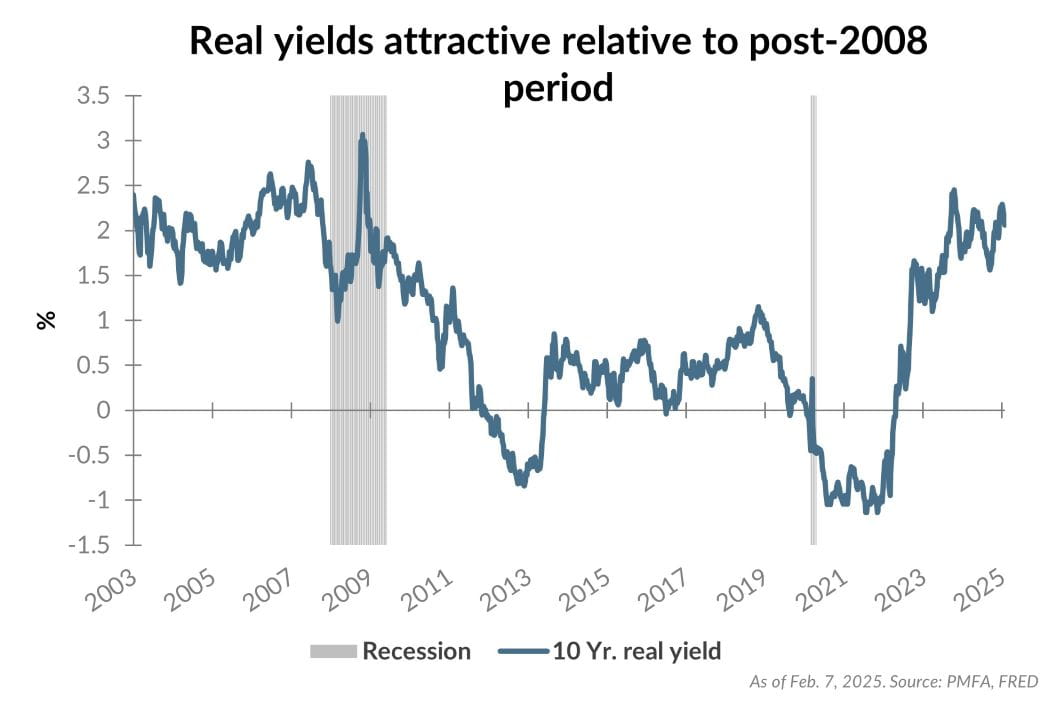

Bond yields have risen notably over the past few months, with the yield on 10-year Treasury bonds rising from below 3.7% in September to more than 4.5% today. As shown in the chart above, this increase has primarily been a result of a rise in real yields (yield minus expected inflation), rather than an increase in inflation expectations. The increase in real yields can be traced back to a variety of factors, including higher expectations for economic growth, rising debt tied to ongoing federal spending and resulting budget deficits, and tempered expectations for additional fed rate cuts in the year ahead.

While this type of rapid increase in yields has a negative shorter-term impact on bond prices, as we discuss in our accompanying piece, income is the primary driver of longer-term bond returns. With real yields above 2%, fixed income investors now receive enough income from their bonds to earn 2% over inflation — nearly the highest real (inflation-adjusted) yield in more than 15 years.

What does this mean for investors? While rate volatility has weighed on recent performance, investors can expect to receive better inflation-adjusted income from their bonds than nearly any other time in recent history, assuming inflation doesn’t break out for an extended period. High-quality bonds continue to play an important role in diversified portfolios and increasingly look attractive as a source of real return. We continue to expect that bonds will have a more meaningful, positive impact on portfolio returns in the coming years than they have in some time.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.