By the numbers

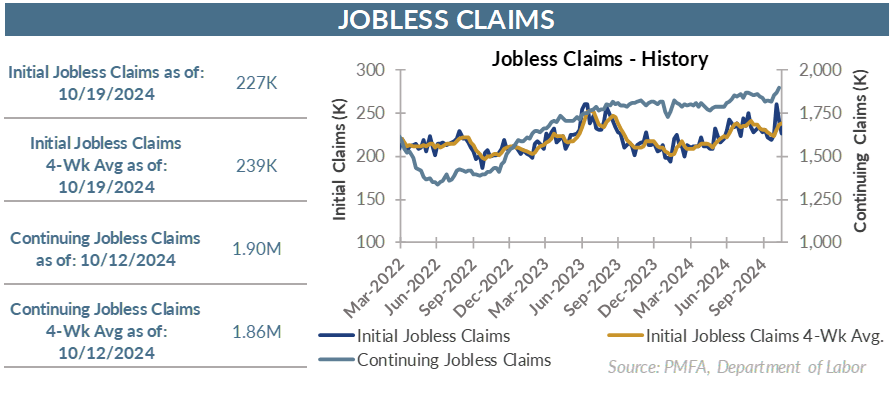

• Initial jobless claims declined last week, dipping to 227,000 for the week ended October 19, well below the consensus forecast of 242,000. That represented a notable reduction from the prior weekly total, which was nudged up by 1,000 to 242,000.

• Smoothing the impact of week-to-week volatility, the four-week moving average edged modestly higher to 238,500 for the week.

• Continuing claims rose by 30,000 to nearly 1.9 million, extending a slow grind higher over the past month.

What’s behind the recent volatility in claims?

• The recent surge in claims can be partially traced to the devastation caused by Hurricanes Helene and Milton and the temporary displacement of many workers in the impacted region.

• However, there have been meaningful upticks in other parts of the country as well in recent weeks, including a sharp — albeit perhaps brief — increase in manufacturing layoffs in Michigan and Ohio earlier this month.

• At this point, those increases look more like short-term aberrations than evidence of a more prolonged uptick in layoffs, but they’re developments that nonetheless merit watching.

Labor markets have been resilient

• Even as other parts of the economy were exhibiting signs of weakness and murmurs of recession risk became louder, the labor markets remained a relative bright spot for the economy in recent years. Hiring remained brisk, job openings were abundant, and layoffs were exceptionally low coming out of one of the toughest environments for recruiters and hiring managers in memory.

• The impact of higher interest rates and the loss of momentum across the economy took some of the wind out of the sails for the jobs market. The result was a moderation in nonfarm payroll growth as hiring slowed, but layoffs have remained relatively contained. Jobless claims have increased but haven’t spiked and remain in a range that reflects positively on the overall state of the labor economy.

• At the same time, an influx of 4 million workers into the labor force over the past two years lifted the number of available workers more quickly than jobs were being created, pushing the unemployment rate back above 4% in recent months.

• Prior to May, unemployment had been consistently below that 4% threshold for over two years.

The bottom line?

• The labor economy has cooled, but that cooling was necessary to alleviate some of the froth in the economy and relieve one of the underlying sources of inflationary pressure.

• Recent volatility in jobless claims don’t appear to be concerning, at least in terms of what they could signal for the broad economy. Those are at least in part attributable to the disruptive effects of the one-two punch from the back-to-back hurricanes that hammered the southeastern United States in recent weeks.

• More broadly, data suggests that job conditions are normalizing, with many measures of labor market health reverting toward the pre-2020 trends.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.