Stocks posted strong returns in the third quarter in spite of some choppy market conditions, as investors turned increasingly positive in their assessment of incoming data and its implications for the economy and Fed rate policy. Q3 results added to what had already been a strong run for equities since late 2023, with the S&P 500 now up more than 20% since the beginning of the year.

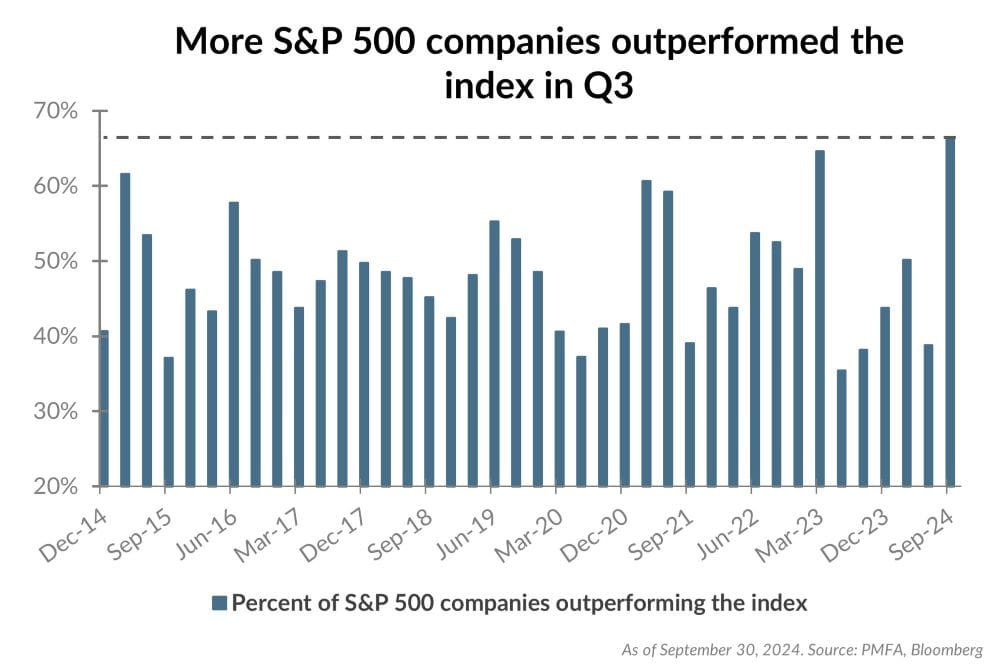

However, the stock market advance in Q3 was notably different than over the past few quarters. The chart above illustrates the percentage of stocks within the S&P 500 index that outperformed the broad index in each quarter over the past decade. It shows market performance over much of 2023 and the first half of 2024 was quite narrow. Returns over much of that period were primarily driven by a handful of mega-cap technology names that have notably outperformed the rest of the market. However, that dynamic reversed in Q3, with more than 65% of S&P 500 companies outperforming the index, the highest percentage in over a decade. Moreover, the stocks that had been leading the market advance fell behind the pack, with the technology sector notably trailing the broader index for the quarter.

What does this mean for investors? Broader participation in market gains is a sign of a healthier environment for stocks, where returns are driven by a wider range of sectors and companies rather than being narrowly lifted by a handful of the largest names. It can create greater opportunity for active managers to add value through stock selection. It also underscores the importance of remaining diversified, versus simply betting on a handful of names that had benefited from market momentum. When investor sentiment shifts and momentum reverses, diversification is beneficial.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.