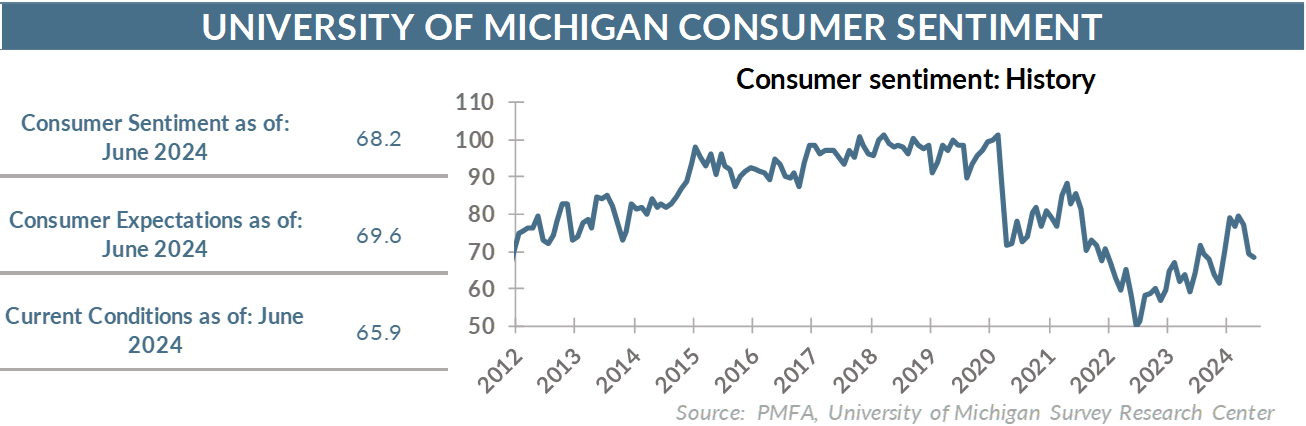

The University of Michigan’s consumer sentiment index was upwardly revised in the latter half of June, topping expectations. That’s largely the end of the good news contained in today’s report.

That the “better-than-expected” result merely exceeded expectations for a more pronounced decline is important context. The bar was quite low.

The collective consumer mood suggests a persistent malaise that shows little sign of changing. It’s not a “not too hot, not too cold” economy that provides a goldilocks backdrop, but one in which inflation is still too high even as growth is slowing.

The result? Consumers are showing signs of tightening up their proverbial pocketbooks, spending much less freely as wage growth slows, unemployment creeps higher, and the stockpile of excess savings that had provided the fuel for brisk spending in recent years dries up.

Those factors appear to be feeding the moderate deterioration in consumers views on the current state of the economy over the past month. Conversely, the expectations index edged fractionally higher, perhaps helped by better numbers on expected inflation a year out, which fell from 3.3 to 3.0% since last month.

Within the context of the past few years, the collective mood has trended higher as inflation pressures have eased. Even so, the index remains well below its long-term historical average, indicative of persistent concerns that simply won’t go away.

The bottom line? Consumer sentiment may be better than expected, but those expectations were far from upbeat. As households increasingly feel the weight of elevated inflation, higher interest rates, and lower wage growth, they’re also recognizing that they just don’t have as much extra cash available to spend. The result? A sense of unease around the economic outlook and their personal finances that’s likely to continue to weigh on household spending in the coming months.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.