Until recently, many taxpayers were unaware of a tax incentive for sellers of qualifying C corporations, but tax changes in the past several years have made this a go-to tax planning strategy that can create massive benefits to selling shareholders. For tax planning purposes, it’s important to understand the tax benefits of this gain exclusion, as well as the corporate and shareholder requirements.

What is the qualified small business stock gain exclusion, also known as Section 1202?

Section 1202 was enacted to encourage investment in small businesses. It allows individuals to avoid paying taxes on up to 100% of the taxable gain recognized on the sale of qualified small business corporation stock (sometimes referred to as QSBS). And even though it’s framed as a small business tax incentive, a business can be quite large and still qualify as a “small business.”

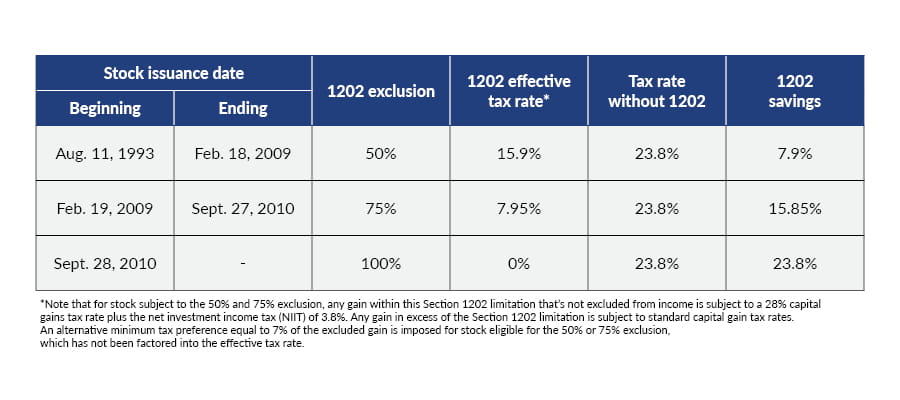

The gain exclusion is available for stock issued after Aug. 10, 1993, and applies to the greater of $10 million or 10 times the aggregate adjusted basis of the stock at the time of the issuance. Section 1202 can create an effective tax rate savings of up to 23.8% for federal income tax. The amount of the gain excludible by shareholders depends on the date of investment in the corporation. Many states also follow the federal treatment, resulting in even more substantial savings. The table below summarizes the amount of federal gain exclusion and potential savings.

Example: The tax savings are out there

Fox Mulder was issued stock in Spooky, Inc. on Jan. 1, 2011, in exchange for $2 million in cash. On June 1, 2016, Fox sold the stock for $22 million, realizing a $20 million gain. If the stock is qualified for Section 1202, Fox would exclude 100% of up to $20 million of his gain (i.e., the greater of $10 million or 10 times his initial basis of $2 million). Since Fox’s entire $20 million of gain realized would be excluded from income, Fox would pay $0 tax. Without Section 1202, Fox would have paid 23.8% on his entire gain, resulting in a tax liability of $4,760,000. Additionally, since Fox’s state applies a 5% tax rate to capital gains and follows the federal Section 1202 treatment, he also pays no state taxes, saving another $1 million. By using Section 1202, Fox saved almost $6 million in tax on a $22 million transaction.

Like many valuable tax incentives, the requirements to qualify for Section 1202 are complex and have many traps for the unwary. This, coupled with very little guidance from the Internal Revenue Service (IRS) in this area, creates challenges for taxpayers navigating the rules.

If you’re interested in the detailed requirements of Section 1202, read on. Otherwise, let us know how we can help.

Requirements to qualify for Section 1202 gain exclusion

Stock must meet eight requirements to qualify for Section 1202 benefits. While each requirement has some nuances that can’t be taken at face value, below is a high-level overview of each of these requirements. Some of these are determined by the shareholder, while others are determined based on facts and activities of the corporation.

Shareholder-level requirements

1. Eligible shareholder

The stock must be held, directly or indirectly, by an eligible shareholder. Eligible shareholders are all non-corporate shareholders including individuals, trusts, and estates. Suppose the shareholder is a partnership or S corporation. In that case, the gain may still qualify, but additional requirements must be met in order for the non-corporate owners of the pass-through entity to claim the benefits of Section 1202.

In particular, partnerships tend to create additional challenges that may reduce the ultimate benefit to the partners unless the partnership is intentional to preserve the Section 1202 qualification.

2. Holding period

The stock must be held for more than five years before it’s disposed. Generally, the holding period of the stock begins on the date the stock was issued. Suppose stock was issued in exchange for non-cash property. In that case, the Section 1202 holding period still begins on the date of exchange even if your holding period for general tax purposes carries over.

If the stock is issued from the conversion of debt or the exercise of stock options or warrants, the holding period doesn’t begin until the conversion or exercise. Additionally, some hedging transactions can disqualify stock from Section 1202 treatment.

In determining whether a shareholder has met the five-year requirement, a shareholder can “tack on” previous holding periods if the stock was received from inheritance, as a gift, in a distribution from a partnership, or in certain stock conversions or exchange.

3. Original issuance of stock

The taxpayer must have acquired the stock on original issuance after Aug. 10, 1993. Consequently, the stock must be purchased from the company, rather than another shareholder. Stock received as compensation for services provided to the corporation meets this requirement. However, the stock doesn’t have to be issued as a part of the initial incorporation. Stock that’s received in exchange for other stock can sometimes qualify, although it’s subject to additional requirements.

A taxpayer may receive the stock through a gift or as inheritance from another individual who acquired the stock at original issuance.

Corporation-level requirements

4. Eligible corporation

The corporation must be an eligible corporation when the stock is issued and during substantially all of the taxpayer’s holding period. An eligible corporation is any domestic C corporation other than certain limited exceptions (such as IC-DISC, former DISC, RIC, REIT, REMIC, or cooperative). An S corporation is not an eligible corporation, but an LLC that has elected to be taxed as a C corporation is eligible. Furthermore, while the corporation must be domiciled in the US, the activity of that corporation or its subsidiaries can be domestic or international.

5. $50 million gross assets limitation

The corporation must not have had more than $50 million of tax basis in its assets at any time between Aug. 11, 1993, through the moment immediately after the issuance of the stock. This test is evaluated at the time of each stock issuance. Once the asset test is met, this test is not reevaluated at a later date for that stock. Therefore, stock issued when the corporation has less than $50 million in tax basis in its assets continues to qualify, even if the corporation’s assets later exceed $50 million.

The fact that this test is generally measured on a tax basis opens up other opportunities. As long as it has low tax basis in its assets, a corporation can be worth significantly more than $50 million while continuing to be able to issue qualified small business stock. On the other hand, a corporation with very low equity value might not be able to issue qualified small business stock if it has a substantial amount of tax basis in its assets that are encumbered by substantial liabilities. However, assets contributed to a corporation in exchange for stock are measured by their fair market value at the time the corporation received the property. This includes assets that are deemed to be contributed to a newly formed corporation in an LLC conversion.

6. Redemption transactions

Because Congress intended to encourage investment in small business corporations, it wanted to prevent situations where capital invested for Section 1202 was used to fund redemptions of other shareholders. To prevent this type of undesirable activity, Congress cast a wide net in disqualifying stock that is issued shortly before or after a redemption of stock. This is one of the most common traps for taxpayers and results in inadvertently disqualifying stock that met all of the other requirements.

Any “significant” redemptions in the year preceding or following a stock issuance can disqualify the stock from Section 1202. Even a redemption as small as 5% can be considered “significant.” When related parties are involved, the threshold is reduced to 2% and the testing period is extended to two years. Some exceptions apply in determining whether the amount of stock redeemed is large enough to trigger disqualification, as well as permitting redemptions of any size in limited circumstances such as death, disability, or termination of services.

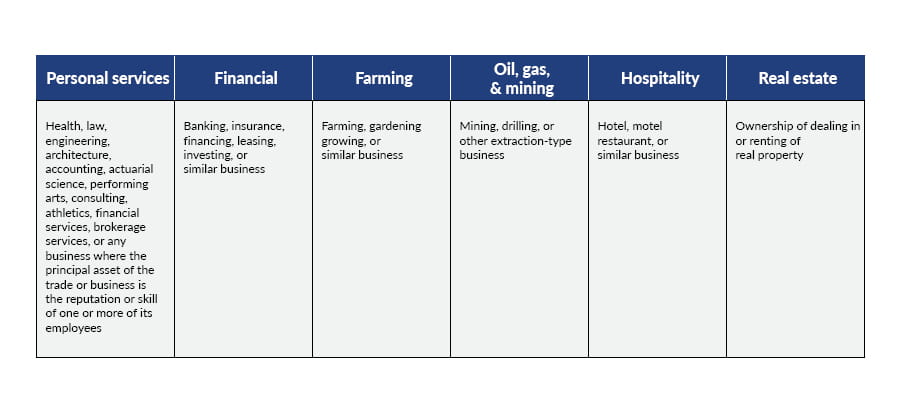

7. Qualified trade or business requirement

The corporation must be engaged in (or performing activities to start up) a “qualified” trade or business. This includes any business other than those in the businesses listed below. Unfortunately, there’s very limited guidance on exactly what most of these terms mean and how broadly they should be interpreted, leaving room for interpretation by both taxpayers and the IRS.

8. Active business requirement

The corporation must use at least 80% of the fair market value of its assets in the active conduct of a qualified trade or business. This requirement must be satisfied during substantially all of the taxpayer’s holding period of the stock. So, a corporation can have activities related to some of the prohibited businesses listed above as long as the value of the assets used in that business are under 20% of all assets. Further, only up to 50% of the corporation’s assets can be made up of working capital held to support reasonable needs of the business or to support research.

For purposes of this requirement, a corporation automatically fails to meet this test if:

- 10% or more of the corporation’s net assets consist of stock or securities in other corporations in which the corporation does not own over 50%; or

- 10% or more of the corporation’s gross assets consist of real property not being used in the active conduct of a qualified business.

- Both of these tests are evaluated based on fair market value, so fluctuations in value of investment stock or real estate relative to the company’s value could cause unexpected disqualification.

How we can help

Whether you’re starting a new venture, planning for a future exit transaction, or you’ve already sold your stock, it’s important that you have all the information you need to claim the Section 1202 exclusion and support the position if challenged by the IRS. If you have any questions about whether your current or future business venture might qualify or what documentation you should gather to support your tax position, or if you’d like to discuss any other tax panning with regard to Section 1202, please give us a call.