By the numbers

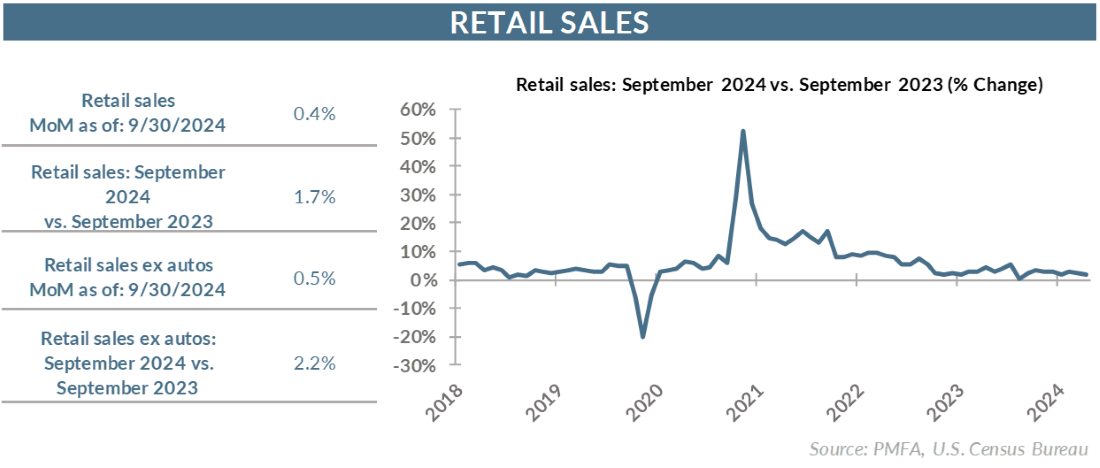

• Retail sales rose by 0.4% in September, coming in fractionally ahead of the consensus 0.3% forecast increase.

• Core retail sales, excluding automobile and gasoline sales, were exceptionally strong, rising 0.7% for the month.

• Despite the solid monthly gain, the trailing 12-month increase edged down to 1.7%, although that decline isn’t reflective of recent positive momentum for the retail sector.

Less fuel for spending, but household finances still solid

• On a trailing one-year basis, retail sales have edged lower, but that’s a function of some unusually strong monthly results of summer 2023 falling out of the trailing one-year data.

• On a year-to-date basis, top-line sales growth of 2.6% suggests that retailers are still benefiting from solid consumption, reflective of a consumer sector that remains in reasonably good shape.

• The three sources of fuel that had boosted household spending earlier in the cycle (a huge stockpile of excess savings, strong wage growth, and credit expansion) have all dissipated to varying degrees. Even so, households broadly remain on a solid footing, supported by constructive labor market conditions, solid wage gains, and manageable debt levels.

• If inflation pressures continue to ease as expected and the Fed can stay on its current rate-cutting path, consumers should feel both tangible and intangible benefits. Relatively stable prices and lower interest rates should provide a boost to confidence, while also providing a stronger tailwind for household spending growth.

The bottom line?

• Various measures of the consumer mood are still restrained, but that caution doesn’t appear to be translating to an unwillingness or inability of consumers to spend.

• Coming off the worst inflationary burst in decades, consumers are still feeling the pinch and adjusting to higher prices, despite considerable easing in the pace of increases over the past year.

• Nonetheless, a return to relative price stability and lower interest rates over time should help to reinvigorate sentiment, as long as the economy stays on a solid growth trajectory and labor conditions remain constructive.

• The further that the inflation scare fades in the rearview mirror, the less likely it is to weigh on the minds of consumers. Every monthly data point that reflects greater price stability also clears the path for the Fed to continue to trim rates back toward neutral, easing the cost of borrowing and opening the door for more consumer spending on big-ticket items such as cars and appliances and providing a boost to housing.

• It’s too soon for the Fed to take a victory lap, but the continued strength of household consumption — as evidenced by the unexpectedly strong retail data — provides a solid underpinning for the broad economy to sustain its positive momentum as inflation eases.

• That keeps the door open for further interest rate cuts and keeps the soft-landing narrative alive.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.