The numbers: U.S. growth eased in Q4 despite consumption pickup

- Today’s report from the Commerce Department reaffirms, with some additional refinement, what was already understood: the economy closed out 2024 with solid momentum, with consumers playing a particularly important role in driving the economy in the final months of the year.

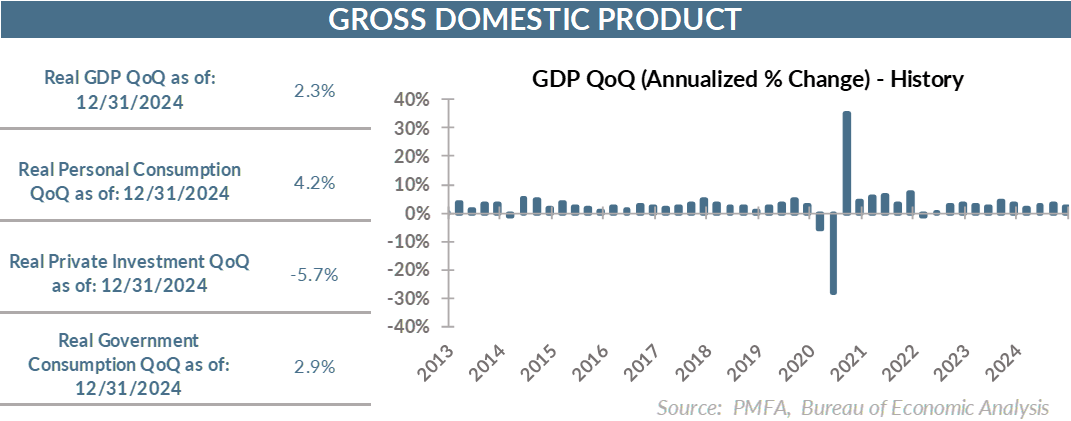

- GDP grew by an estimated 2.3% in Q4, consistent with the advance report released last month.

- That suggests some moderation in momentum to close out last year, but still reflective of an economy growing at a solid pace.

- Underlying that top-line easing was a notable acceleration in consumption, which grew by 4.2% on stronger spending on both services and goods.

- The 6.1% increase in goods spending was particularly notable, painting a much better demand picture for goods than was the case coming into the year. A surge in auto sales in Q4 provided a meaningful lift to durable goods purchases, as dealer incentives helped to clear out inventory.

- It’s unclear how much the threat of looming tariffs on a range of imported goods might have also incentivized consumers to pull forward planned expenses to avoid higher prices, but it undoubtedly provided some tailwind to Q4 spending.

- Although headline growth was unchanged, underlying gauges in the report cast another cautionary note about the near-term direction of inflation. The PCE price index for Q4 was adjusted upward by 0.1 to 2.4% for the fourth quarter, with core PCE being nudged up to 2.7% for the same period.

- On a year-over-year basis, inflation receded; that’s the good news. Indications that price pressures may be catching a second wind even before the potential impact of additional tariffs should send a cautionary message about the near-term inflation outlook.

Q4 was solid, but questions persist about near-term outlook

- Now nearly two months into 2025, the impact of today’s report is mitigated by the greater focus on more recent data and the near-term outlook.

- The unexpected increase in jobless claims last week to 242,000 was notable, although it’s too soon to conclude whether it’s part of a more sustained increase in layoffs — at least for the time being.

- The recent string of announcements of federal governmental layoffs has dominated discussion around labor market conditions of late but still haven’t moved the needle on jobless claims. Some of the higher job losses last week could have been government contractors that were terminated, but that’s also unclear.

- Notably, job losses in the manufacturing sector were specifically flagged by the two states with the largest weekly increase in claims during the week ended February 15. Those don’t appear to be tied to federal spending cuts; whether those layoffs spread to other manufacturers in other states remains to be seen.

- The big questions hanging over the economy today are largely policy oriented. How significant will federal job and spending cuts be? What impact will the fluid outlook for trade and tariffs have on growth and inflation? Can and should the Fed cut rates as prior forecasts have reflected? How might Fed policymakers react in a potentially stagflationary outcome of slower growth, weaker labor conditions, and reaccelerating inflation?

- Given the range of uncertainties, it’s unsurprising that consumer sentiment has eroded. Investors are also searching for direction, flyspecking economic data and corporate earnings reports for any indication of what the near term might hold in store. That’s contributed to a bit more choppiness in the markets of late and a moderation in long-term treasury yields despite rising inflation expectations.

- Markets hate uncertainty, but investors are getting it in spades right now. That’s apparent even today, as it now appears that the “on again/off again” tariffs on goods from Mexico and Canada are now on again, set to take effect on March 4, with an additional 10% levied against China on top of those previously imposed.

- What the impact of the current policy calculus will be remains to be seen; at a minimum, it creates more considerations and potential risks for investors to try to absorb as they navigate what could be a bumpy policy path with more twists and turns than they’d prefer.

Media mention:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.