First, the bottom line: Softer-than-expected retail sales not a cause for alarm. Yet.

- The Valentine’s Day data drop on January sales showed little love for the retail sector.

- One data point doesn’t make a trend, but the January retail sales report suggests that consumers took a step back at least temporarily last month, ending a strong run for the retail sector dating back to late summer.

- Despite a slow start in 2024, the economy closed out the year on a better note. Strong consumption provided the primary lift, as consumers demonstrated both a willingness and ability to spend at a brisk pace. Coming on the heels of that, perhaps January’s setback is just a temporary breather for a consumer base that spent freely in recent months; perhaps it’s reflective of a period of more constrained spending habits. That remains to be seen.

By the numbers: Consumers retrench

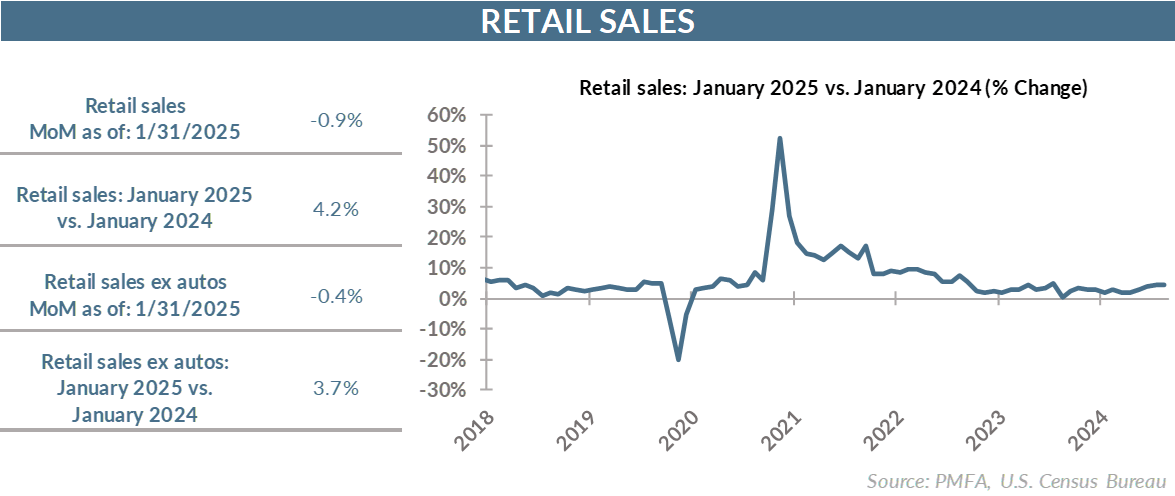

- Retail sales declined sharply in January, falling 0.9% for the month against an expected decline of 0.5%.

- While disappointing, the impact of the unexpectedly poor monthly result was largely offset by a solid upward revision to the December advance from 0.4 to 0.7%.

- Further, a sharp drop in auto sales specifically accounted for more than half of the single-month decline. Retail sales ex autos declined, but by a much less concerning 0.4%. That step back wasn’t surprising on the heels of a sharp surge in vehicle sales in November and December. January sales were notably lower, but in line with the average monthly pace over much of the past two years.

Broad thoughts: A redux of 2024? Maybe, maybe not

- The result is eerily similar to the same period one year ago, when retail sales also dropped by 0.9%, stumbling out of the gate in 2024 and raising questions at the time about the potential loss of economic momentum. Sales bounced back sharply in the two months that followed, alleviating those concerns.

- Even so, soft consumption numbers in the first quarter weighed heavily on the economy early last year, which posted a lackluster 1.6% advance in Q1 before nearly doubling that pace in the two successive quarters.

- Whether consumers will follow a similar pattern in the coming months remains to be seen. With the potential of higher tariffs on a range of imports, either already in place or looming, higher prices are likely to act as a headwind to consumer enthusiasm in the coming months. That represents a major wild card and additional challenge to household spending that wasn’t present last year.

- The question is how broadly tariffs will be applied and how significant the near-term impact might be on prices — and that will in turn provide important perspective on how consumer sentiment may turn.

- Weaker-than-expected consumption to start the year will give Fed policymakers one more angle to consider as they contemplate the timing and direction of their next move. Tangible evidence of an inflationary resurgence — and the potential of more to come — has pushed back expectations for another interest rate cut, enabled in part by signs of solid economic momentum in recent months.

- Whether the pattern for 2025 ahead echoes 2024’s weak start and subsequent resurgence remains to be seen. There’s a risk in reading too much into today’s report. One weak retail sales result isn’t going to materially move the needle on expectations for the Fed, particularly if other data on consumption and labor conditions remain solid, or at least “good enough.”

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.