By the numbers

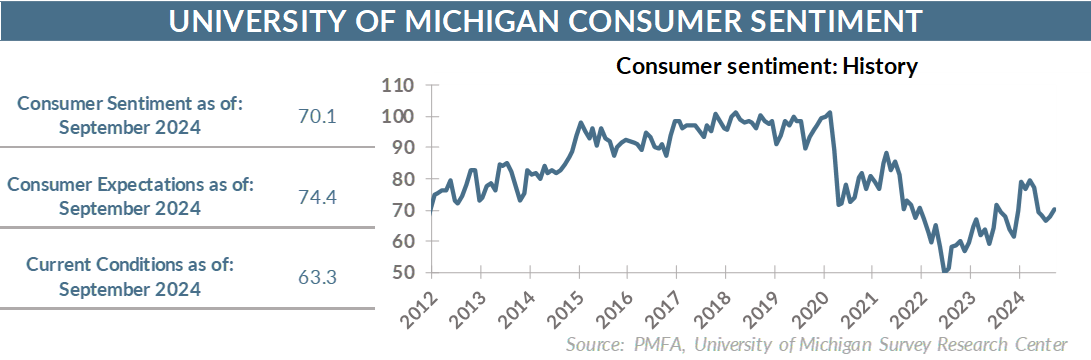

• Consumer sentiment improved ever so modestly in September, coming in at 70.1 — slightly better than the preliminary September estimate of 69.0 and the August 67.9 reading.

• Suggesting that the collective consumer mood has improved in recent month’s likely overstates the reality though, as the index has been tightly rangebound since a more pronounced slide in May.

• The index remains well off its current-year peak and below its long-term average.

Broad thoughts

• On a positive note, sentiment has rebounded since its cyclical low in 2022, when the one-two punch of soaring inflation and recession fears hit consumers hard.

• Inflation has fallen considerably over the past two years, ultimately opening the door to the first Federal Reserve rate cut in nearly five years last week.

• This morning’s PCE inflation print reaffirmed the disinflationary trend, coming in at a very benign 0.1% increase in August. The trailing 12-month index increase of 2.2% was the lowest since February 2021.

• Even strong indications that inflation continues to ease doesn’t alleviate the ongoing challenge posed by elevated prices, as many households continue to feel the weight of a higher cost of living.

• The three pillars that supported strong consumption earlier in the expansion have all weakened: wage growth is receding, the excess stockpile of cash has been largely (if not fully) depleted, and credit card debt has grown at a rapid clip.

• That doesn’t suggest that consumers can’t continue to spend, but with less cash or credit available to fuel that spending, a sharp resurgence in consumption appears unlikely.

• Lower interest rates will certainly provide some relief, particularly for more highly indebted consumers that will benefit from a reduction in variable rate credit or may be able to refinance higher fixed rate mortgages originated in the past few years.

Looking ahead

• The improvement in sentiment crossed over both key metrics, encompassing both respondents’ views on the current state of the economy and their expectations for its direction in the near term.

• That modest improvement has undoubtedly been fueled in part by the strengthening of the soft-landing narrative, which — while far from guaranteed — remains plausible given the underlying tone of much of the economic data. Job creation has cooled considerably, but there’s been no discernable signs of a pickup in layoffs. If that narrative holds, a goldilocks landing for the labor economy would likely result in a further moderation in wage growth but an otherwise solid underpinning for workers.

• The half-point Fed rate cut, while important, was only part of the story — one that was well received by the markets. A further reduction in the Fed’s projected path for interest rates through 2025 reinforced the expectation that much more easing was still in the pipeline that would provide further relief to borrowers while removing a meaningful headwind to growth.

The bottom line?

• It’s relatively rare that the economy is truly hitting on all cylinders, and there’s no potential source of risk or potential concern for consumers. Inflation has fallen, but prices remain high. Layoffs are low, but wage growth has moderated. And while there’s a very plausible path to a soft landing and a continuation of the current expansion, the risk of recession in the next year can’t be dismissed.

• Against that backdrop, consumers remain guarded about the current state of the economy, but increasingly optimistic that the coming year will be characterized by improvement.

Media Mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.