Many of the most significant recent accounting standards have now been adopted or have been in effect for the last few years, including the adoption of CECL. Although adoption is now behind us, there are still many ongoing accounting considerations to keep in mind, as well as other new or recently issued accounting standards on the horizon that could impact reporting and operations of financial institutions.

Allowance for credit losses: Post-implementation

There are a number of ongoing considerations and challenges related to accounting for the allowance for credit losses following the implementation of the standard. To name a few of particular interest: accounting for any changes in the measurement of the allowance for credit losses (ACL), determination of qualitative factors, and model validation activities. During our Financial Institutions 2024 Year-End Webinar, we polled more than 300 participants to better understand their perspective on these topics and they responded as follows:

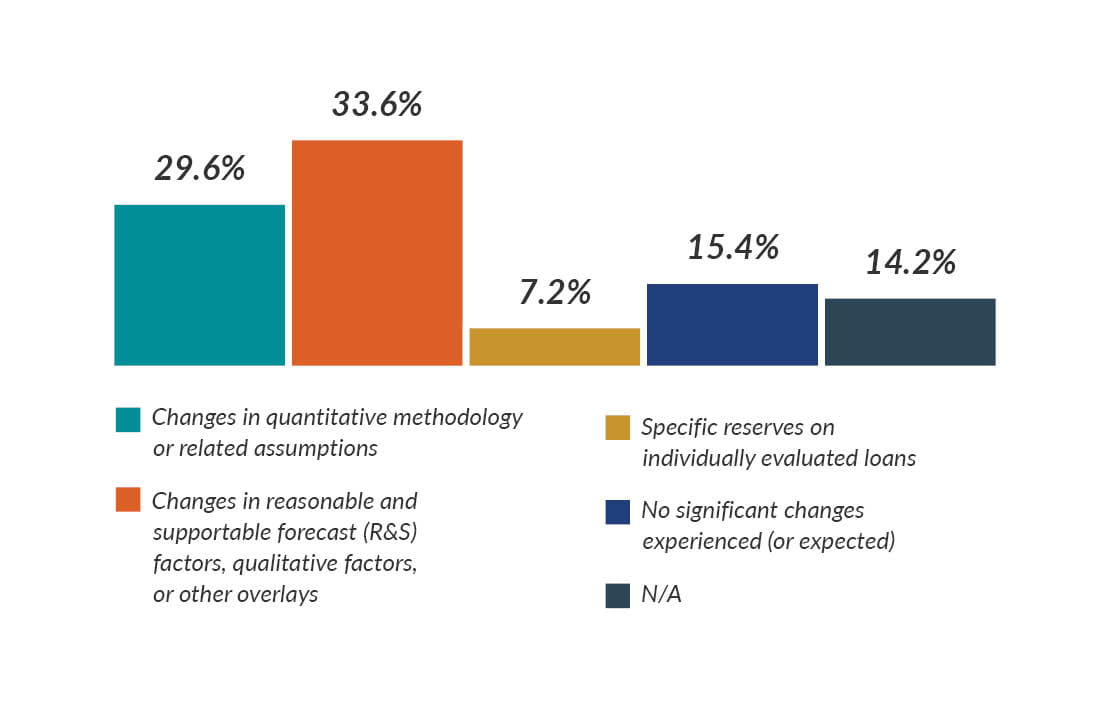

What was (or what do you think could be) the biggest change in accounting for the ACL in the periods following initial adoption?

More than 60% of participants responded that the biggest challenge will be accounting for changes in the quantitative methodology and assumptions or accounting for changes in forecasts and qualitative factors. It’s important to acknowledge that keeping everything the same may not be appropriate and consider observed or expected changes in portfolio conditions and environmental conditions. With these changes, it will likely be necessary to update policies and model documentation.

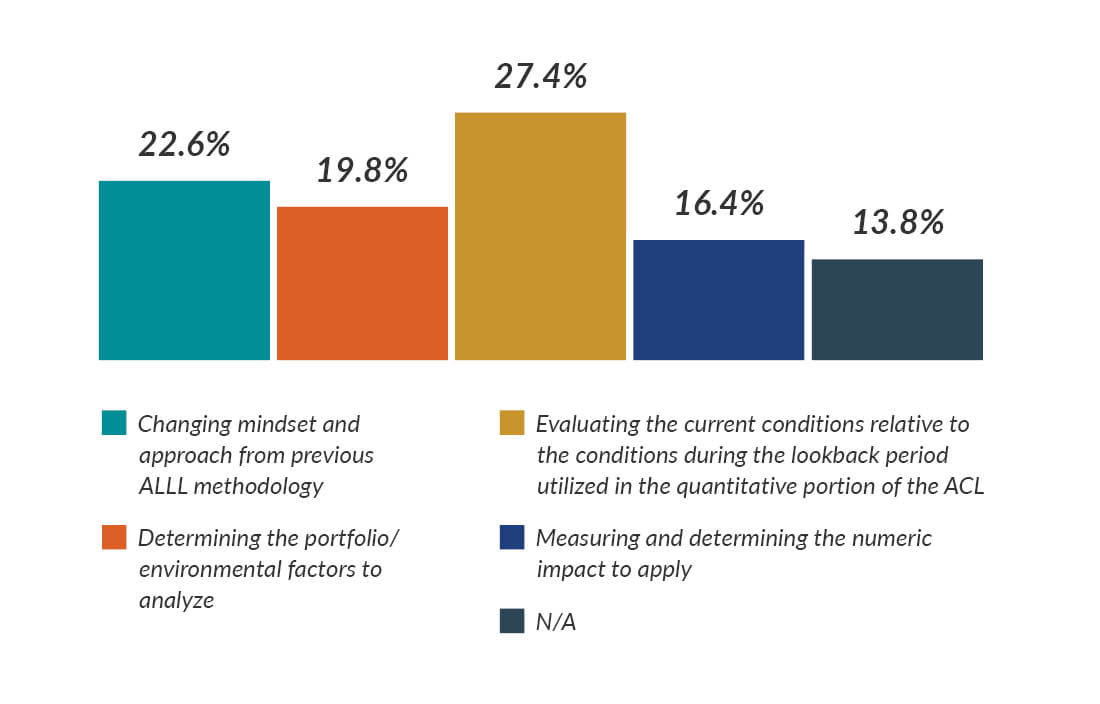

What has been the biggest challenge in determining qualitative factors?

One of the most universally challenging topics is the determination of qualitative factors, especially when the factors are judgmental and represent a significant percentage of the total reserve. Accordingly, the results of the poll appeared somewhat evenly split. Ultimately, the measurement of qualitative factors will be a dynamic process and should be continually reviewed and updated, considering the overall objective of these factors, which is to account for the effect of current conditions, not captured in the quantitative calculation of expected losses, and keeping in mind, it may be appropriate to apply no qualitative factor adjustments at all.

When applying judgment to these factors, it’s best to accompany these conclusions with observable data or quantitative analysis that can help support the direction and numeric range of the adjustments as of specific measurement date being reported. We expect such documentation will need to be updated for each measurement period based on the volatility or changes being experienced in the environment. Keep in mind, it may be necessary to continually monitor or update the specific loss drivers and macroeconomic variables being relied upon to produce reasonable and supportable economic forecasts.

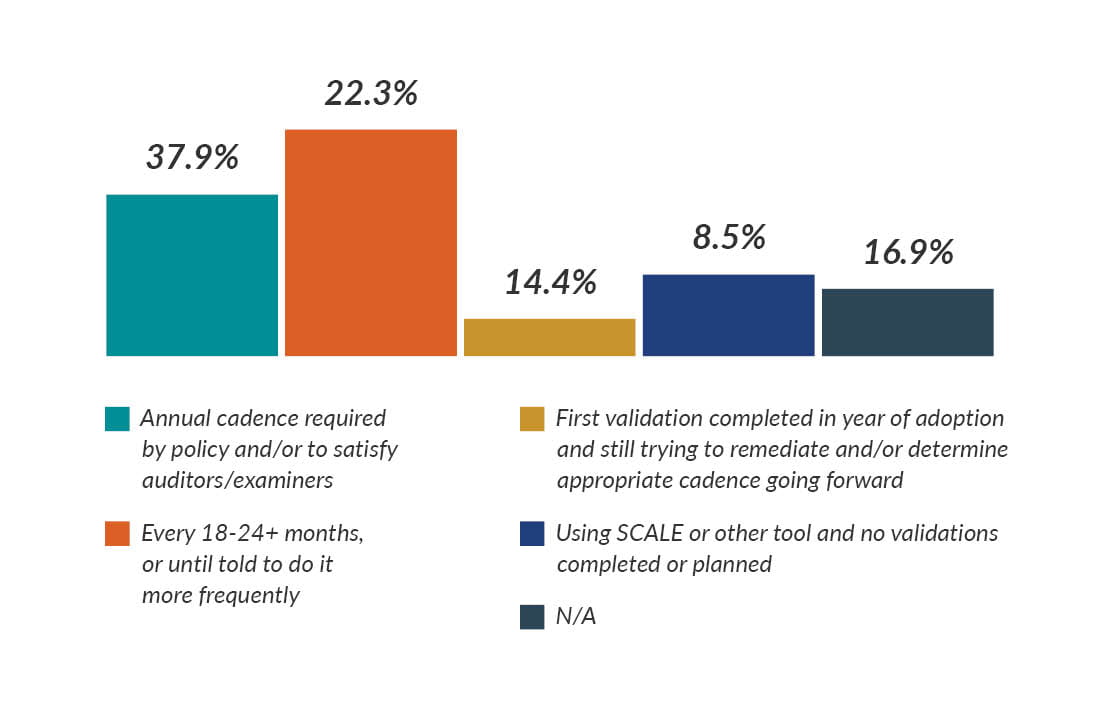

Which of the following most closely represents your ACL model validation cadence?

Lastly, we know a very common question has been the necessary cadence for performing model validation activities regarding the institution’s allowance for credit loss model. We know this is a topic addressed within the interagency guidance, but without any specific timing requirements defined, other than requiring appropriate model risk management activities be performed that are commensurate with the risk and complexity of the institution’s model.

Ultimately, we believe the cadence of model validation activities should be driven by policy governance, intended internal control activities, and the various potential users of the model validation report or other interested parties, such as your external auditors and examiners. Given the risk and complexity of an allowance for credit loss model, relative to most other models utilized by institutions, it’s not surprising the poll results indicate a majority of participations are performing model validation activities on an annual basis or at least every 18–24 months.

Overall, now that we’re past the implementation phase, institutions should continue to review and update the measurement of the allowance for credit losses, and there’s likely an opportunity among most institutions to further refine and improve modeling activities.

Update on purchased financial assets

Under the current guidance in ASC-326, the accounting treatment for purchased financial assets varies depending on the initial classification of the purchased financial assets as “Purchased Credit Deteriorated” (PCD), or non-PCD. Since adoption of the current guidance, FASB issued a proposed ASU and has been redeliberating the proposal based on comments provided. Under the proposed guidance, all purchased financial assets (with some exceptions) should follow the accounting of PCD assets using the “gross-up” approach in which the day one credit mark is recorded as your allowance for credit loss for the purchased asset, with no income statement impact. Additional considerations have been proposed for HTM securities, contract assets, and loan commitments, and research is still being performed regarding acquired AFS debt securities, credit cards, and revolving credit facilities. The effective date and transition plan aren’t yet known but may be announced during 2025.

Derivatives and hedging: Ongoing considerations

The guidance in ASU 2022-01 was previously issued and expanded the assets eligible for portfolio layer method hedging, among other things. The guidance also emphasizes the need for ongoing assessments of hedging effectiveness, including both quantitative assessments to support the expectation that the hedged layer or layers will be outstanding for the designated hedge period, and qualitative assessments in the event the initial quantitative assessment was performed and considered highly effective in subsequent periods.

As portfolio and economic environments change, institutions should be aware of the potential for changes in the behavior of the underlying hedged assets, which may impact the assessment of hedge effectiveness, and highlights the importance of performing appropriate assessments of hedge effectiveness on an ongoing basis. To the extent hedging strategies change, swaps are settled, or hedges are no longer considered effective, the standards in ASC 815 provide guidance on the discontinuance of hedging activities.

The Financial Accounting Standards Board (FASB) has issued several new standards, including the following that could be most impactful to financial institutions:

ASU 2023-07 — Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures

Effective for public business entities in fiscal years beginning after Dec. 15, 2023, and interim periods within fiscal years beginning after Dec. 15, 2024, the new segment reporting standard (ASU 2023-07) aims to improve the disclosure of reportable segments. This update requires entities to provide more detailed information about their segments, which will enhance transparency and provide better insights into the financial performance of different business units. The key provision in this ASU for the financial institutions is that the update is applicable to one segment reporting entities. The added disclosure requirements for each reportable segment include:

- Segment expenses that are regularly provided to the chief operating decision-maker (CODM).

- An amount for other segment items by reportable segment and a description of its composition. The other segment items category is the difference between segment revenue less the segment expenses disclosed under the above (a).

- Disclose reportable segment’s profit or loss (likely net income for banks) and assets.

- Disclose the title and position of the CODM and an explanation of how the CODM uses the reported measure of segment profit or loss in assessing segment performance and deciding how to allocate resources.

Additionally, if the CODM utilizes non-GAAP measures in decision-making, the standard requires that in addition to the measure that’s most consistent with the measurement principles under generally accepted accounting principles (GAAP), a public entity isn’t precluded from reporting additional measures of a segment’s profit or loss that are used by the CODM in assessing segment performance and deciding how to allocate resources.

ASU 2023-09 — Income Taxes (Topic 740): Improvements to Income Tax Disclosures

The FASB has also issued ASU 2023-09, which introduces improvements to income tax disclosures. This standard is effective for fiscal years beginning after Dec. 15, 2024. Banks will need to enhance their income tax disclosures, providing more detailed information about their tax positions and the impact of tax regulations on their financial statements. The key provisions include:

Additional rate reconciliation disclosure

- Disclosure of specific categories in the rate reconciliation in a tabular form.

- Require additional disclosure for any reconciling item greater than 5% of income from continuing operations times statutory income tax rate.

Additional taxes paid disclosure

- Income from continuing ops before taxes paid disaggregated between domestic and foreign.

- Income tax expense from continuing ops disaggregated by federal, state, and foreign.

ASU 2023-02 — Investments-Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method

The new accounting standard expands the option to use the proportional amortization method (PAM) in tax equity investments beyond Low-Income Housing Tax Credit (LIHTC) structures. Under ASC 323-740, eligibility criteria require that income tax credits and other income tax benefits must account for substantially all of the projected benefits expected as a return on the investment. Previously limited to LIHTC investments, common tax credit programs that may now be eligible include New Markets Tax Credits (NMTCs), Historic Rehabilitation Tax Credit (HTC) programs, and Renewable Energy Tax Credit (RETC) programs, although the current structure of some RETC programs doesn’t meet the “substantially all” criteria. The PAM accounting treatment involves amortizing the cost of investment in proportion to the income tax credits and other benefits.

ASU 2024-01 — Compensation — Stock Compensation (Topic 718): Scope Application of Profits Interest and Similar Awards

The amendments in this ASU are intended to improve GAAP by adding an illustrative example that includes four fact patterns to demonstrate how an entity should apply the scope guidance in paragraph 718-10-15-3 to determine whether a profits interest award should be accounted for in accordance with Topic 718. The fact patterns in the illustrative example focus on the scope conditions in paragraph 718-10-15-3, and are intended to reduce complexity in determining whether a profits interest award is subject to the guidance in Topic 718 and reduce existing diversity in practice. The amendments in this update are effective for public business entities for annual periods beginning after Dec. 15, 2024. For all other entities, the amendments are effective for annual periods beginning after Dec. 15, 2025. Early adoption is permitted.

ASU 2023-08 — Crypto Assets (ASC 350-60): Accounting for and Disclosure of Crypto Assets

With the growing interest in digital currencies, the FASB has issued ASU 2023-08, which addresses the accounting for and disclosure of crypto assets. This standard is effective under the modified retrospective approach for fiscal years beginning after Dec. 15, 2024, including interim periods within those fiscal years. Banks holding or transacting in crypto assets will need to comply with these new requirements, ensuring accurate reporting and disclosure of their crypto holdings. The ASU should be adopted under the modified retrospective approach.

The provisions in ASC 350-60 applies to assets that:

- Meet the definition of intangible assets as defined in the codification.

- Do not provide the asset holder with enforceable rights to or claims on underlying goods, services, or other assets.

- Are created or reside on a distributed ledger based on blockchain or similar technology.

- Are secured through cryptography.

- Are fungible.

- Are not created or issued by the reporting entity or its related parties.

Under the ASU, assets are to be measured at fair value under ASC 820 with fair value changes recorded in net income. While the updates provide information on recording of the asset, it doesn’t provide guidance on commissions, transaction fees, and other charges incurred to acquire.

Stay ahead of the curve post-adoption

Although the adoption of many significant standards is now behind us, there are still important ongoing accounting considerations to keep in mind for the upcoming year, as well as other new or recently issued accounting standards on the horizon that could impact reporting and operations of financial institutions.