- The preferred scenario would be for strong growth and job creation to be sustained, with solid productivity gains blunting the inflationary impact, allowing for consumer inflation to continue to edge toward the Fed’s 2% goal. Whether that’s an achievable goal remains to be seen.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.