U.S.-based manufacturers of clean energy components may qualify for benefits enacted by the Inflation Reduction Act. Learn how a strategic approach to incentives like the 45X tax credit can help businesses in this sector lower their federal taxes.

The Inflation Reduction Act of 2022 (IRA) created an integrated ecosystem of tax credits, deductions, grants, and loans designed to support the manufacture and deployment of clean energy products in the United States over the next decade. The bill included nine new and 12 modified tax credits and incentives, as well as billions in funding for grants and loans to support the adoption of clean energy technologies and the retrofitting of existing operations. The broad spectrum of supply- and demand-side support included in the law is expected to have a lasting impact on the domestic market for these products.

With so many options available, small to midsized manufacturers need to implement strategies that will help them maximize the potential benefits under the new law. A comprehensive plan will include claims for the Advanced Manufacturing Production Credit under Internal Revenue Code Section 45X (45X credit) as well as applications for loans and grants under Department of Energy programs designed to support production of clean energy technology in the United States.

Claiming the Section 45X Advanced Manufacturing Production Credit

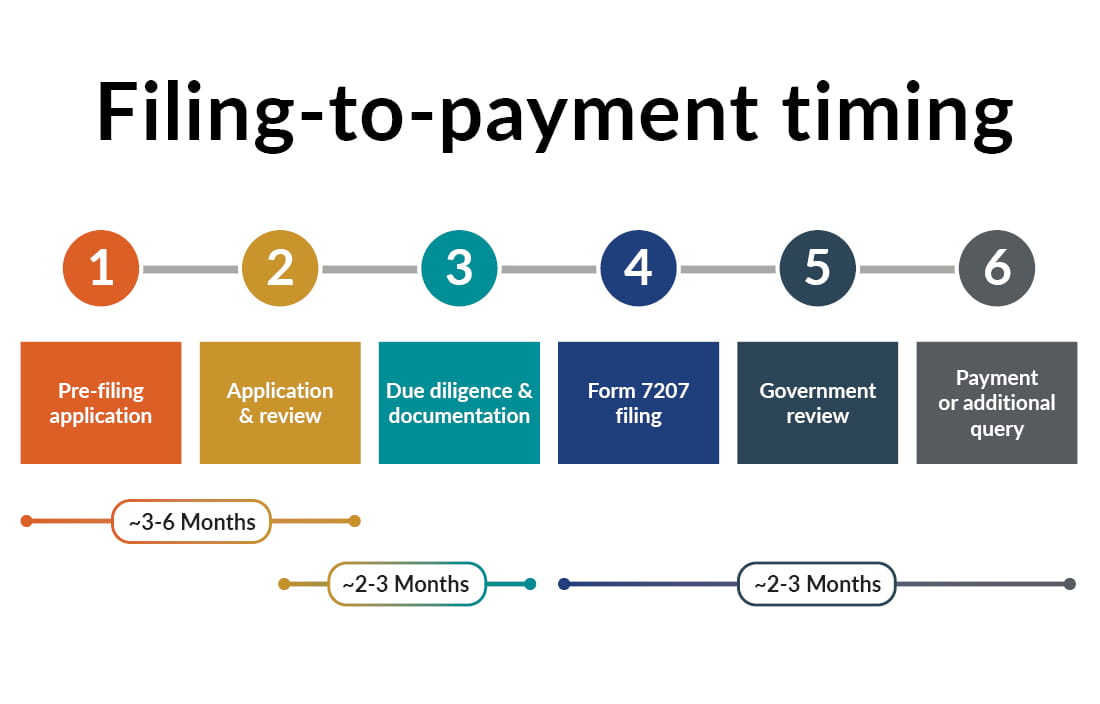

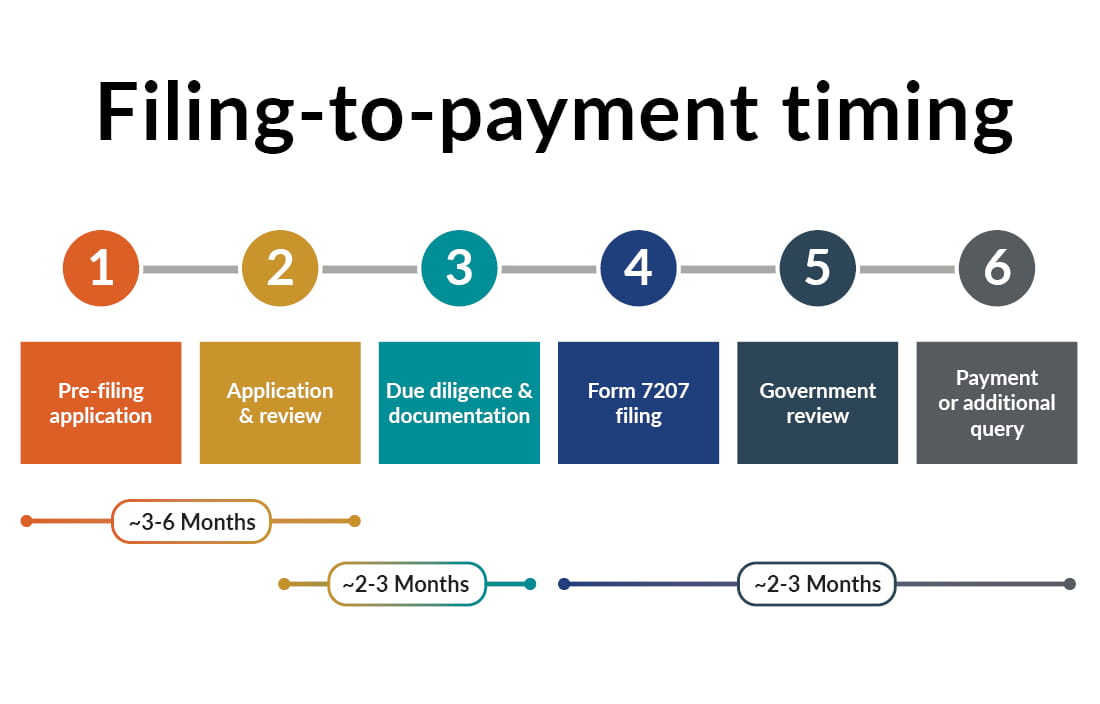

Claims for the 45X credit involve some additional administrative effort, but they’re well worth it. U.S. manufacturers that produce and sell eligible components can claim this credit based on their annual production. Manufacturers seeking to claim the 45X credit will need to document their eligibility and undertake procedural steps to submit their tax filings. The tax filing process begins with a pre-filing registration application, if the manufacturer will utilize the direct pay or transferability elections. In response, the IRS will issue an I.D. number that’s required to file for the credit. Once the I.D. number is received, the taxpayer begins the documentation process to support the qualification for the credit and the calculation of the amount. This information is provided to the IRS on form 7207 and the government typically pays refunds under the direct payment option in two to three months.

Filing-to-payment timing

The pre-filing process includes options to elect a direct payment or a transfer of the credit. In the absence of an election for either of these options, the manufacturer would simply claim the credit as part of its tax return and receive the benefit as a general business credit. This option works best for a manufacturer whose tax position will allow them to use all or most of the credit in the year it’s generated, carrying forward any excess to future years.

Direct payment and transfer options under Section 45X

A direct payment election allows the manufacturer to file form 7207 and receive payment of the credit amount within two to three months as a fully refundable credit. Although the direct payment election may only be utilized by a manufacturer for five years. The IRA also allows eligible manufacturers to sell their credits if that’s a more effective way to monetize the tax benefit. This approach may allow taxpayers to receive a quicker return on their credit compared to waiting for the government under the elective pay option. However, market discounts typically apply to credit transactions, meaning the taxpayer will likely receive less overall cash benefit.

Some manufacturers have agreed to share the benefit of the 45X credit with their customers who purchase the eligible components. This strategy helps the manufacturer who claims the credit improve its market position. Producers often incur fees in order to calculate and document the credit, so it’s important to ensure that sharing arrangements account for the costs necessary to claim the credit. Agreements might also include volume requirements that tie the amount of the credit benefit shared to the amount of components purchased and claw-back provisions that help to indemnify the producer if the IRS disallows the credit at a later time.

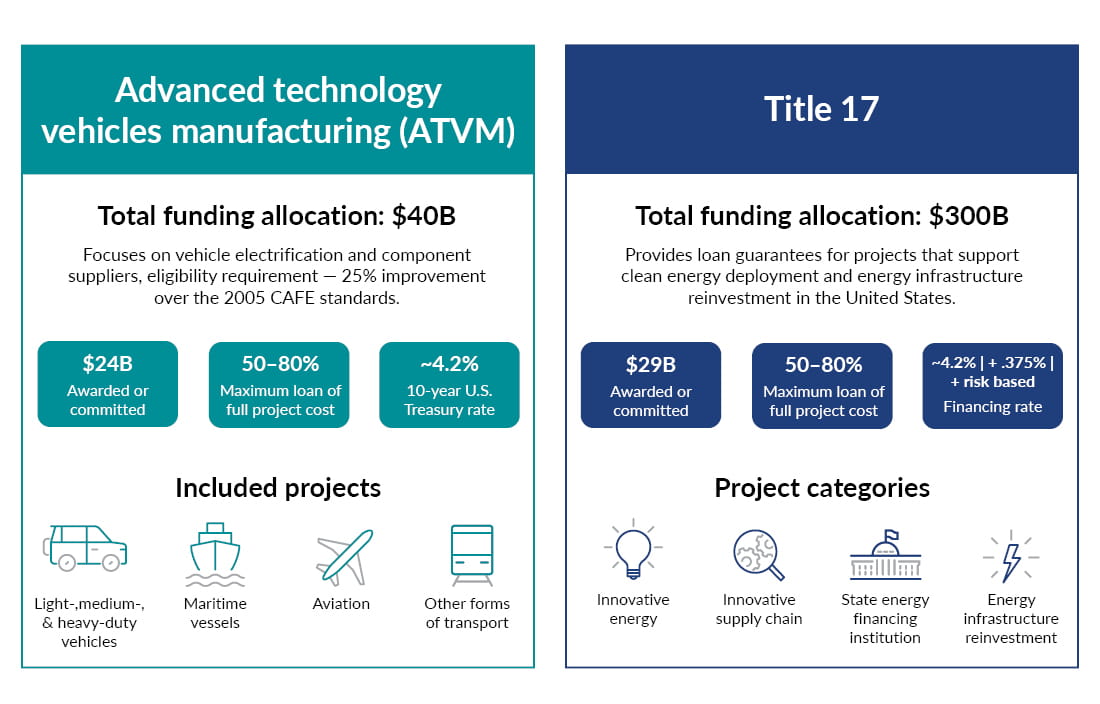

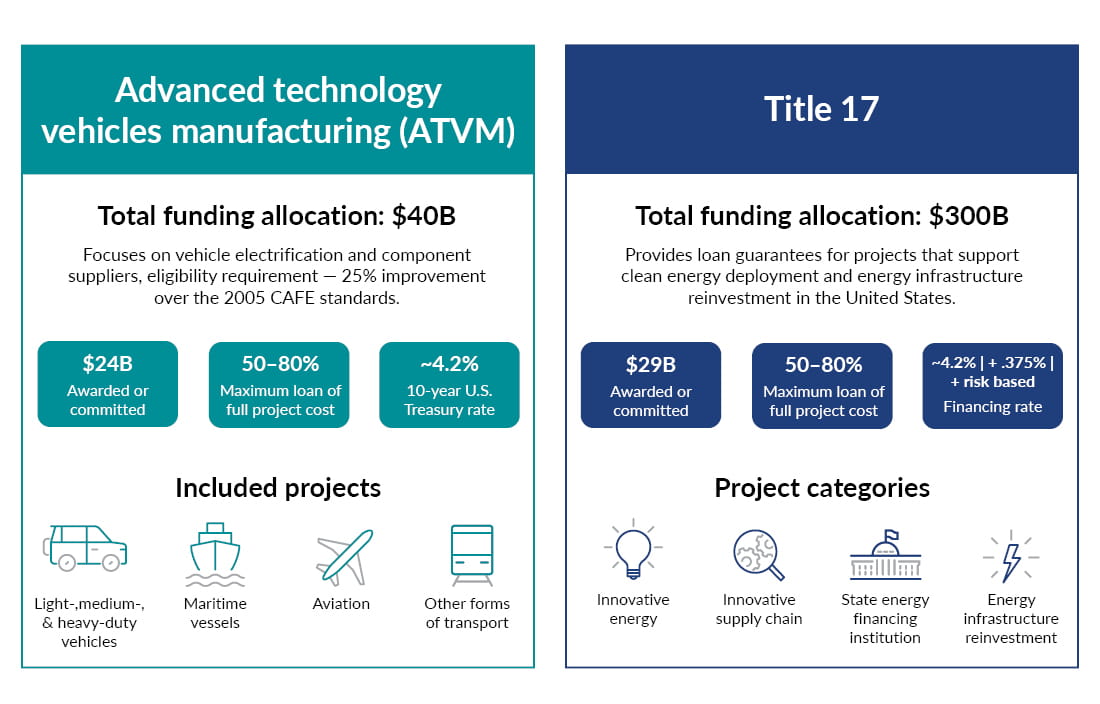

Federal loan funding opportunities for clean energy manufacturers

The IRA also included several loan programs designed to help midsized clean energy manufacturers access capital in order to secure supply chains for these core industries within the United States. These programs include Advanced Technology Vehicles Manufacturing (ATVM) loans intended to help vehicle electrification and component suppliers, and Title 17 that provides loan guarantees for projects supporting clean energy deployment and energy infrastructure reinvestment within the United States. This chart shows the types of manufacturers that are being supported under each of these programs.

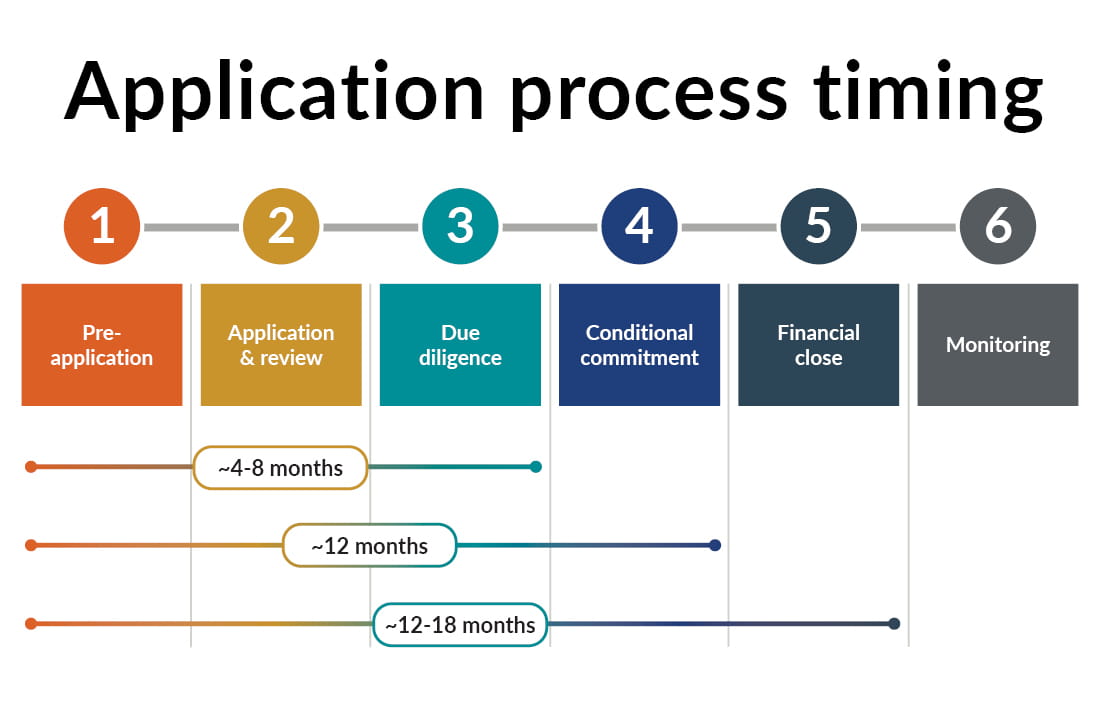

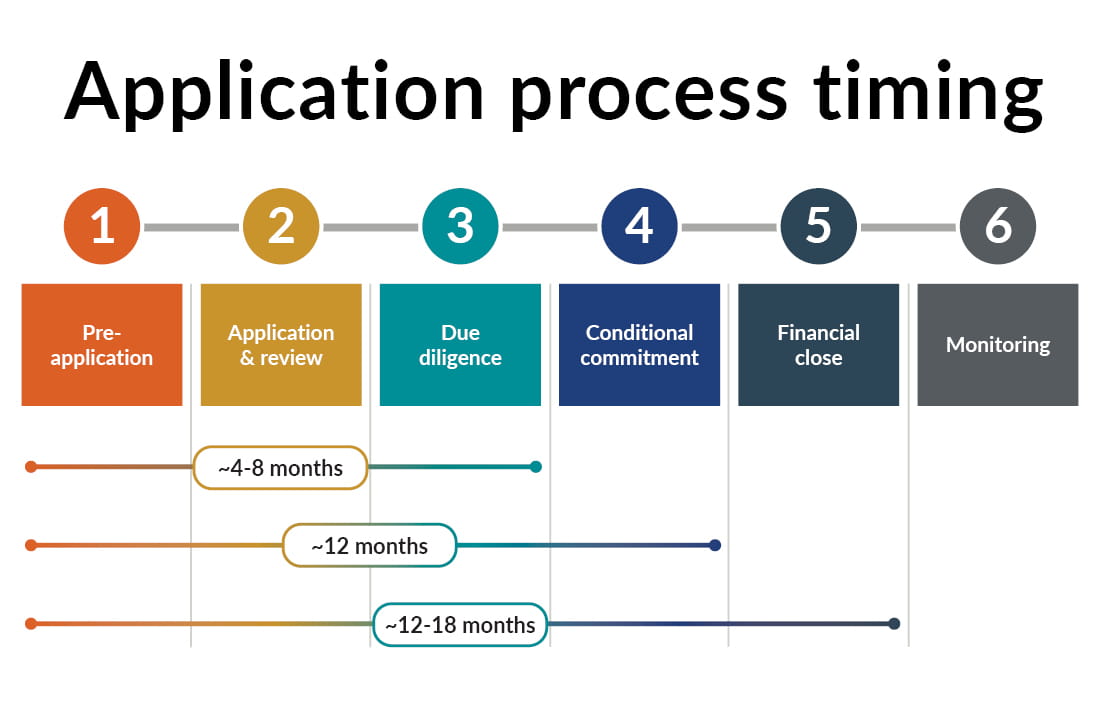

The loan program office (LPO) runs an open application process, so qualified applicants can submit requests anytime. The process can take anywhere from a year to 18 months but can move faster depending on the applicant’s ability to submit all of the required materials.

Application process timing

Federal grant funding opportunities for clean energy manufacturers

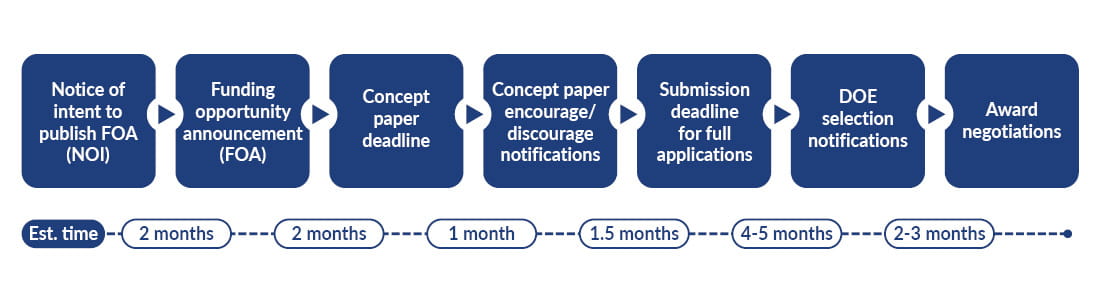

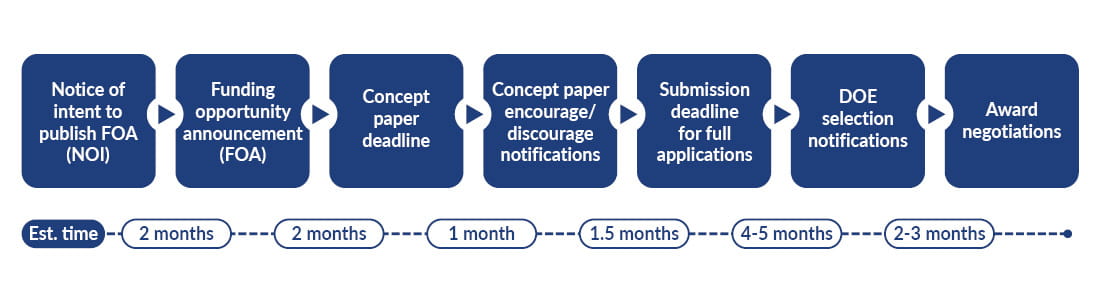

Federal grant policy in this area has been focused on building a domestic supply chain for lithium-ion batteries. The Department of Energy (DOE) was allocated $7 billion ($3 billion has been awarded) to modernize the nation’s energy infrastructure and support a clean energy transition in areas like raw material production, materials processing, and component and battery cell manufacturing. Another grant program run through the Renewable Energy Office has an allocation of $70 million focused on developing demonstration projects to improve the economics of battery recycling and enable profitability.

The grant application process can take 12–14 months, starting with the DOE publishing a notice of intent for a funding opportunity. Applicants need to submit a concept paper that’s considered and, if approved, leads to the submission of a more extensive application.

A comprehensive business plan is the key to funding success for clean energy projects

In order to take full advantage of the funding opportunities available under these programs, a manufacturer must have a comprehensive business plan that thoroughly documents the company’s operational strategy. The plan should include the following elements:

To learn more about developing a business plan to effectively utilize the tax incentives, loan programs, and federal grants available to U.S. manufacturers of clean energy products, please contact Donny Lucaj or Dan Lee.

Discover actionable strategies for small and midsized manufacturers to maximize benefits from the IRA's Section 45x advanced manufacturing production credit.