On April 22, 2024, the Office of Management and Budget (OMB) published into the Federal Register, revisions to various sections within title 2. Previously referred to as the OMB Guidance for Grants and Agreements, the revisions begin with the renaming of Subtitle A to OMB Guidance for Federal Financial Assistance to communicate more clearly that this guidance is applicable beyond just grants and cooperative agreements. Whether your organization receives federal awards, passes federal awards through to other organizations, or performs single audits of grant recipients, there are key changes to be aware of and understand.

What do I need to know right now?

The revisions to Uniform Guidance are effective for all grants awarded after Oct. 1, 2024. It’s important for grantees to evaluate the impact of each revision carefully, given the implementation guidance published in August by The Council on Federal Financial Assistance (COFFA), which was established by OMB to assist in oversight of federal financial assistance. COFFA published, FY 2024 Revisions to 2 CFR: Federal Agency Implementation, which provide additional implementation guidance for federal agencies. Although this document is directed at federal agencies, the information will help recipients of federal funding better understand what to expect from grantors going forward.

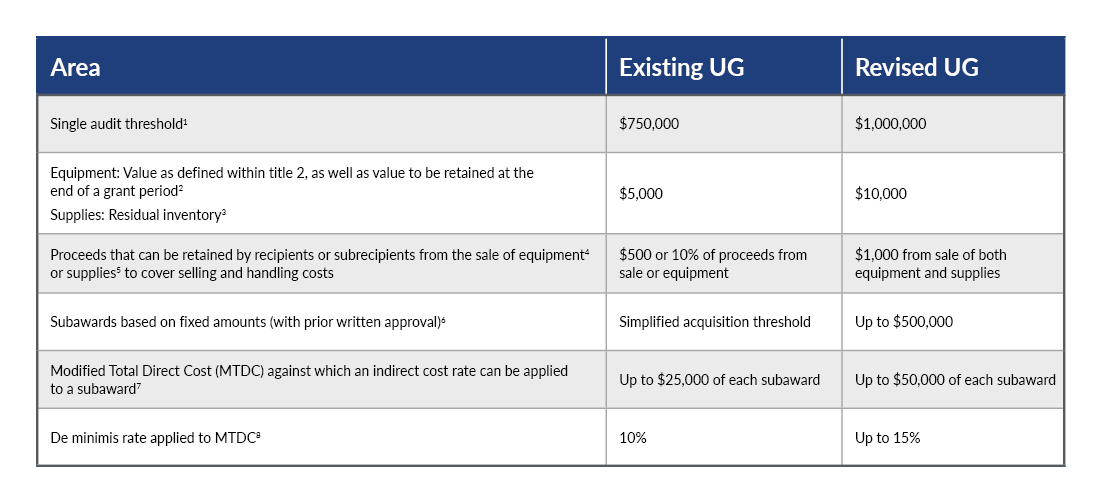

Some of the most significant changes in thresholds are summarized in the table below. These increases were aimed at one of the primary objectives of these revisions for grant recipients — to reduce agency and recipient burdens.

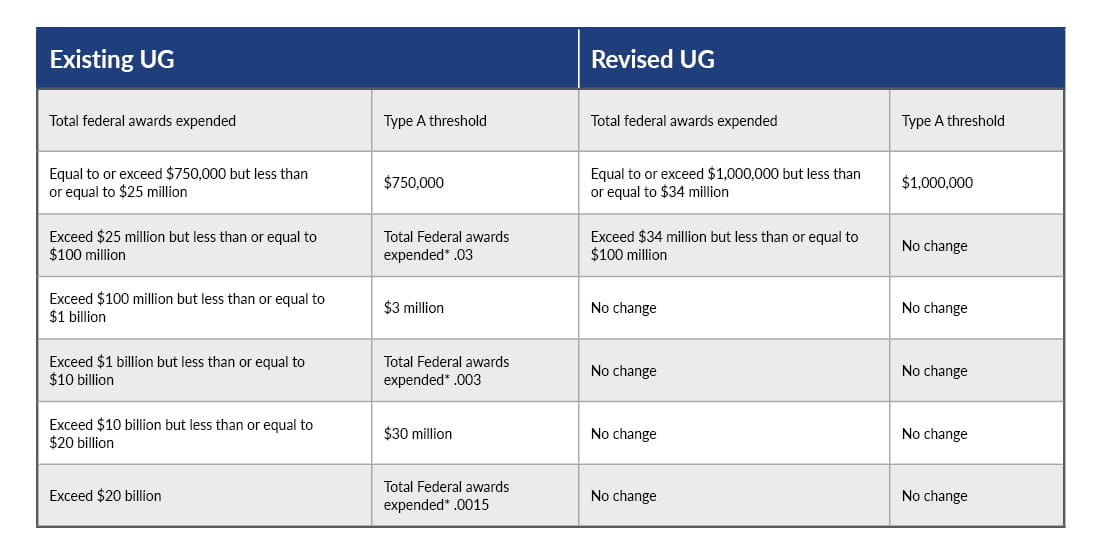

In conjunction with the increase in the single audit threshold, the Type A threshold used by auditors to determine which major programs will be subject to testing will also increase. The changes within Subpart F, Section 200.518 Major Program Determination, are summarized below (changes indicated in bold).

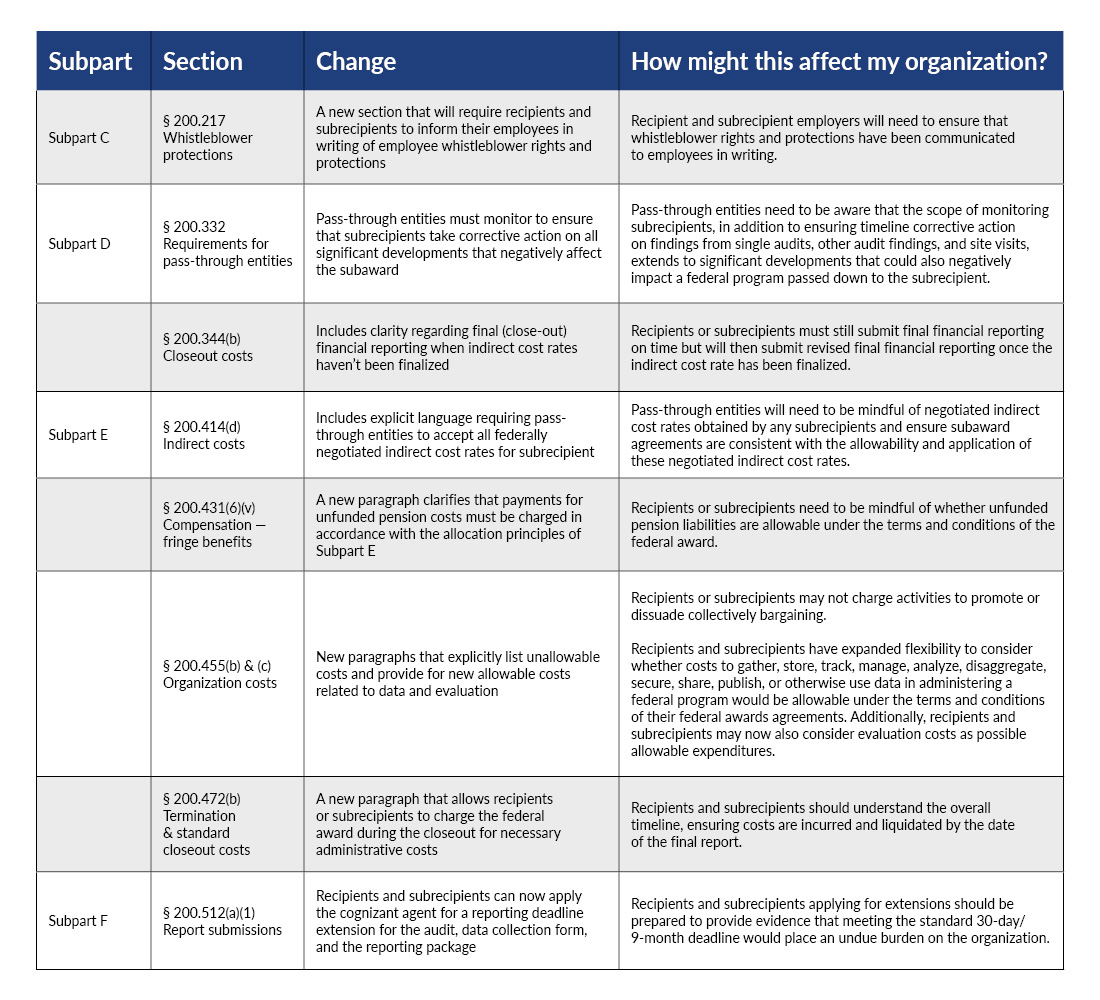

Throughout the various Subparts of title 2, the following key revisions are also worth noting:

Other key objectives of OMB’s revisions include clarifying sections that recipients or agencies have interpreted in different ways and rewriting applicable sections in plain language, improving flow, and addressing inconsistent use of terms. Changes to definitions within Section 200.1 Definitions, which precedes Uniform Guidance within 2 CFR 200, satisfy these objectives. For example, new terms, such as continuation funding, participant, and prior approval have been added, while existing definitions have been enhanced or supplemented with further examples.

Examples of revisions or enhancements in definitions include:

- The revised definition of contract now clarifies that contracts are any “legal instrument by which a recipient or subrecipient conducts procurement transactions” under a federal award. This change separates contracts from subawards, which aren’t considered procured transactions. Additionally, the definition for a subaward has been revised to clarify that a subrecipient “contribute[s] to the objectives of the projects by carrying out part of the Federal awards received by the pass-through entity.”

- Throughout title 2, the term nonfederal entity has been replaced with recipient, subrecipient, or both, depending on the circumstances.

- Where cost sharing or matching together used to refer to the portion of project costs not paid by federal funds or contributions, Section 200.1 now clarifies that the definition applies to cost sharing, while matching is included as a type of cost sharing but more specifically refers to required levels of cost sharing that must be provided.

- The definition for improper payments has been enhanced with context that these include: any payment to an ineligible recipient, any payment for an ineligible good or service, any duplicate payment, any payment for a good or service not received (except for payments authorized by law), any payment not authorized by law, and any payment that does not account for credit for applicable discounts.

- In addition to trademarks, copyrights, patents and patent applications, loans, notes, and other debt instruments, the definition for intangible property now includes data (including data licenses), websites, IP licenses, trade, and secrets. Similarly, in addition to land, land improvements, structures, and appurtenances, the definition for real property now includes legal interest in land, such as fee interest, license, rights of way, and easements.

- The definition for questioned costs has been enhanced first by moving much of the guidance previously located in Subpart F up to the glossary, but then also with new insight into how known and likely questioned costs are calculated by the auditor and clarifies that questioned costs do not simply result because of deficiencies in internal control or noncompliance with reporting requirements.

Finally, once again, the OMB has intentionally avoided defining a beneficiary and explains that the term can vary widely, not only across federal agencies, but also across various programs funded by any one federal agency. The OMB continues to defer to federal agencies to define beneficiaries depending on the funding provided.

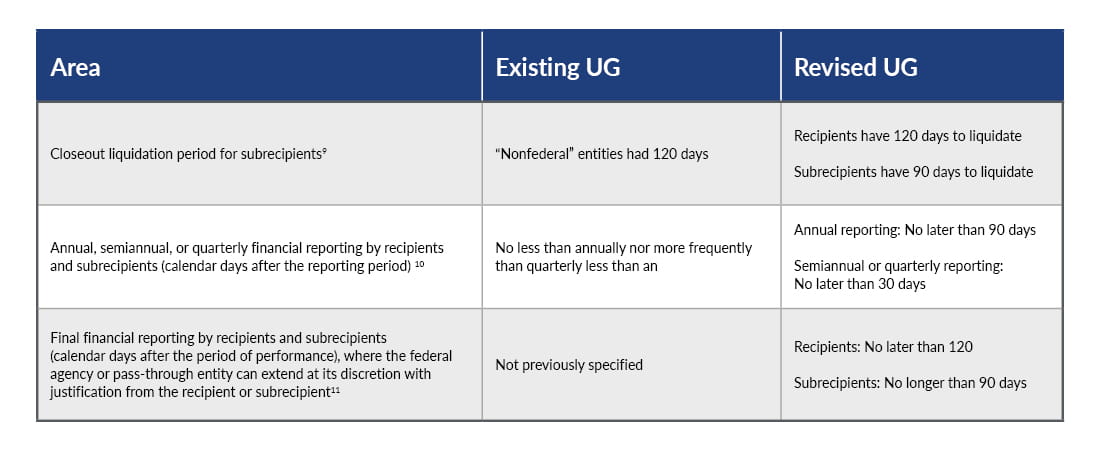

OMB has also expanded guidance surrounding certain reporting requirements. In the table below, OMB not only clarified reporting deadlines based on the type of report, but also based on the type and level of recipient.

What’s the overall timeline?

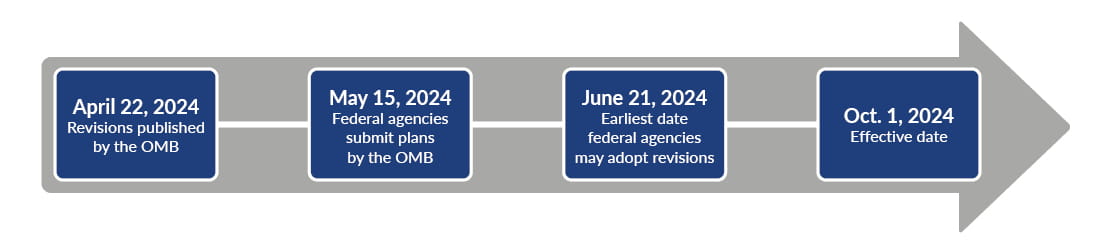

Key dates in the implementation timeline leading up to the Oct. 1, 2024 date are outlined below. As with past revisions, leading up to the effective date, each federal agency is required to adopt the revisions into regulation. Because federal agencies can have different implementation plans, it’s important that grantees carefully review new grant agreements, amendments to existing grant agreements, and any communications received from funding agencies and pass-through entities to understand when revisions will be effective on a grant-by-grant basis. As full implementation may not be required of grant recipients for one or more fiscal cycles yet, organizations should be prepared for a period of transition where some grant agreements operate under existing Uniform Guidance and other grant agreements operate under these 2024 revisions to Uniform Guidance.

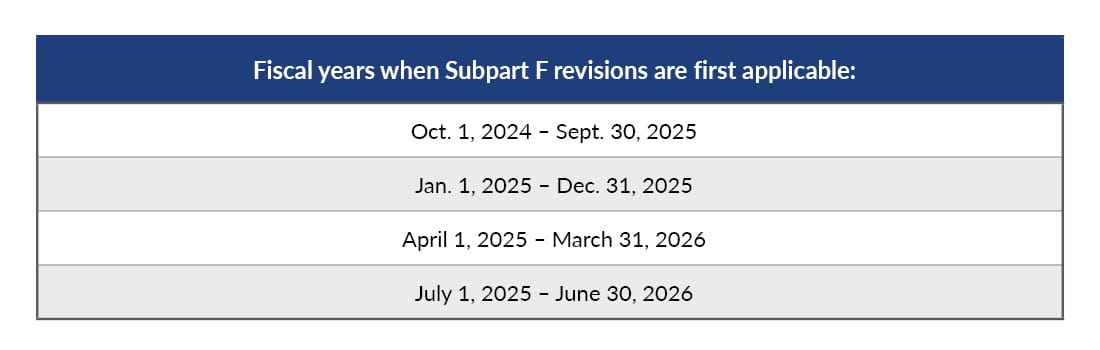

In addition, grant recipients should understand that the single audit threshold changes described in Subpart F will be effective for the organization’s fiscal periods beginning on or after Oct. 1, 2024. These changes would be effective in the first single audit cycle, as follows:

Learn more

View our presentation – Uniform Guidance 2024 revisions: What you need to know – on demand to learn more.