First, the bottom line

• Job creation in October was exceptionally weak, but significantly influenced by the disruptive effects of two hurricanes that battered the southeastern United States and a temporary drag on net job creation from the Boeing strike that was subsequently resolved.

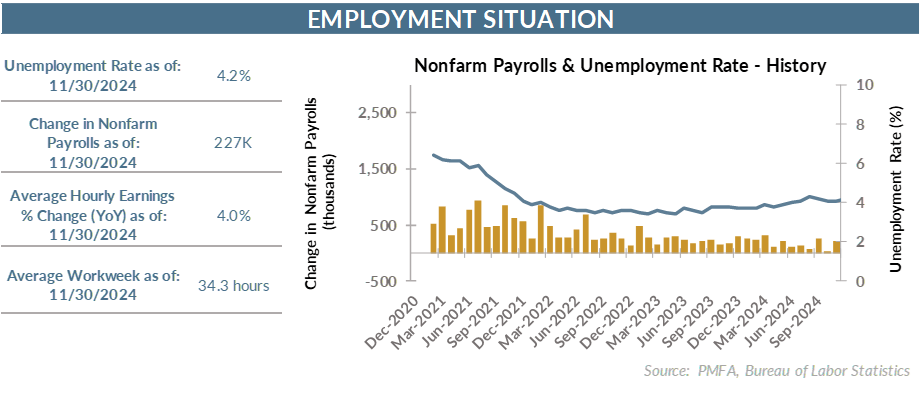

• As a result, the November employment report was set up for a sharp reversal; it didn’t disappoint. The 227,000 gain in payrolls delivered on those expectations. However, the outsized gain in payrolls appears to be much more consistent with a reversal of the short-term headwinds last month than a durable pickup in the pace of job creation.

• Labor conditions have eased over the past year as the pace of hiring has slowed and the musical chairs environment of voluntary turnover has normalized.

• It’s a labor market that has cooled considerably from the go-go hiring blitz of a few years ago. Employers aren’t scouring for workers the way that they were at the time and certainly aren’t throwing aggressive compensation packages at potential hires to lure them in.

• Setting aside the post-2020 period, wage growth of 4.0% over the past year is still quite solid though and gives Fed policymakers plenty to think about as they try to balance the employment and inflation components of their dual mandate.

Broad thoughts: Plenty of noise but also some signal

• There’s been plenty of noise in the jobs data over the last two months, largely driven by the convergence of two temporary shocks to the jobs market. Even so, the underlying weakening in the pace of job creation is more than just noise.

• It’s difficult to definitively quantify the degree to which October payrolls were negatively impacted by the hurricanes in the southeast United States and the Boeing strike, but there’s no question that the impact was significant.

• The sharp bounce back in payroll growth in November was widely expected and validated expectations that it was that trio of exogenous events that hammered job creation in October and not a broad-based slowdown in the economy.

• Alongside the estimated 227,000 new jobs created in November was a moderate upward revision to the October data that lifted nonfarm payrolls by another 24,000 for the month to 36,000.

• Despite the volatility in the recent data, there’s still a signal in the trend that suggests that the labor market has cooled over the course of the year. Job creation over the past six months has averaged about 143,000/month — well below the 204,000/month over the comparable period last year and slower that the pace of job creation early this year.

• Unemployment ticked up to 4.2% in the household survey. Through that lens, the number of employed individuals declined by 355,000, standing in sharp contrast to the gains reported by employers.

• Ultimately, the seemingly conflicted household and employer data and the bumpiness in the month-to-month payrolls data will be resolved.

• The underlying signal points to a labor economy that has come off the boil and has reverted toward a more normal, sustainable pace.

• The question is whether job creation can and will stabilize in a constructive range that’s neither too hot nor too cold. Given other indications that the economy remains on a solid growth trajectory, that outcome appears achievable in the near term.

The Fed is watching

• The November jobs report delivered a host of important data for Fed policymakers to consider as they head into their December policy meeting.

• There’s still a broad expectation that policymakers will deliver another quarter-point rate cut later this month. The bigger question is whether the resiliency of the economy in recent months and uncertainty on multiple fronts for next year will be enough to push policymakers to tamp down expectations for the pace of cuts next year.

• Measures of inflation have fallen considerably over the past few years, but progress toward the Fed’s inflation target has stalled more recently. Sticky shelter costs have played a significant role, but other parts of the service economy have also kept broad inflation measures elevated. Wages play a role in that dynamic, particularly in the service sector where wages represent a higher portion of the cost structure of many businesses.

• The November reports on producer and consumer inflation loom large but are unlikely to sway policymakers from delivering a pre-holiday quarter-point cut. It may just come with a warning to all that we shouldn’t expect the Fed to be as generous in 2025.

Media mention:

Our experts were recently quoted on this topic in the following publication:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.