Navigating the 2024 Revisions to Uniform Guidance: Tips for seamless adoption

February 26, 2025 / 4 min read

The 2024 revisions to the Uniform Guidance aim to improve oversight, enhance accountability, and reduce administrative burdens. Here are three key things to know and a checklist to help simplify the transition in your organization.

Applicable transition provisions

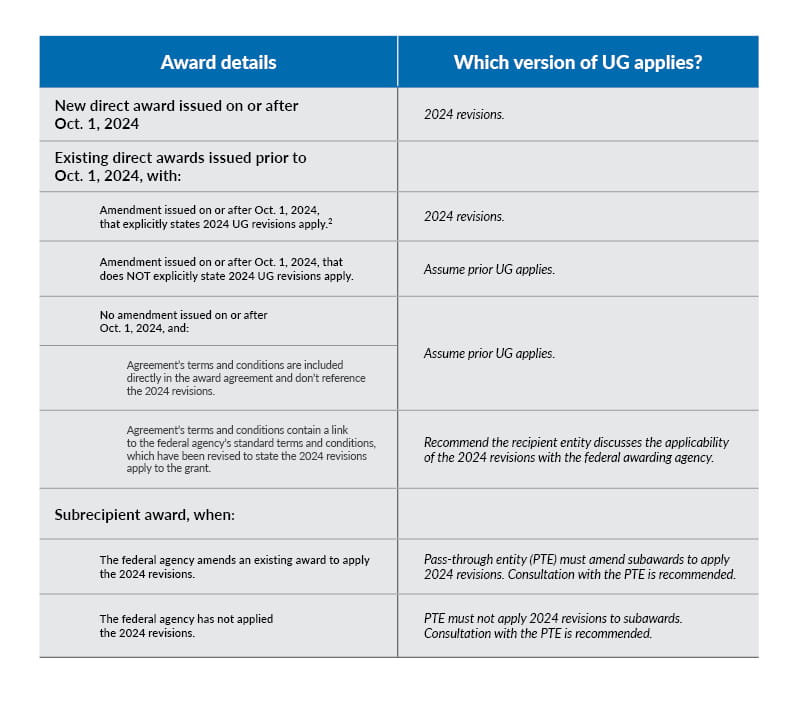

Your first step in the transition is identifying which version of UG applies to each award agreement, and which version of UG is applicable to transactions that occur before and after the transition date. The answer can be nuanced because the 2024 revisions don’t automatically go into effect for existing awards issued prior to Oct. 1, 2024.

Start by reviewing the terms and conditions of each award to identify the applicable version of the UG. When there’s uncertainty, consult with applicable federal awarding agencies and/or pass-through entities.

Unless otherwise indicated in federal statutes, agency regulations, or the terms and conditions of specific federal awards, refer to the table below for guidance on which version of UG applies to common scenarios.

Application of UG to common scenarios. Adapted from a Jan. 15, 2025 memo issued to the Federal Financial Assistance Community by the Council on Federal Financial Assistance.

Increased flexibilities and thresholds

The 2024 revision increases many thresholds such as the equipment threshold, the fixed amount for subawards, and the de minimis rate for indirect costs. Understanding these additional flexibilities and increased thresholds will not only save your organization time but will help you maximize the value of the federal funding you’re receiving. For more details read our previous article, “How will OMB’s revisions for federal financial assistance impact my organization?”.

Impact of increased single audit threshold

A key provision within the 2024 revisions is an increase to the single audit threshold from $750,000 to $1,000,000. This change will first impact Sept. 30, 2025, year-ends because the revisions to Subpart F of the Uniform Guidance became effective for non-Federal entities’ fiscal years beginning on or after Oct. 1, 2024.

Organizations with federal expenditures that have traditionally fallen between the $750,000-$1,000,000 threshold should carefully assess the requirements under the revised threshold; it’s possible that a single audit will no longer be required. Appropriate planning and due diligence in this area is merited.

Use the following checklist to help simplify your transition.

1. Update existing policies and internal controls

Certain internal policies and procedures may need to be updated to align with the new requirements. Consider the following:

- Ensure that existing policies address your organization’s understanding of the regulations under the various versions of UG and when they’re applicable.

- Review the updates made to definitions in 2 CFR 200.1. Update existing policies to address these changes, if needed.

- Review grant agreements in place and new awards/agreements received on or after Oct. 1, 2024. If your organization has been applying the 10% de minimis rate, consider whether you can apply the new up to 15% de minimis rate for indirect costs in your budgeting and cost reporting.

- Ensure your internal controls effectively allow for awards to be administered under the applicable version of UG.

- Check equipment and supplies thresholds in your policies and consider whether changes to your organization’s asset management policies are required to qualify for the increased $10,000 threshold.

- Notify employees about whistleblower protections by providing all employees with written notice of their whistleblower rights and protections.

2. Consider cybersecurity protocols

Given the requirement to implement “reasonable cybersecurity and other measures to safeguard information,” consider whether your organization’s current cybersecurity measures are sufficiently robust to protect sensitive information including personally identifiable information. Also consider whether your organization is regularly updating and testing cybersecurity protocols to ensure compliance. For more detail, see our recent article, “Uniform Guidance and cybersecurity requirements: Charting a path forward.”

3. Prepare for audits

To ensure a better audit process, check and confirm that your records and documentation are up-to-date and compliant with the new requirements. This should include documenting which version of UG applies to your awards. Also consider conducting internal assessments or audits to identify and address any potential issues before the external audit process begins.

Prepare now for a smooth transition

The 2024 revisions to the Uniform Guidance present significant challenges and opportunities for organizations receiving federal financial assistance. By staying informed, updating your policies and procedures, and investing in data management and cybersecurity, you’ll ensure a smooth transition and continued compliance. Contact your advisor for more detailed information or assistance managing the transition in your organization.

As your organization navigates through the revisions to UG, you may also want to view our on-demand webinar, “Uniform Guidance revision: What you need to know.”