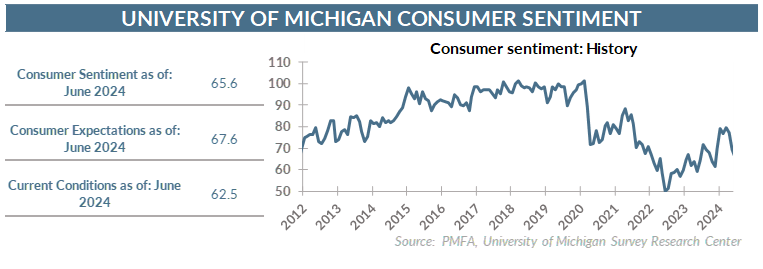

Consumer moods dimmed modestly in early June, as the collective assessment of current economic conditions took a step back. The University of Michigan Consumer Sentiment survey eased from 69.1 in May to 65.6 this month — a decline that was within the margin of error but a decline, nonetheless.

Despite the step back, the index remains modestly above its level one year ago and is well off the trough two years ago, when inflation was a significant source of consumer angst as prices accelerated at the fastest pace in decades.

Consumers aren’t as concerned about the inflation outlook today but still appear skeptical about how easy it will be for the Fed to engineer an easing of inflation to the pre-pandemic 2% range anytime soon.

Consumers still expect inflation to top 3% over the next year; more notable is the upward pressure on long-term expectations, which edged up to 3.1%. That seemingly reflects a belief that a new inflation regime could be in place for some time, replacing the sub-2.0% norm that followed the global financial crisis and the resulting policy focus on the risk of deflation. Those concerns are now long gone, replaced by the recognition that getting the inflation genie back in the bottle comes with its own set of challenges.

Standing in contrast to the notable deterioration in current conditions, consumer expectations ticked only modestly lower, as recession concerns have faded considerably. That doesn’t mean that the loosening in economic conditions that’s underway couldn’t ultimately result in a recession, but for now at least, consumers continue to buy into the soft-landing narrative.

Much will seemingly hinge on whether the Fed can successfully navigate the path and timing to cut rates soon enough to avoid a policy-induced recession while not moving too soon, raising the risk of a secondary surge in inflation.

The relative calm of the equity market suggests that investors still believe that outcome is likely, but the flow of economic data in the coming months focused particularly on jobs, the health of the consumer sector, and price pressures will be important to watch.

The bottom line? Heading into the summer, the collective consumer mood is cautiously measured, lacking signs of either excessive optimism or pessimism. Consumers appear content to buy into a benign soft-landing forecast, but with a degree of skepticism, acknowledging persistent questions about inflation and interest rates that’s keeping a more pronounced sense of optimism in check.

Our experts were recently quoted on this topic in the following publication:

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.