Against the backdrop of economic data and political noise, a September Fed rate cut has become nearly a foregone conclusion. But what goes into the Fed’s thought process when determining the appropriate level and direction of interest rates? Congress defines the Fed’s dual policy mandate to promote maximum employment without sacrificing stable prices. The challenge for policymakers is that conditions are constantly in a state of flux. Further, there’s no way to know with precision what the neutral rate is or exactly how much they may need to raise or lower rates to achieve their goals.

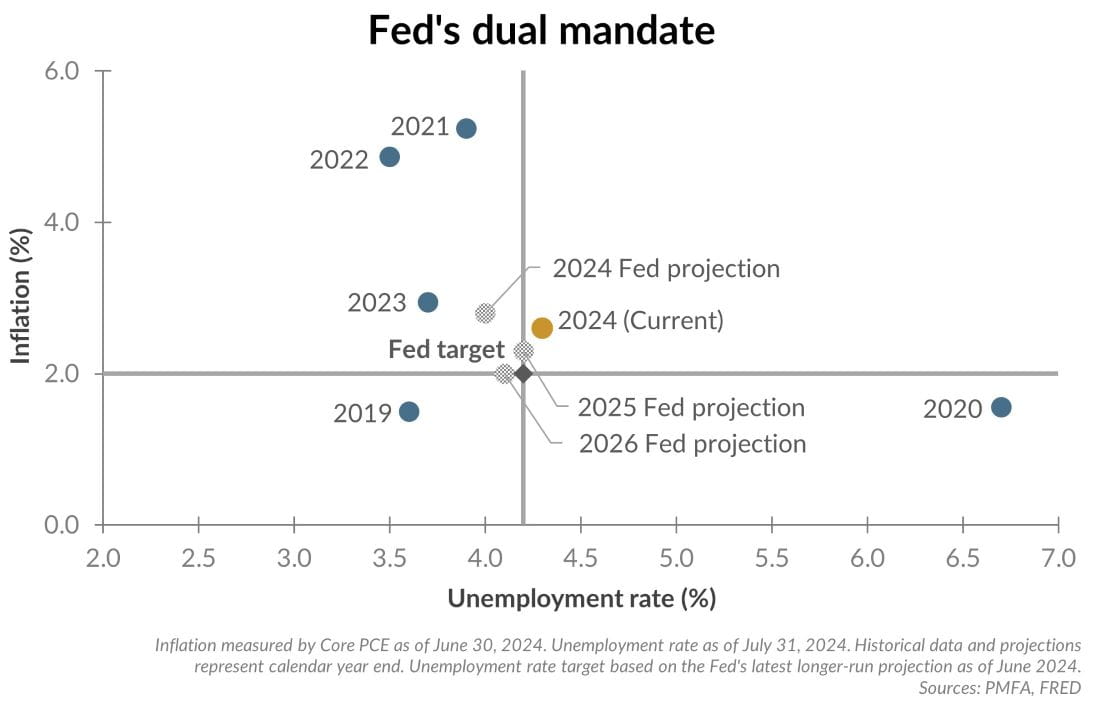

The chart above illustrates the Fed’s current targets for inflation (2%) and unemployment (4.2%) as well as the evolution of those data points since 2020. Understanding where each of these metrics stand — and where they’re seemingly headed — can be valuable in assessing the likely direction of monetary policy.

As shown, unemployment surged in 2020, peaking at nearly 15% in April before declining by the end of the year, prompting the Fed to cut rates. In 2021 and 2022, as inflation soared and unemployment plummeted, the Fed in turn aggressively raised rates. Today, the backdrop is much different. Inflation has fallen considerably and is now closing in on the Fed’s 2% target. That’s been accompanied by a nearly 1% increase in the unemployment rate to over 4%. Meanwhile, the Fed’s policy rate remains relatively tight, well above the Fed’s “longer run” neutral estimate of 2.8%.

What’s the bottom line? Economic conditions don’t justify an easy policy stance or an injection of stimulus but do indicate that restrictive policy over the past two years has been successful. Similarly, a near-term pivot by the Fed to begin to cut rates and ease policy appears warranted. We expect that will likely start in September.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.