With the Fed now a few rate cuts into its easing cycle, questions remain about whether an economic “soft landing” can be achieved. Will the Fed be able to lower rates further without reigniting inflation? That was already a question before the election, but its outcome raised the stakes. Raising specific concerns has been the topic of import tariffs, which would lift prices for any impacted goods, all else being equal.

Despite those questions, the Fed’s bias toward easing reflects a belief that the greater risk today is keeping rates too high for too long, jeopardizing job creation and positive economic momentum. To that end, the Fed has moved comparatively quickly to trim its policy rate before any discernible surge in layoffs.

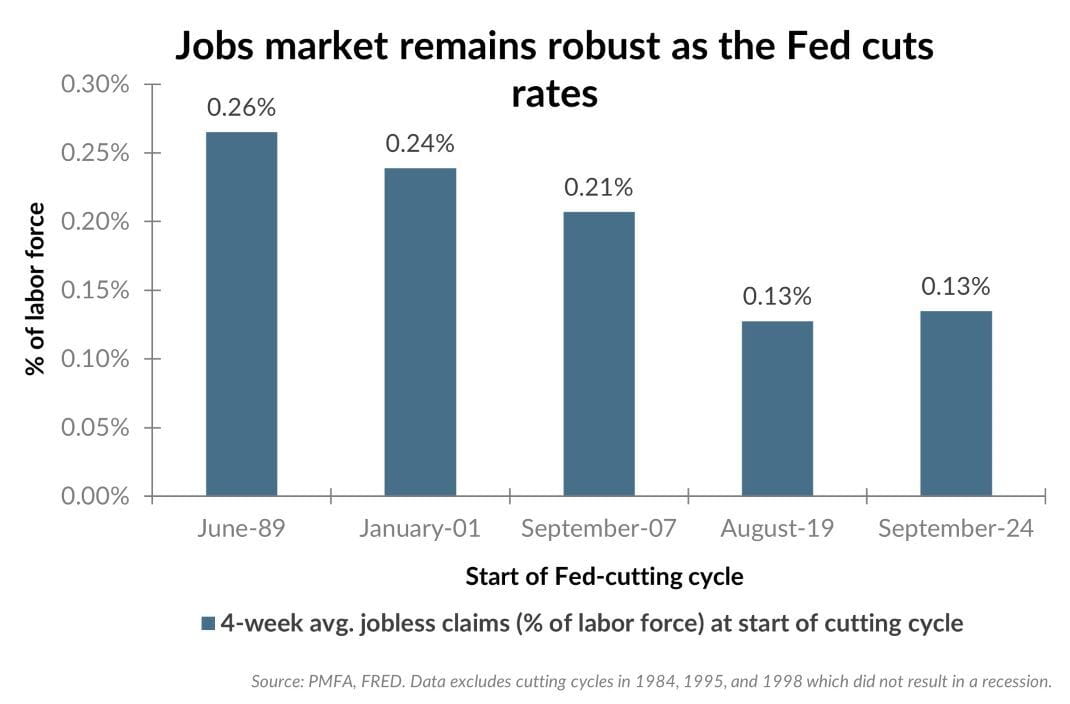

The chart above illustrates the number of new claims for unemployment benefits (as a percent of the labor force) at the beginning of the cutting cycle preceding each of the past four recessions. As shown in the chart, the labor market today is in a much stronger position than it typically has been during “hard-landing” scenarios (1990, 2001, 2007) in which the economy slipped into recession. Since the late 1980s, only the rate cut in 2019 came at a time that initial jobless claims as a percentage of the labor force was fractionally lower than this year. The recession that followed wasn’t a result of high interest rates, but the global economic shock resulting from the COVID-19 pandemic.

The Fed’s decision to move more quickly reduces the risk that policy falls behind the curve, improving the potential for a soft landing. Still, the risk that inflation could reaccelerate isn’t lost on Fed policymakers. For now, their bias is still toward cutting, although that could reverse if 2025 brings a renewed flare-up in inflation pressures.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.