Interest rate volatility has picked up in recent months, weighing on fixed income returns as a meaningful move higher in rates pushed bond prices lower. However, income is by far the dominant driver of bond returns over multiyear periods, accounting for over 95% of total return for long-term investors. Price movements on high-quality bonds, while meaningful over shorter-term time periods, typically have negligible impact on bond returns over multiyear periods.

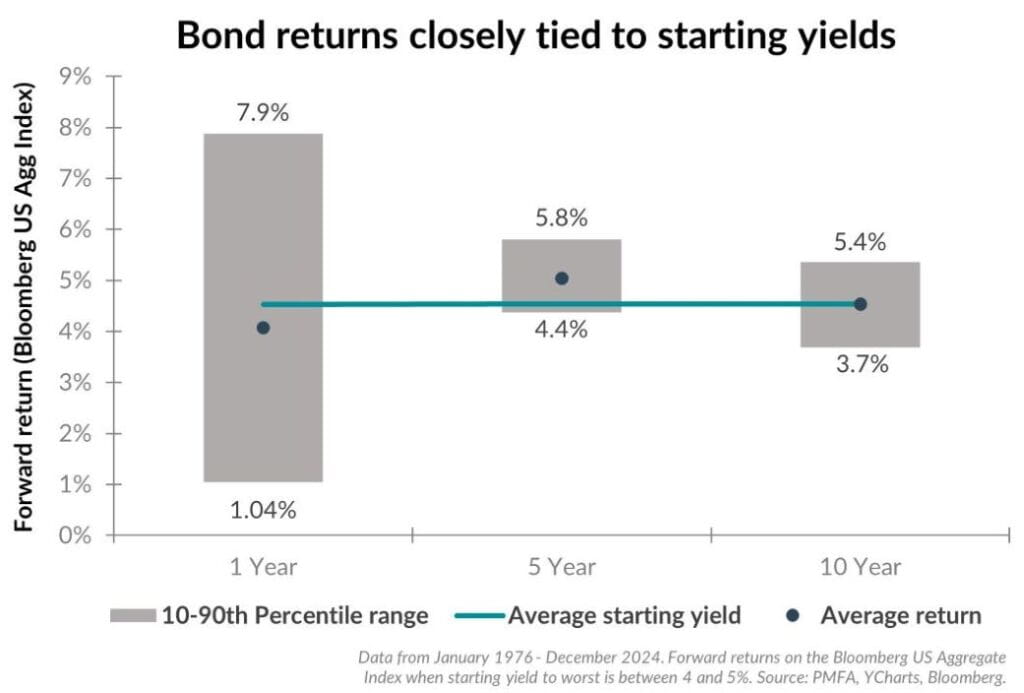

The chart above shows the range of subsequent returns on high-quality core bonds (represented by the Bloomberg Aggregate Index) over one-, five-, and 10-year periods when the initial yield is between 4 and 5%. Over shorter periods, such as a year, the range of returns is wider since periods of interest rate volatility can lead to price fluctuations that dominate total return profile over the short term. This is particularly impactful when interest rate volatility is high and yields are exceptionally low, as was the case in 2022. As the period measured is extended to five or 10 years out, the range of returns tightens considerably in and around the starting yield, exemplifying the heavy influence of income on fixed income returns.

What’s the bottom line? As we discuss in our accompanying piece, fixed income investors can now enjoy yields that are near their highest level in 15 years. The transition from exceptionally low rates to a more normalized environment in recent years was a painful one, but high-quality bonds now offer a more attractive opportunity to long-term investors than has been the case in many years.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.