By the numbers

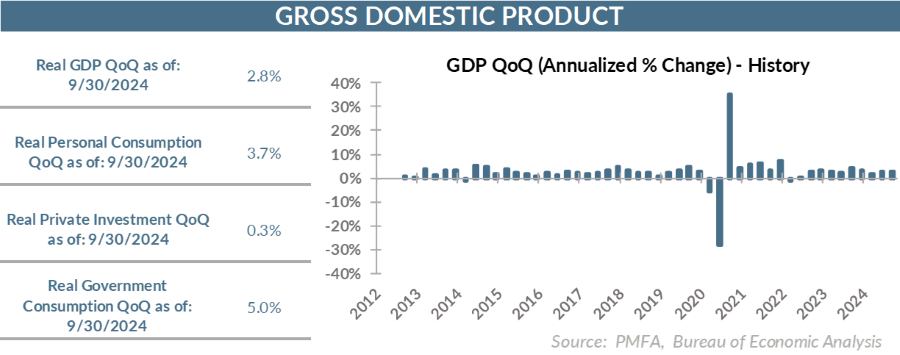

• The advance release of Q3 GDP confirms that the economy maintained strong momentum through the late summer, coming in at 2.8, a result modestly shy of the consensus forecast of 3.0% for the quarter.

• Growth expectations had ranged from 2.0–3.5% coming into the release, a relatively wide range that illustrated the range of views about the economy’s near-term outlook and the ongoing debate around the no-landing, soft-landing, or hard-landing scenarios.

• Unsurprisingly, consumers were once again the driving force behind the continued positive momentum for the economy, with personal consumption growth accelerating to 3.7% during the quarter.

• Consumption on goods surged by 6.0%, effectively doubling up its Q2 gain. It was the strongest quarterly gain for spending on goods since the first quarter of 2023.

It’s still a consumer economy

• If there’s one key takeaway from the GDP report, it’s that the state of the U.S. consumer is strong.

• Consumers are not only still spending but did so a bit more freely in recent months, particularly on goods. That’s a welcome relief to retailers that had felt the sting of shifting consumer spending preferences that favored services over goods in recent years. It’s also tangible proof of an improving consumer mood, already illustrated this week by the largest monthly gain in consumer confidence in over two years.

• That doesn’t mean that consumers aren’t still feeling the lingering effects of the inflation surge of the past few years. Prices are still high, although no longer rising at a frenetic pace. It does suggest that they’ve been willing and able to absorb the impact of those higher prices and still move forward.

• Beyond the positive consumer story, there’s also not much in the way of other bad news in the Q3 GDP report. One exception is that housing remains soft — not surprising given soaring housing costs in recent years and the spike in mortgage interest rates that chewed into affordability. With prices stabilizing and lower mortgage rates potentially on the horizon, there are likely better days ahead for homebuyers.

• Government spending also contributed positively to growth, with defense spending in particular surging by nearly 15% annualized, much of which is directly related to U.S. support related to the war in Ukraine and ongoing conflict in the Middle East.

Is the economy at a turning point?

• With most recent data still pointing to solid underpinnings to the economy and inflation gradually receding, there’s little to suggest that the Fed’s aggressive tightening efforts over the past few years were overdone.

• Now, policymakers are shifting their focus from inflation risk to the cooldown underway in the job market, and there’s a sense that the Powell Fed might succeed where many of its predecessors have failed, navigating the economy through the worst inflation scare in decades without choking off expansion.

• The October employment report that’s set to be released this Friday will contain a plethora of valuable data for Fed policymakers as they head into their policy meeting next week, but other labor data has been solid. Nothing in the report should be a game changer for the Fed, which is expected to result in a 25-basis point trimming of the central bank’s policy rate.

• Today’s employment report from ADP may or may not correlate with the government’s report on Friday, but strongly suggests that the labor market didn’t lose momentum over the past month, despite the devastation and disruption caused by the pair of hurricanes that hit the southeast United States earlier this month.

• Still, the economy is growing at a rapid clip. If that continues, it could at some point raise questions about the Fed’s rate cut projections, with the risk of cutting too aggressively into economic strength potentially contributing to a potential resurgence in inflation at some point.

• For now, though, the Fed appears well positioned to continue to methodically trim rates as inflation recedes and the labor market cools.

The bottom line?

• Consumers remain the lynchpin to the strength of the U.S. economy, having put their money where their mouths were in recent months. They’ve stated that they’re more confident in the current state of the economy, and they showed that they were serious by opening their wallets and spending.

• The economy’s positive momentum continues to shift the debate on the near-term outlook. Increasingly, the debate isn’t between hard landing and soft landing. At least as measured by GDP, there’s little evidence of any landing for now.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.