By the numbers

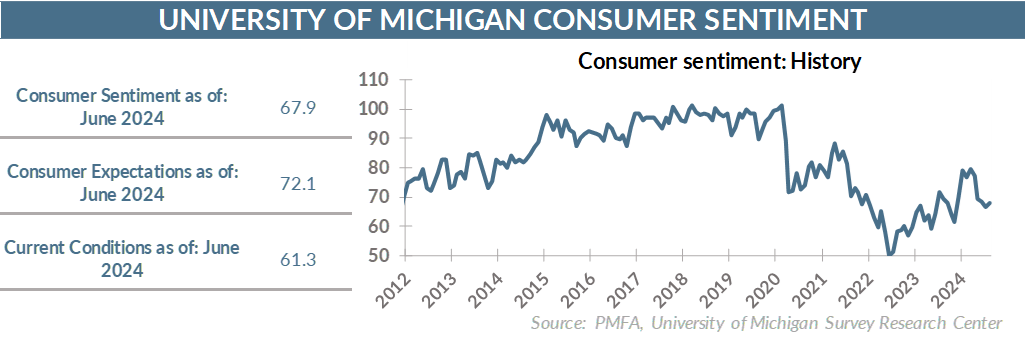

The University of Michigan Index of Consumer Sentiment edged modestly higher in August, coming in at 67.9 — staying in line with its recent holding pattern. The index remains well off its March high of 79.4, while remaining virtually unchanged from its level last August. Keep an eye on how consumers react to the Fed’s shifting focus away from inflation and toward the softening labor market.

Broad thoughts

Consumer sentiment has improved significantly since 2022, when inflation was gripping the economy and challenging household spending budgets. Inflation challenges gave way to recession risk, casting a dark cloud over sentiment. Despite the growing sense that a soft landing appears like a near-term plausible outcome, sentiment has yet to fully recover from a range generally reserved for recessionary periods.

The November election appears to be playing a heavy role in coloring the collective consumer mood. In an unusually volatile election environment that has seen a change in candidates in one major party and a whipsaw in expectations for the election, many Americans are viewing the outlook for the economy through a partisan lens.

The decision by President Biden to drop out of the race and the subsequent affirmation of Vice President Harris as the Democratic nominee provided a significant boost in the spirit of those self-identifying as Democrats in the survey. Conversely, the prevailing mood among self-identified Republicans turned south, likely in response to recent polling that has suggested that former president Trump’s lead has evaporated over the last month.

Soft landing runway?

Questions persist about the risk of a recession or the probability of a soft landing for the economy over the coming year. The economy has slowed but not to an alarming degree. Labor demand has softened, but that was a necessary step to bring some balance back to the jobs market and rein in price pressures. Most measures of inflation are on a positive path back toward a more sustainable range in line with the Fed’s 2% target.

Those developments have set the table for the Fed to deliver its first interest rate reduction in what’s expected to be a string of cuts when they meet next month.

Whether current Fed policymakers can succeed where many of their predecessors have failed remains to be seen. For now, there’s a sense — and a growing one — that they just might stick the landing this time.

The bottom line

Greater clarity has emerged regarding Fed policy, and lower interest rates will be a welcome development for consumers. Whether lower rates will arrive soon enough to allow the glide path for the economy to coast into a soft landing remains to be seen.

Increasingly, near-term questions about the economy are receding as the presidential election takes center stage. In a sharply divided electorate, there’s a perception that the stakes are high for its outcome.

Absent a major, unexpected turn in the general tone of economic data, it may be the election, and the uncertainty of a close race, which keeps sentiment in check in the near term.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.