By the numbers: Generally positive, but mixed

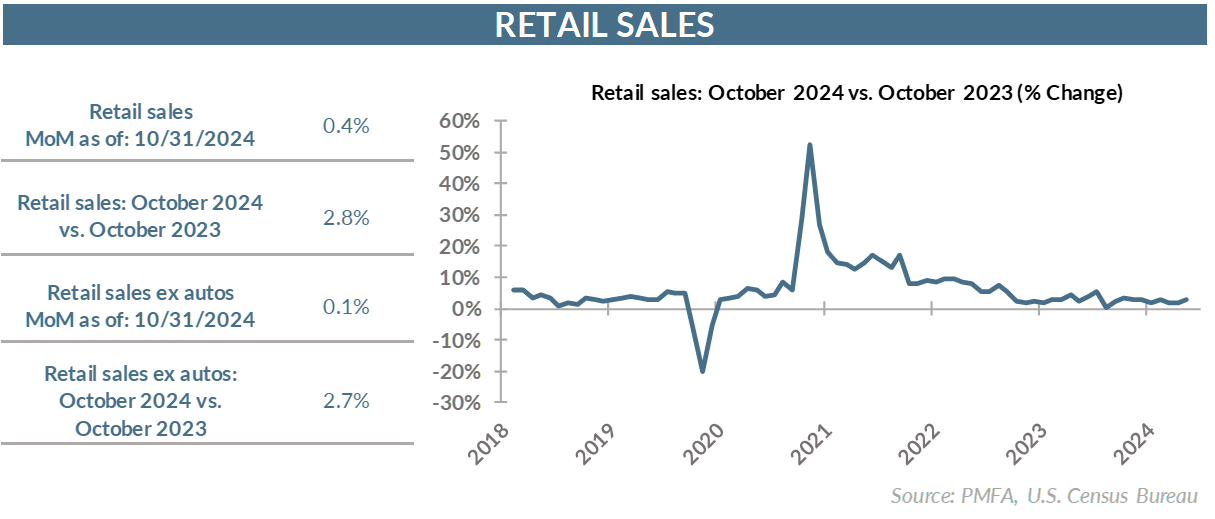

- Retail sales rose in October by 0.4% month over month, modestly ahead of expectations for a 0.3% increase.

- Core retail sales, excluding automobile and gasoline sales, barely moved, edging up by just 0.1%.

- The important control group reading that feeds directly into GDP fell by 0.1%, a result that was well short of the consensus 0.3% gain forecast for the month. While a disappointment, it was accompanied by a big upward revision to the September increase to 0.5%, muting its impact.

- Both readings reflected a sharp slowdown on the heels of strong September gains of 0.8% and 1.2% for headline and core readings, respectively.

Holiday forecast: Solid but unspectacular

- Coming off another solid quarter of momentum for the economy that was boosted by a sharp pickup in goods spending, the October gain suggests that spending momentum may have slowed a bit but remains constructive.

- The top-line gain for the month was solid, and the underlying monthly gain in auto sales and stronger spending on electronics and appliances are positive indicators of the current consumer mood.

- The uptick in spending at restaurants reflects positively on consumers who appear comfortable in their ability to spend a bit more to dine out rather than having to stay home. Grocery store sales were basically flat.

- Lower gas prices and a flattening in food prices over the past year have provided a bit more flexibility for households to spend a bit more on discretionary items, undoubtedly one catalyst for a more upbeat consumer outlook.

- Looking ahead toward the holiday season, consumers appear well positioned to spend into the end of the year, although the tailwinds are likely not as strong as in recent years. Wage growth is slowing, and cash stockpiles aren’t as sizable as they were in recent years, providing less fuel for spending. Conversely, lower inflation and a rosier consumer outlook for the economy should help. All in all, forecasters generally are looking at a holiday shopping season that’s more solid than spectacular.

The bottom line?

- Retailers benefited from decent sales gain in September, juiced by strong auto sales.

- The next few months will be key, as retailers attempt to position for a strong close to the year.

- The strong tailwinds of wage growth, credit availability, and cash stockpiles that fueled household spending in recent years have all weakened. A much-improved economic outlook, lower inflation, and falling interest rates should help.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.