Despite recent volatility, equity markets are meaningfully higher since the start of the year. Year to date, the large-cap S&P 500 index has reached over 30 new all-time highs. Investing in stocks after such a significant run-up in equity markets can often make investors nervous. While it can be tempting to hold excess cash and wait for an equity market downturn to invest, as we have discussed in a previous piece, all-time highs are often followed by further periods of strong performance.

Despite recent volatility, equity markets are meaningfully higher since the start of the year. Year to date, the large-cap S&P 500 index has reached over 30 new all-time highs. Investing in stocks after such a significant run-up in equity markets can often make investors nervous. While it can be tempting to hold excess cash and wait for an equity market downturn to invest, as we have discussed in a previous piece, all-time highs are often followed by further periods of strong performance.

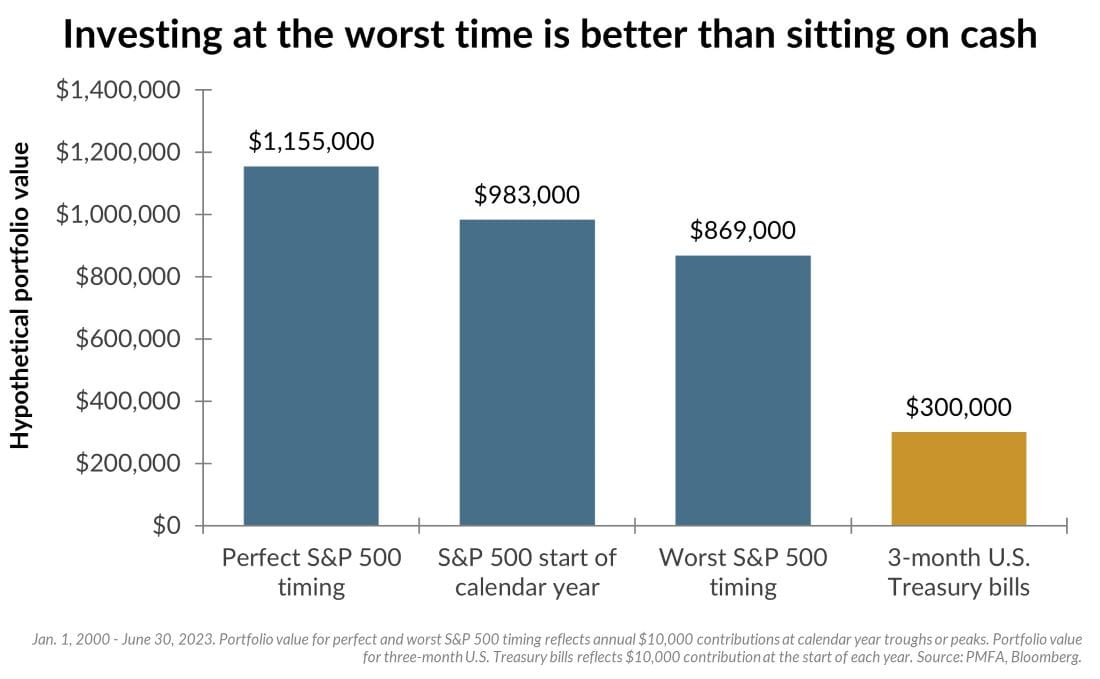

History suggests that in the long run, the difference between investing at the best and worst entry points isn’t as significant as one might expect. The chart illustrates the impact of consistently investing on the first day of each calendar year since the year 2000, relative to investing at the highest point in each year (worst timing) and the lowest point (best timing). While achieving the impossible task of adding to the portfolio at the best possible time each year does result in higher returns than a simple program of investing on the first day of the year, even investing at the worst possible time each year results in a significantly better outcome than remaining in cash.

What’s the bottom line? Waiting for the perfect time to invest can result in missing out on periods of strong stock market returns. Timing the market perfectly is an impossible task, but getting invested, even at the worst times should pay off over the long run. And as we discuss in our accompanying piece, a long time horizon is an important part of investing in equity markets.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.