By the numbers

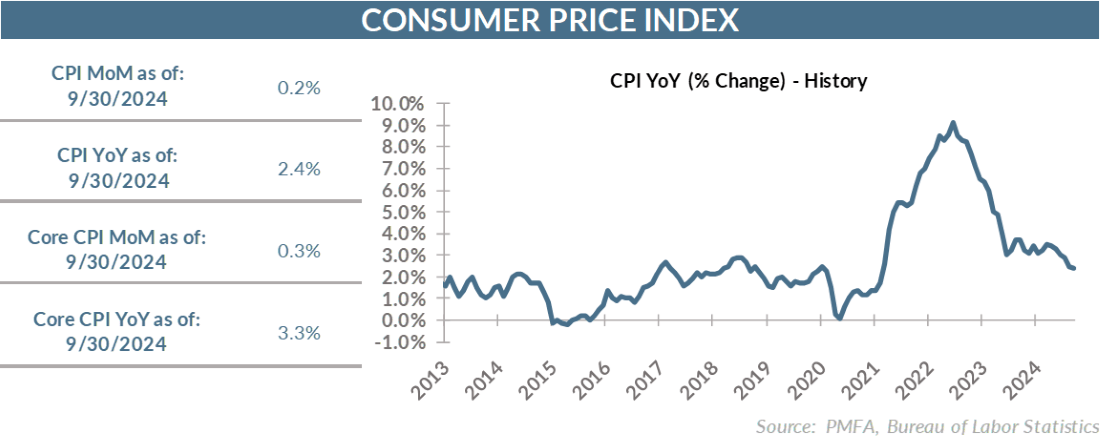

• The consumer price index edged higher in September, rising by 0.2% — a result that was modestly higher than the consensus forecast of 0.1%. Core inflation, which excludes more volatile food and energy prices, rose by 0.3% for the month, also a touch hotter than the collective economist forecast of 0.2%.

• More broadly, the longer-term disinflationary trend appears intact, although the divergence between headline inflation and the core reading over the 12 months ended in September will raise some questions. The one-year reading of headline inflation fell for the sixth consecutive month to 2.4%, aided by a continued decline in energy prices. Core inflation edged up to a 3.3% year-over-year pace of increase, largely driven by sticky shelter costs.

• A stiff 0.4% increase in grocery costs last months might raise an eyebrow but isn’t concerning, following a six-month stretch over which they were virtually unchanged. Higher food costs are likely here to stay, but the trailing 12-month increase of 1.3% suggests a welcome degree of relative stability in grocery prices.

Steady as she goes for the Fed

• Since the path back to relative price stability started, there’d been a broad sense that a return to sub-4% inflation wasn’t going to be difficult as economic conditions normalized in the post-lockdown period.

• The greater challenge would be getting inflation — particularly the Fed’s preferred measure — from 4% back to the central bank’s 2% target. That’s proving to be the case.

• At 2.4%, headline inflation isn’t terribly worrisome, particularly since it’s been running at an even cooler rate well below 2% annualized over the last six months — a pace that alone would suggest that the Fed’s war on inflation has likely been won.

• However, underlying the inflation story remains the sticky problem of shelter inflation, which fell from 5.2% to 4.9% over the year ended in September. Whether or not that number even reflects the underlying economic reality across the country is a reasonable question, given the methodology used and evidence from other more sanguine readings of housing inflation.

• While representing a little more than a third of the consumer price index, shelter costs account for about three quarters of headline inflation over the past year — a reality that likely skews the current inflation story more negatively than should be the case.

• That’s not to say that there’s not a risk of inflation flaring up again, at least temporarily. Looking ahead, the potential for a more volatile oil market raises the risk that headline inflation could reverse course and edge up in the coming months. Uncertainty about the ongoing conflict in the Middle East and the risk that it broadens could push prices higher in the near term, although some of that potential has already been baked into crude oil prices.

• For the Fed, there doesn’t appear to be much in the September inflation report that’s likely to move the needle on their policy path, even with the data coming in slightly above expectations.

• If anything, the report was good enough to solidify the case for another quarter-point cut. Inflation hasn’t receded so rapidly to justify an accelerated pace of policy easing, but the upside surprise also wasn’t sufficient to raise serious questions about the underlying disinflationary trend.

The bottom line?

• Inflation was modestly higher than expected in September but not to a degree that should create anxiety for consumers or dissuade the Fed from its rate-cutting path.

• The stickiest piece of the inflation challenge continues to be housing — and that’s one that isn’t likely to be resolved through higher interest rates. Outside of housing, the bigger picture on inflation looks increasingly manageable.

Media mentions:

Our experts were recently quoted on this topic in the following publications:

Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain.

Data sources for peer group comparisons, returns, and standard statistical data are provided by the sources referenced and are based on data obtained from recognized statistical services or other sources believed to be reliable. However, some or all of the information has not been verified prior to the analysis, and we do not make any representations as to its accuracy or completeness. Any analysis nonfactual in nature constitutes only current opinions, which are subject to change. Benchmarks or indices are included for information purposes only to reflect the current market environment; no index is a directly tradable investment. There may be instances when consultant opinions regarding any fundamental or quantitative analysis may not agree.

Plante Moran Financial Advisors (PMFA) publishes this update to convey general information about market conditions and not for the purpose of providing investment advice. Investment in any of the companies or sectors mentioned herein may not be appropriate for you. You should consult a representative from PMFA for investment advice regarding your own situation.