First, the bottom line: Still solid

- Just as the economy itself came into 2025 with solid momentum, there’s little evidence of any increase in layoffs, consistent with a job market that remains relatively firm.

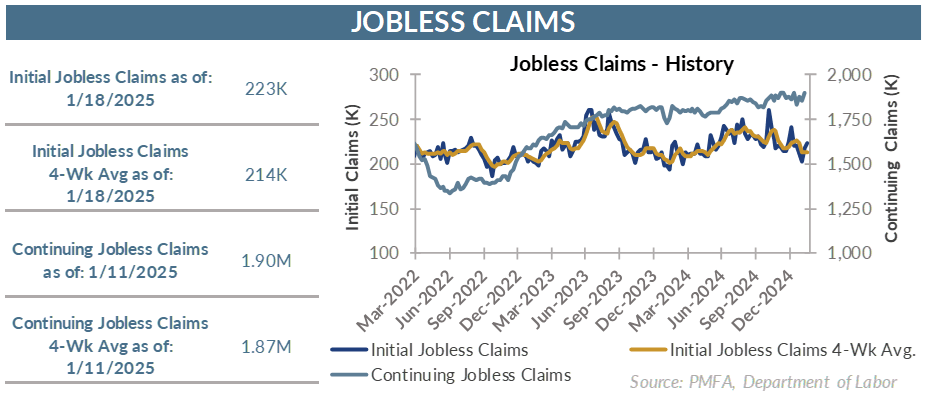

- Despite a summer surge, the weekly pace of layoffs hasn’t increased meaningfully over the past year.

- If there’s any weakness to be found, it’s more apparent in continuing claims, which rose to 1.90 million versus 1.76 million a year ago, although even that’s not terribly concerning.

- The gradual uptrend in continuing claims over the past few years corresponds with a decline in the number of openings and a slowdown in the pace of job creation. It also reflects a labor force that grew by more than 1.11 million over the past year.

- Bottom line: The frenetic hiring spree and job-hopping atmosphere of a few years ago has largely normalized. Labor conditions remain largely constructive, consistent with an economy that remains on a solid growth path.

By the numbers: Slight weakening, but no alarm bells

- Initial jobless claims edged higher last week, rising to 223,000 for the week ended January 18.

- Economists had forecast a more modest increase to 220,000 from the prior week’s level of 217,000, which wasn’t revised in today’s report.

- The 4-week moving average was virtually unchanged at 213,500 from the prior week.

- Continuing claims rose to 1.90 million from 1.85 million a week ago.

- Despite the gradual stair-stepping increase in continuing claims, growth in the labor force is part of that story. The insured unemployment rate was unchanged at 1.2% — exactly where it was one year ago.

What next?

- For now, most data points to an economy that has come into 2025 with few signs of faltering.

- Consumer sentiment has risen, lifted in part by decent wage gains and the positive wealth effect of higher home values and a solid two-year advance in the stocks market. The combination of solid household balance sheets, stronger income, and a sunnier disposition has fueled continuing growth in consumer spending — the lynchpin to continued economic growth.

- That’s not to say that there aren’t sources of concern, particularly for lower-income households.

- The pace of price increases has slowed, but the inflationary surge in prices in recent years isn’t likely to reverse course. Prices remain much higher for most goods and services than before the surge and continue to pinch household spending, particularly for lower-income consumers.

- Higher prices are a frustration but haven’t broadly derailed consumer spending and doesn’t appear likely to do so in the near term.

- On the heels of his inauguration earlier this week, President Trump has already announced a flurry of executive orders. While no firm plans have been formally announced, he appears poised and ready to move full steam ahead with a batch of new tariffs levied against several of the country’s trading partners.

- What his next steps on trade, immigration, and deregulation will mean for the economy remain to be seen but will hinge on their specifics — how aggressively they’re pursued, along with their breadth, duration, and magnitude.

- Crosscurrents from the Trump administration’s policy priorities, which are focused on immigration, trade, deregulation, and taxes, create a host of questions about the economic outlook. Some are expected to provide a boost to the economy, while the effect of others is less clear.

- The potential inflationary impact of higher tariffs remains a risk in an environment in which the Fed is focused on reining it in. Further, much of the job creation in recent years has been fueled by the influx of immigrants into the workforce. That’s highly unlikely to continue to the same degree, although there are still more questions than answers around how quickly and aggressively Trump will move from campaign promises to action.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.