Key Takeaways

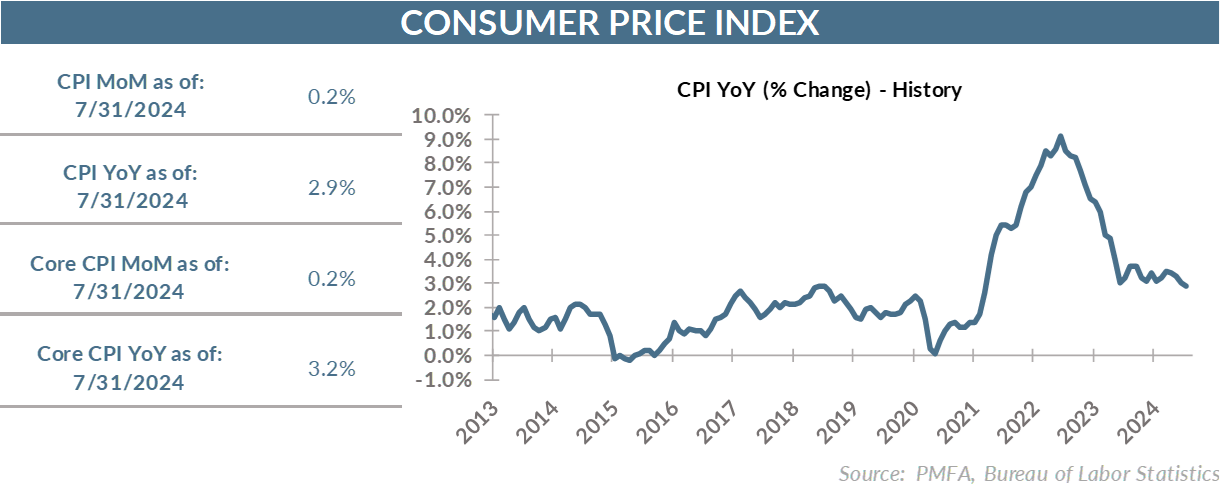

- Expectations for the July CPI numbers were relatively tame, and those expectations were met, with today’s release indicating a 0.2% increase in both the headline and core numbers for the month.

- At 2.9%, the 12-month increase in the Consumer Price Index remains higher than the Fed would prefer over time, but there’s been a notable slowdown in the magnitude of price changes in recent months.

- Since April, the CPI’s average monthly increase has been a very manageable 0.1%, and expectations are for inflation pressures to remain in check in the coming months.

Behind the numbers: Even at 2.9%, headline CPI overstates the current inflation risk

- Having now broken below 3.0% for the first time in over three years and most measures of inflation remaining on a gradual descent, it increasingly appears that the Fed can check the box on successfully beating back the worst inflation scare in the United States in four decades.

- It’s important to recognize that the headline CPI print of 2.9% is backward looking, with the oldest monthly data reflected in that 2.9% being some of the most significant. As a result, it’s quite likely that the 12-month pace of increase should recede in the coming months, perhaps considerably.

- Further, the stickiest piece of the puzzle remains shelter costs, which rose by 0.4% in July and remain above 5% over the past year. That’s significant as it represents an outsized part of the index, but shelter costs are also notoriously hard to measure accurately and are often perceived to move with a lag. Other indicators suggest shelter costs are well positioned to fall further in the months ahead.

For the Fed

- With every additional reading on inflation providing additional evidence that the worst of the inflation scare is firmly in the rearview mirror, Fed policymakers should be increasingly assured that enough has been done to address that part of their dual mandate.

- At this point, the balance of risks appears to be tipped much more notably toward the growing, but persistent, signs of weakness in labor market conditions.

- The steady rise in the unemployment rate and marked slowdown in the pace of job creation may not be an imminent signal of recession. Still, with monetary policy still tight and inflation closing in on the Fed’s 2% target, weaker labor conditions kick the door open for the Fed to have the leeway to ease rates, perhaps even more aggressively than would have been expected earlier this year.

- The challenge for Fed Chair Jay Powell and other Federal Open Market Committee (FOMC) members will be twofold. First, the Fed needs to get the decision on rate policy right to avoid remaining too tight for too as both inflation and economic momentum slows. Secondly, they’ll need to be particularly mindful of their messaging, providing reassurance that the economy is slowing — not stalling — and that they are prepared to move as rapidly as necessary to ensure that economic growth can be sustained.

For investors

- The markets have already started repositioning in expectation of looser policy and lower interest rates ahead. Bond investors have caught the tailwind of lower long-term yields, providing a nice uptick for fixed income portfolios — a welcome offset to some of the recent volatility in stocks.

- Equity investors have been recalibrating expectations since the weak July jobs numbers caught markets by surprise and prompted a brief fit of volatility early this month.

- Looking ahead, investors will grapple with whether bad news is perceived to be bad news or good news.

The bottom line?

- On a relative basis, inflation risk is increasingly the lesser of the two concerns for Fed policymakers with labor conditions taking center stage.

- The key question is whether the Fed can navigate a narrow goldilocks path that incorporates rate cuts against the backdrop of lower inflation and a soft landing and whether investors perceive that to be the case.

- Any sense that the Fed is behind the curve in easing policy or that economic data is deteriorating faster than the Fed can or will provide support would be a catalyst for additional volatility extending to equities, credit, and other risk assets.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.