Unpack the data

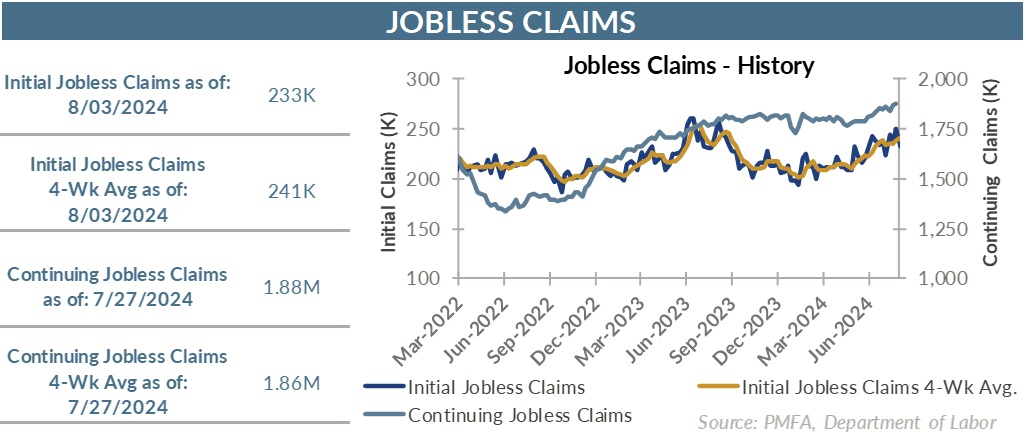

• Initial jobless claims dipped to 233,000 last week, a considerable dip from the revised 250,000 for the week ended July 27. Continuing claims rose by 22,000 to 1.96 million, a nominal uptick.

• Despite the pullback, the four-week moving average edged up to 240,750, reflecting the lagged effect of the uptrend in claims over the last month.

Weaker labor conditions have raised questions

• First-time claims for unemployment have been stair stepping higher since January but, given their low level, hadn’t really been a source of potential concern. That’s changed more recently, as other weaker-than-expected economic data has brought the potential for a near-term hard landing back into the discussion.

• Against that backdrop, today’s report provides some respite from those concerns, at least temporarily.

• Much of the recent concern about labor market weakness has been driven by the continued, very gradual rise in the unemployment rate over the past 15 months, reaching 4.3% in July. The pace of job creation has also slowed considerably over that period, consistent with the economy more broadly coming off its stimulus-fueled boil.

• The fact that the unemployment rate has been grinding higher without a marked increase in the pace of layoffs is meaningful. Labor force growth — much of it directly tied to immigration — has exceeded the pace of job creation, adding to the gap.

• Even so, the more pedestrian pace of job creation still reflects the softening in broader economic conditions. Housing has struggled under the weight of elevated home prices and high mortgage rates. Manufacturing has been muddling along for the past two years. Even the service sector — the most critical of the three in terms of its breadth — has experienced a slowdown in the pace of activity. As a result, the pace of hiring across all sectors has slowed.

What’s it mean for the Fed and the rate outlook?

• All of this has raised questions about whether the Fed has remained too aggressive in holding rates in restrictive territory as inflation has receded toward its 2% target.

• The reemerge of recession fears in recent weeks has prompted more vocal calls for the Fed to start cutting rates soon and in a more aggressive manner than previously expected.

• A September rate cut now appears likely, with investors now listening intently for any indications from the Fed about how their views of current conditions are evolving and what that might mean for their willingness to move beyond a measured trickle of quarter-point cuts to a more aggressive easing posture.

The bottom line?

• The decline in first-time unemployment claims last week may provide a breather temporarily but won’t flip the narrative on the hard-versus-soft landing debate. Significant questions remain.

• Claims are still relatively low, but the prolonged, gradual rise viewed in tandem with other signs of a weakening labor market will keep questions around the trajectory of the economy on the table.

• All eyes are now on the Fed as investors, economists, and Fed watchers call for rate cuts to provide relief with the worst of the inflation fading from view and the Fed’s 2% target seemingly in sight.

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.