By the numbers

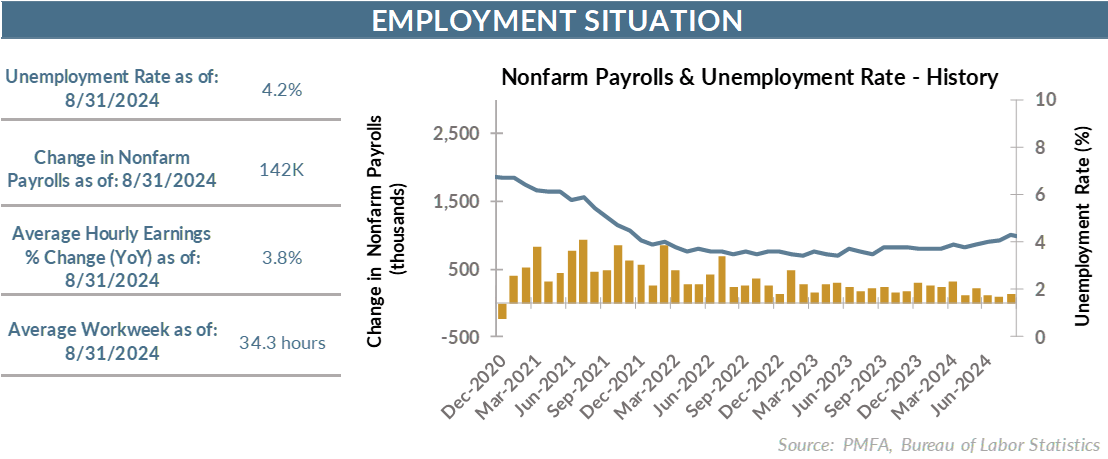

- Job creation came in softer than expected in August, as employers added 142,000 new workers to payrolls last month. Economists had forecasted a more pronounced rebound of 165,000 from the disappointing July job gains.

- However, the bigger news was buried in the revisions to previously reported gains from June and July, which were slashed by 86,000 to a tepid two-month gain of 207,000.

- The resulting increase of 349,000 from June through August represents the weakest three-month gain in nonfarm payrolls since the economy slid into recession in March 2020.

- The 116,000 average pace of job creation over the past three months is also well behind the pace of job gains in the year leading up to the 2020 recession.

- The unemployment rate edged fractionally lower to 4.2%, as the estimated pace of workers entering the labor force slowed.

- Overall, the data points to a labor economy that has cooled considerably in the past several months and not just back to a comfortable trend.

- If anything, the August report affirms the need for the Fed to act quickly and decisively to cut short-term rates.

Some noise, but more bad news than good in the August jobs report

- The August jobs report is a warning shot across the bow for the Fed with the critical CPI report on deck next week and an important FOMC meeting looming in two weeks.

- Job creation has been grinding lower since May, as the pace of hiring has continued to rapidly lose momentum. The sharp downward revisions to June and July gains reinforce the magnitude of that slowdown and raise new worries that the foundation under the soft-landing narrative isn’t as strong as it’s appeared in recent months.

- Despite edging lower last month, the unemployment rate has risen materially since reaching its cyclical low of 3.4% in April 2023. Under normal circumstances, such a sustained increase would be an unambiguously ominous sign for the economy. Of course, very little about the economy has been normal over the past few years.

- Notably, it hasn’t been a surge in layoffs that has been the primary catalyst for the steady increase in the unemployment rate. Data from the household survey suggest that the number of employed individuals has held relatively steady over the past year. Conversely, the number of unemployed individuals has risen by about 775,000 over the past year — virtually matching the estimated gain in the civilian labor force over that period.

- The disparity between the household and employer surveys is perhaps most obvious in the measurement of job gains in the last year. The household survey tells a story that’s lackluster at best, indicating very little movement in the number of employed Americans since August 2023. That stands in sharp contrast to employer data that still indicates a slowing, but positive, pace of hiring.

- Labor conditions needed to soften up from the unsustainable, breakneck pace of hiring that accompanied the stimulus-fueled spending spree that overheated the economy and contributed significantly to the surge in consumer prices. In that sense, the slowdown in hiring was necessary to relieve inflationary pressures and restore some balance in the economy.

- The question is whether the degree of that slowdown has gone too far, pushing the economy further into a recessionary danger zone.

Potential for half-point Fed cut just went up

- The jobs report provided a treasure trove of information for the Fed as they contemplate the size of their much-anticipated policy rate cut later this month.

- A quarter-point rate cut is all but locked in, but the potential for an initial half-point cut appears to be rising, particularly if next week’s report on consumer inflation is benign. The magnitude of the cooling in labor market conditions appears to be more significant than policymakers had expected even a few months ago.

- Coming off three months in which consumer prices barely moved, another tepid reading coupled with the weaker-than-expected jobs report could provide Fed policymakers with enough cover to ease by a half-percent later this month.

- The stakes have been raised for the Fed, which still hopes to navigate the economy to a soft landing after the worst inflation scare in decades.

The path to a soft landing is narrowing

- The August jobs report may not have been a definitive tipping point for a Fed that has been mulling how aggressively to kick off its rate cut cycle, but it gave policymakers plenty to think about before deciding on that move.

- Against the current state of labor market and inflation conditions, Fed policy looks increasingly restrictive, arguing for a more aggressive move toward neutral.

- No rate cut will have an immediate overnight impact; it’s going to take some time for the benefits to broadly filter out into the economy.

- Moving too aggressively at this point could be viewed as a sign that they realize that they may have waited too long. Moving too slowly could be viewed as a lack of responsiveness to conditions that have weakened more rapidly than forecast.

- Whatever their decision, it will be imperative for Fed Chair Powell and his fellow policymakers to get not only the pace of cuts correct but also the message.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.