Traditionally, equity-oriented investors have relied on public equity markets for capital appreciation in their portfolios. While public equities remain an investment bedrock, the universe of available public companies has been shrinking for nearly three decades. Many companies that may have otherwise gone public in the past have instead concluded to stay private, with a growing number being sold to or seeking investment capital from private equity funds. Over the last 20-plus years, private equity has compiled an impressive track record of enhancing equity returns while also diversifying equity exposure. Increasingly, we’re seeing a growing number of qualified investors interested in carving out a portion of their public equity allocation for private equity investments. In this paper, we evaluate the historical performance of private equity and the characteristics of these strategies that have helped them generate outsized returns.

Historical performance of private equity

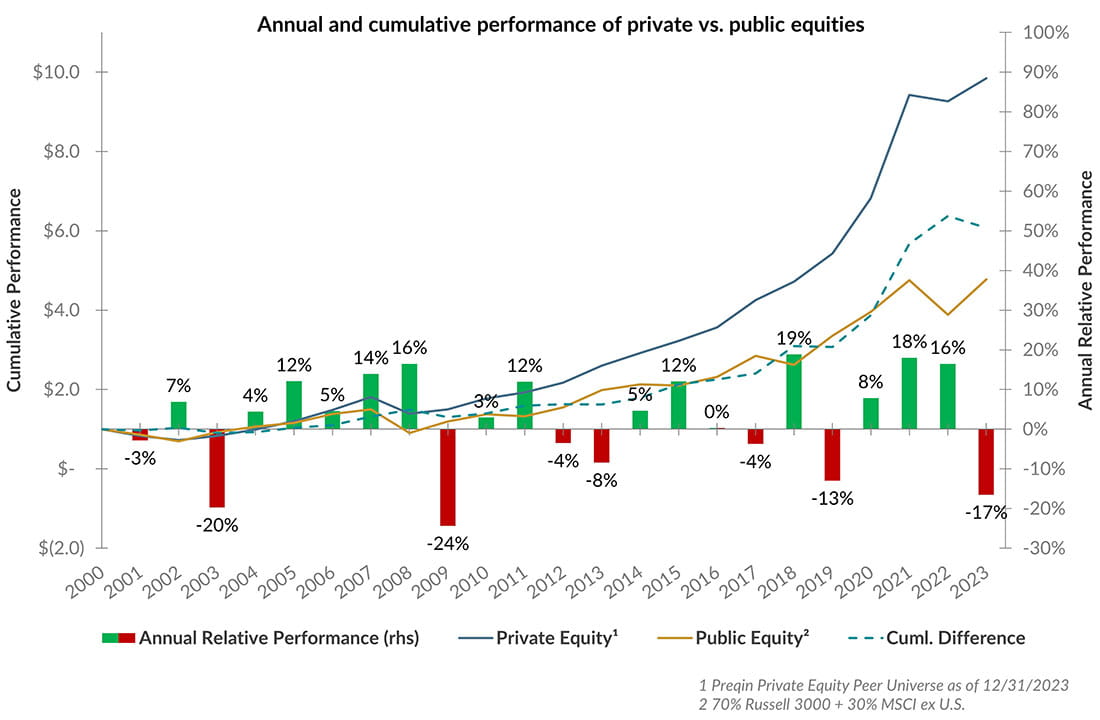

Over the past two decades, private equity returns have outpaced public equity markets by a considerable margin. Since the end of the year 2000, the global private equity index as measured by Preqin has delivered an annualized return of 10.5%, while a global public equity portfolio produced 7.0%, resulting in an average annual return premium of about 3.5%. When compounding this excess return, a dollar invested in private equity at the end of the year 2000 grew to nearly $10, which is just over double the amount you would have received in public equities if you remained invested over that duration.

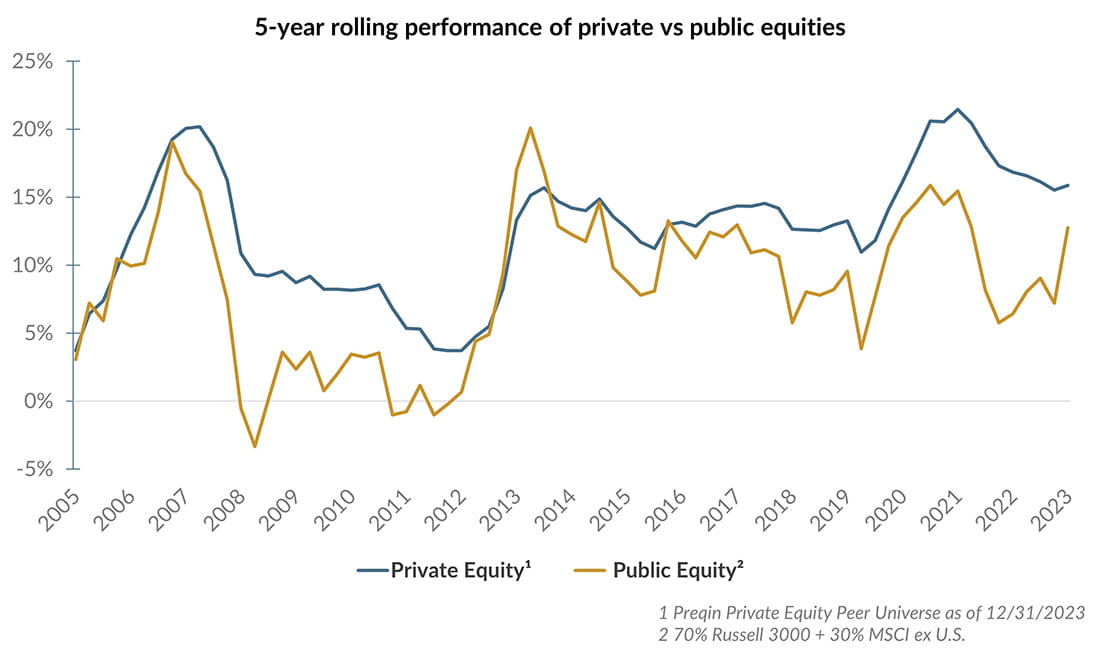

Over that time frame, private equity performance has been more consistent and sustained compared to public equities when looking at five-year rolling return periods. The lowest returning five-year periods, which encompass both the Dotcom Bubble and the Global Financial Crisis, private equity produced a 3.7% annualized return (period ended Dec. 31, 2005, and Dec. 31, 2012). The worst five-year stretch for public equities was following the Global Financial Crisis, and they were down over -3% (period ended March 31, 2009). Public equities only meaningfully outperformed private equity during one of the periods reviewed, and that was the five-year period that ended March 31, 2014.

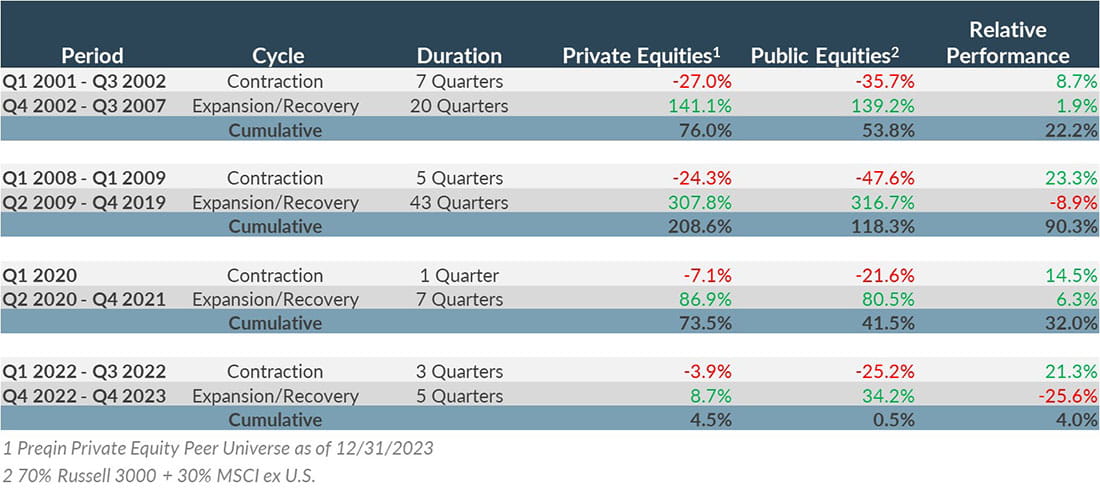

While the returns are enticing, private equity investments are high-risk strategies. Over the long run, they will be closely correlated to public equity markets because the two asset classes bear similar sensitivities to several factors, including the business cycle, consumer demand, and interest rates. Despite this, private equity tends to act differently during market drawdowns and expansion/recovery cycles, which can make it a useful complement to traditional stocks.

Due to the illiquid nature of private investments and limited pricing availability, private equity funds are valued less frequently and are therefore somewhat insulated from public market volatility. However, that doesn’t make them less risky. In many ways, private equity funds carry more risk than public equities due to the leverage, lack of liquidity, and very long lockup periods associated with such holdings. That said, the table below shows four separate periods since 2000 where public equity markets experienced a peak to trough drawdown of greater than 20% (contraction) before recovering. In all the periods observed, public equities experienced a greater drawdown than private equity. For instance, during the Great Financial Crisis (2007-2009), private equity faced significant downward pricing of over -24%. However, this was only about half of the -47% decline in public equities during that same period. Conversely, public equities benefited from a faster and stronger snapback in 2009, but the cumulative experience encompassing both the bear market and the subsequent decade-long bull market shows that private equity produced a smoother ride with a shallower drawdown and strong upside recovery following the decline. The result is a consistent outperformance of private equity in each of these periods.

How does private equity deliver excess returns?

To generate high returns, private equity strategies implement a few common tactics.

1. Leverage

Private equity funds utilize a heavy degree of debt or leverage to finance a portion of the company purchase price. Much like buying a house, private equity investors contribute equity capital and buy the rest of the company using debt. The company’s assets and future cash flow are used as collateral for the financing. Since the cost of debt is typically lower than the return on equity, the returns of the investment can be greatly amplified. On the other hand, when debt is unusually expensive or if the company is going through a financial hardship, the company might struggle to cover its debt service cost while simultaneously investing for continued growth. If cash flows are too tight, necessary investments within the business may be difficult to make and expected returns for equity holders can be negatively impacted. Lower levels of leverage can mitigate this risk but may also lead to lower net returns.

2. Market inefficiency

In theory, investors with better information should be at an advantage to produce superior returns. This dynamic only works in markets when participants don’t have readily available access to the same information. With limited exceptions, investors in public equities tend to make decisions based on the same set of publicly available information such as quarterly earnings, financial statements, and third-party analyst reports. Transactions and price discovery occur frequently, typically in very high volumes involving a large number of market participants. As a result, it’s more difficult to generate stand-out performance in public markets than private markets, where information is gathered from primary sources such as industry experts in managers’ personal networks and thorough on-site diligence visits, in addition to the aforementioned sources. Transactions and price discovery occur infrequently, contributing to the inefficiency of private markets and rewarding those who have an information edge.

3. Company size

Investment targets tend to have smaller market capitalizations which implies higher risk and therefore an increased return premium. Oftentimes, private equity managers are looking to grow or scale a smaller business by upgrading its management team, acquiring synergistic or complementary businesses, improving operational efficiency, investing in technology, or providing better access to capital. In short, there are more levers to pull at these smaller companies to facilitate strong performance.

4. Insulation from short-term market volatility

Private equity valuations aren’t subject to short-term market volatility, and asset owners can continue executing carefully thought-out value creation efforts. Furthermore, because private equity limited partners participate in closed-end vehicles, during periods of market distress, when public equity investors might need to withdraw their capital, private equity funds can take advantage of lower pricing to buy quality assets at attractive discounts.

5. Value creation

Private equity investment professionals will typically have close relationships with the management teams at their portfolio companies, influencing and advising on key business decisions. Private equity firms help develop value creation plans, which are specific strategies pursued to improve the profitability of the company. This can include improving the operations of the business through buying/upgrading or selling assets, divesting noncore business lines, or improving the organizational structure. They can help companies pursue top-line growth through scaling and increasing market share, pursuing add-on acquisitions, or improving operational excellence and marketing. Private equity firms often bring a full suite of professionals from within their networks to replace or augment existing management team members like putting in place a new CEO better equipped to lead a larger company or adding a chief marketing officer to institutionalize the sales team. A recent study conducted by Cambridge Associates found that private companies tend to have higher EBITDA and revenue, and thus better margins, than publicly traded companies1.

Active management is critical

It’s important to point out that the performance data shown above for private equity is based on the average of the universe of funds. Historically, private equity managers have shown a strong correlation between past performance and future performance. Managers that have achieved above-average performance historically also tended to perform better prospectively as well. This clearly illustrates a key consideration for investors in private equity: hiring the strongest managers can improve the rates of return above the average by a wide margin. Private equity funds experience greater performance dispersion compared to public equity-focused managers; however, there are many factors contributing to this dispersion. Some managers may focus on a couple of specific industries like technology or manufacturing. This can allow them to develop strong executive networks and excel at adding value in operating capabilities. Other managers might be more industry-agnostic but have a robust and well-tested process for platform roll-ups and merger integration. There is no right or wrong strategy in private equity, but the team should have the necessary expertise to execute on their value creation plan. These factors are highly qualitative in nature, so determining which manager might drive the best outcomes requires a robust diligence and selection process. Because transactions in private equity occur infrequently, most funds will be active and investing for several years, and those funds will maintain many investments for a decade or longer, correctly identifying managers with repeatable, effective strategies is critical.

Private equity’s active management does come with higher costs. Management fees are typically about 1.5 to 2% per annum, and the investment manager is entitled to 20% of the profits on average. While these figures are a stark contrast to the lower costs for public market investment options, the historical net-of-fee returns from private equity have justified the cost. As the asset class continues to grow and competition increases, it’s natural to expect the performance premium may compress. But hiring proven private equity managers with excellent long-term track records has historically led to stronger overall performance.

Bottom line, despite the asset class’s higher fees, private equity’s value creation, its lower recognized volatility compared to public equity markets, and opportunity to exhibit expertise in a large, inefficient market, make it an attractive option for investors to consider amongst their risk assets.

1. Cambridge Associates: cambridgeassociates.com/en-eu/insight/us-private-equity-looking-back-looking-forward-ten-years-of-ca-operating-metrics/

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.