By the numbers

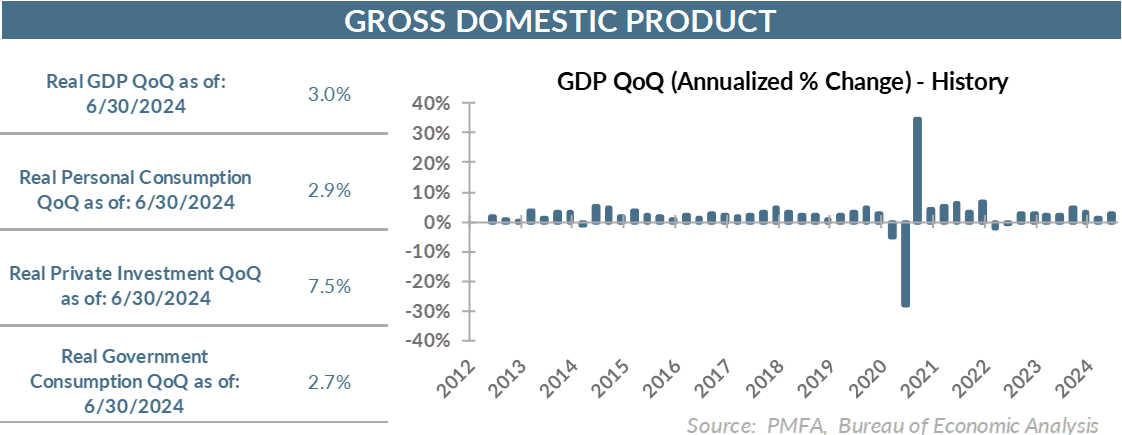

The second release of Q2 GDP benefited from additional number-crunching that lifted estimated growth to 3.0% versus the advance estimate of 2.8%. Importantly, it also reflected a considerable reacceleration for the economy, coming off a lackluster 1.4% advance in Q1. The report came in at the high end of the forecast range of 2.4–3.0%, providing a modest upside surprise for the markets.

Recession risk fading?

Although the unexpectedly strong Q2 GDP gain is backward-looking and doesn’t reflect what’s happening in real time in the economy, it still provides support for the soft-landing/no-landing case.

Personal consumption growth was strong, notably spanning across spending on both goods and services. The rebound in goods spending was particularly good news, rebounding from a 2.3% contraction in Q1. The service sector has had to carry more weight as households shook off the hangover from the stimulus-fueled buying binge on goods that provided a massive boost to the economy even as Americans were slow to return to in-person activities coming out of the pandemic. That appears to be changing.

Private investment also gathered steam in the second quarter, but that momentum was limited to the commercial sector. Inventory restocking contributed a solid 0.8% to top-line growth, largely offsetting two consecutive quarters of drawdowns.

Housing investment was weak — perhaps surprisingly so given the 16% surge at the beginning of the year. High mortgage interest rates undoubtedly continue to play a role in softening up demand but should become less of a headwind as the Fed turns to rate cuts in the coming months. Even so, the quarterly decline doesn’t appear too concerning given the strength of the year-to-date gain.

Fed rate cut? All systems go

There’s nothing of note in the GDP report that should deter the Fed from their rate-cutting path. Growth remains solid, providing policymakers with a backdrop that suggests a panicked, aggressive series of cuts to stem a near-term recession isn’t necessary. Core PCE inflation was 2.8% for the quarter — still higher than policymakers would like to see, but also well off their 2022 peak.

Today’s jobless claims report also suggested a relatively stable trajectory in layoffs consistent with a labor economy that remains on a relatively solid footing. Demand for workers has fallen significantly as the Fed turned down the burner on an overheated economy but not to an alarming degree.

The larger inflation picture has shown ample evidence of considerable improvement. Some measures are still clearly running hotter than the Fed would like but remains directionally constructive.

The two big reports that will drop in the coming weeks — the August jobs and CPI reports — will be ones to watch. Nonetheless, it would take a few big surprises though for the Fed to not deliver a quarter-point cut next month. Of the two, the labor report appears to be the more consequential given the slowdown in job creation in recent months. Investors will be looking for at least some stabilization in nonfarm payrolls; a moderate reacceleration in hiring would go a long way toward alleviating concerns about a more pronounced uptick in the jobless rate.

Q3 GDP data will matter, but comparatively little, coming well after the Fed’s next meeting. The Atlanta Fed’s GDPNow forecast suggests a moderation in growth to around 2.0%, very much in line with most forecasts of longer-term trend growth for the economy. Again – nothing there that should prove problematic for policymakers.

Investors are counting on that, and the Fed appears both well positioned and sufficiently comfortable in the success of their prior rate policy measures to deliver on those expectations.

The bottom line?

Growth is solid, labor demand has moderated, layoffs have steadied, and inflation gauges are easing. That’s a solid combination for the Fed to reverse course and a potential goldilocks scenario that has quelled recession concerns and provided new support for a potential soft landing.

The economy may not be out of the woods, but there are growing signs that the Fed may have successfully kept it on a path that will lead it there.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.