First, the bottom line: Retail sales soft, but not alarmingly so

- The economy came into the year with decent momentum but was also easing back toward a more normalized growth pace. While it’s still early in the year, momentum appears to be slowing further, exacerbated by a notable deterioration in the collective consumer mood.

- Growing policy uncertainty is causing consumers to think twice about how they’re spending — a change in mood that’s being felt squarely by the retail sector. Importantly though, it’s a step back, not an aggressive retreat.

- Against the backdrop of a notable decline in investor animal spirits and three consecutive monthly declines in consumer sentiment, February’s modest pickup in retail sales doesn’t seem too bad.

- At the same time, tariffs haven’t really yet started to bite. Given the pace of developments on the trade front, it’s impossible to say exactly how the picture will develop in the near term.

- Policy uncertainty alone is likely to weigh a bit on consumption, with the reality of higher prices almost certain to influence household spending in the coming months. How that plays out remains to be seen. Consumers can and likely will lean into alternative products at comparatively attractive prices, but shifting to relative bargains may not be enough to avoid a general softening in household spending.

By the numbers: Not as bad as the headline number suggests

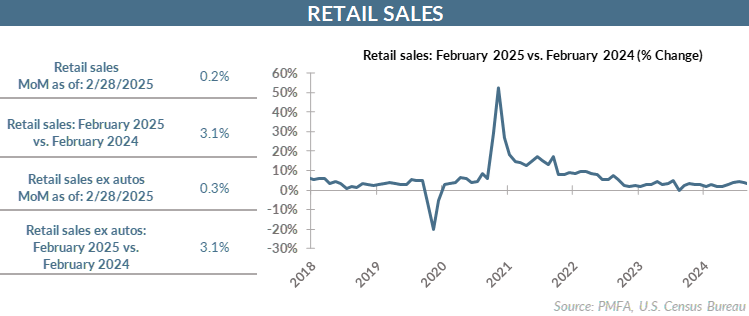

- Retail sales rose by a tepid 0.2% in February, falling well short of an expected 0.7% increase. That was the bad news.

- Soft auto sales played a role, falling by 0.4% for the month; ex-autos, retail sales growth edged up 0.3% for the month, consistent with forecasts.

- The good news underlying the data came in the control group reading, which was up a solid 1.0% in February. That’s the data point that feeds into GDP, making it one to watch closely. The strong February gain was good news, although it’s muted by the downward revisions to the January decline from a previously reported -0.8% to -1.0%.

- Boil it all down: It’s been a soft retail backdrop thus far this year, but not one that suggests a severe retrenchment in household spending has already taken hold.

Broad thoughts: Consumers take note of policy flux

- Tepid retail results aren’t surprising given the notable slippage in consumer sentiment in recent months. It’s also not surprising given that Q1 tends to be a weaker period for retailers more broadly.

- How much of the recent weakness can be chalked up to concerns about tariffs and rising prices for a range of imported goods? How much is giveback for the surge in Q4 consumption? How much of the soft retail backdrop is explained by seasonal factors? All likely play a role.

- The February CPI release provided a modestly positive surprise but is backward-looking, limiting its impact on the near-term consumer outlook, which has turned more negative.

- Specifically, consumer inflation expectations have risen sharply in recent months, with households bracing for higher prices as the trade war heats up.

- Whether or not the divergence between slowing growth and rising inflation coalesces into a stagflationary backdrop remains to be seen, but the downside potential is evident.

- Consumers are increasingly cautious in their assessment of the economic outlook; if that uncertainty persists or intensifies, consumers will be increasingly likely to become more restrained in their spending habits in the coming months.

- For now, consumers appear to be hanging in there. It’s not a robust backdrop for household spending, but it’s also not as bad as an array of soft measures of the consumer mood would suggest.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.