While every investor is unique, most allocate to a mix of traditional stocks and bonds as the foundation of their portfolio. This approach is well-rooted in decades of market history as stocks and bonds have typically provided positive returns as complementary asset classes across market cycles spanning many decades. Over time, stocks have contributed more to portfolio returns, while bonds typically provide a source of income and relative stability to reduce aggregate portfolio risk.

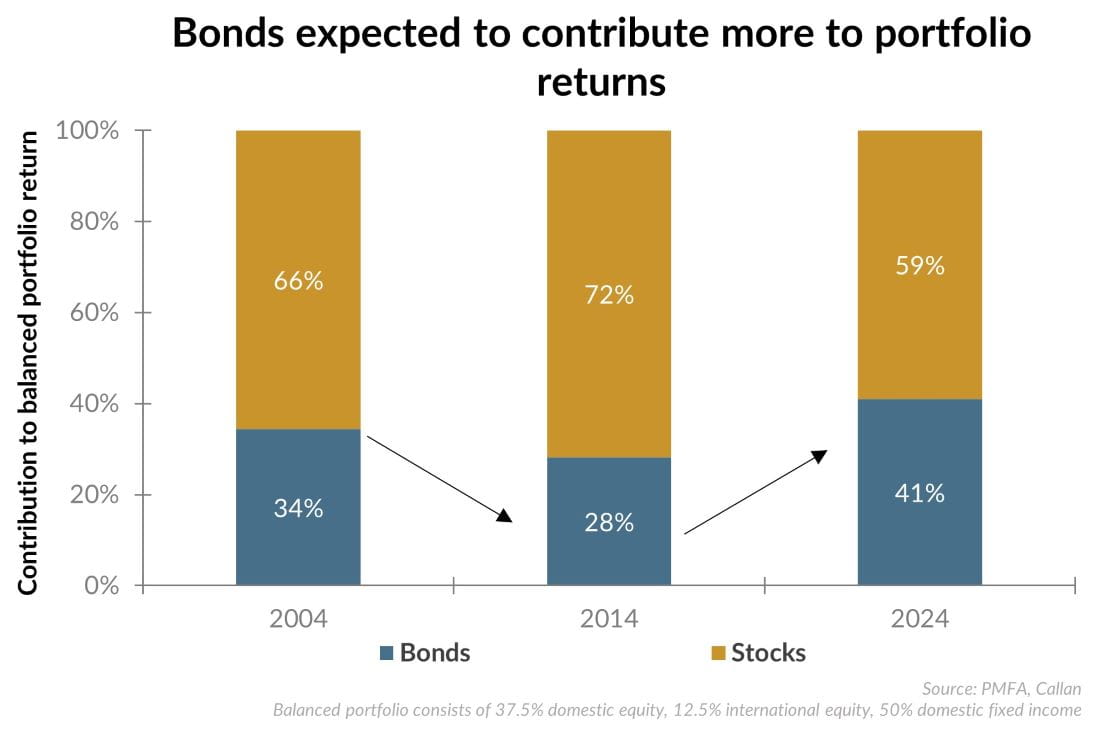

For much of the 15 years leading up to 2022, the ultra-low-rate policy maintained by the Federal Reserve produced an extremely low yielding environment for bonds. For a portfolio balanced between equities and fixed income, bonds still provided safety but contributed less on a relative basis to portfolio returns. This is evident in the expected return contribution in 2014, shown in the chart above. Lower yields translated to a lower contribution to portfolio returns than had been the case during the period prior to 2008.

That dynamic has changed dramatically since the Fed’s aggressive interest rate hiking cycle that commenced in early 2022, lifting yields across the bond market. In turn, the expected contribution of bonds to balanced portfolio returns has increased to over 40%, well above the post-2008 range, and even surpassing expectations in the mid-2000s, prior to the Great Financial Crisis and initiation of zero interest rate policy.

What’s the bottom line? The risk-and-return makeup of a balanced portfolio is more favorable today than during the era of ultra-low rates. Normalized yields suggest that bonds should contribute more to future portfolio returns than has been the case in over a decade, representing a favorable regime change for the asset class and for fixed income investors.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.