The Inflation Reduction Act of 2022 (IRA) made significant changes to the tax credits that were previously available for renewable energy projects. Chief among these are the investment tax credit under Section 48 (ITC) and the production tax credit under Section 45 (PTC). The modifications made by the IRA expanded those credits both in terms of the nature of qualifying projects as well as the value that might be obtained. However, new opportunities are balanced against the need to satisfy complex requirements in order to achieve maximum value. Here’s what you should know to understand how these credits can be maximized.

Overview of the Section 48 Investment Tax Credit (ITC) and Section 45 Production Tax Credit (PTC)

The Section 48 Investment Tax Credit (ITC) and Section 45 Production Tax Credit (PTC) have many similarities but differ in key respects. The ITC is claimed by taxpayers that place qualifying energy property in service during an applicable tax year. In that sense, the ITC is a one-time credit calculated as a percentage of the qualifying investment. Conversely, the PTC is a per kilowatt-hour (kWh) tax credit claimed annually during the first 10 years of the qualifying project’s operation. Taxpayers may wish to complete modeling to determine whether the ITC or PTC path is more favorable, factoring in project eligibility, opportunities to monetize tax credit benefits, financing options, and the time value of money.

Many projects will qualify for both the ITC and the PTC. Importantly, however, some projects will only qualify for the ITC. In situations where both credits may be available, taxpayers must choose whether to claim the ITC upfront or the PTC over time. Duplicate benefits are precluded for the same equipment. However, it may be possible for a taxpayer to claim both credits based on separate types of equipment that are co-located on the same property (e.g., the PTC for wind or solar equipment and the ITC for energy storage equipment (batteries)).

There are numerous details that must be considered when evaluating ITC and PTC opportunities. However, the following structure may help clarify the key categories of questions:

- Equipment — Does the project involve qualifying equipment?

- Timing — When did construction begin, and when will this be placed in service?

- Credit amount — Does this qualify for the base credit or the increased amount?

- Bonus credits — Are bonus credits available based on the location, use of domestically produced equipment, or connection to a low-income project?

- Cash benefits — Who is the taxpayer, and how will the cash value of the credit be realized?

- Documentation — What actions can be taken to maximize tax credit benefits?

Equipment: Does the project involve qualifying equipment?

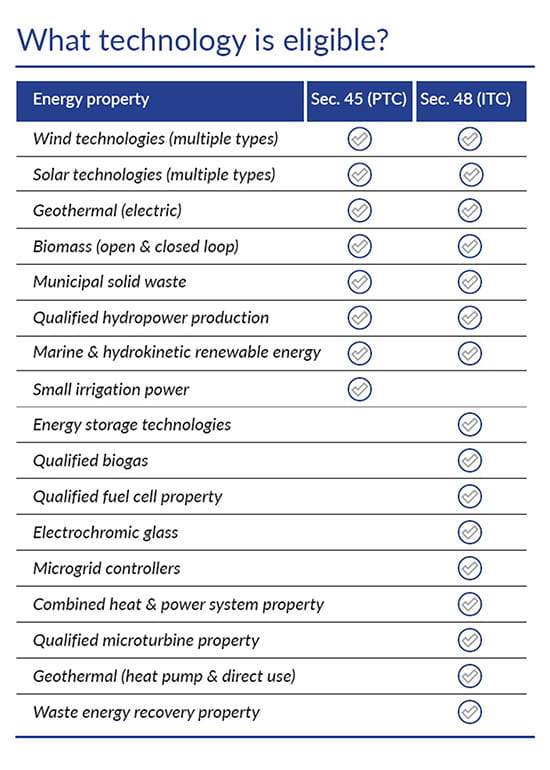

A core focus of both the ITC and PTC is the production of electricity from renewable resources. Accordingly, the starting point for both credits are technologies relating to wind, solar, geothermal, hydropower, biomass, etc. However, the ITC also includes other technologies. Namely, those involving energy storage, biogas, combined heat and power, and fuel cells, among others are eligible for the ITC. A summary of the qualifying technologies for each credit is included below.

Timing: When did construction begin, and when will this be placed in service?

The timing of a project is a critical factor in evaluating which tax credit rules will apply. This situation was caused by the fact that the IRA modified the previously existing ITC and PTC while also creating new versions of those credits with delayed effective dates. Thus, taxpayers must consider whether a project is subject to the old rules, the modified rules, or the new rules. One important distinction is that certain projects will qualify under the modified rules but not the new rules.

The dates when construction begins and when the property is placed in service are relevant data points. IRS guidance provides two alternative options for establishing the beginning of construction date. The first option is the physical work test, which is satisfied when “physical work of a significant nature begins.” This can include on-site work as well as off-site work. The second option is the 5% safe harbor, which is triggered when the taxpayer pays or incurs 5% or more of the total cost of the energy property. At the conclusion of a project, equipment is considered to be placed in service when it’s first placed in a state of readiness and availability for a specifically assigned function. Taken together, these rules require the completion of deliberate actions in order to begin construction and place the project in service.

In simple terms, the prior versions of the ITC and PTC apply through 2022. The modified versions of those credits then took effect for 2023 and 2024. Finally, the new versions of those credits are set to take effect in 2025. More specifically, these are the relevant effective dates for the rules:

- Old rules: ITC and PTC prior to modification by the IRA — Projects that were placed in service prior to Jan. 1, 2023, aren’t subject to any of the modifications made by the IRA. One positive would be that complicated rules such as the prevailing wage and apprenticeship hour requirements don’t apply to these projects. However, that also means that technologies added by the IRA will not be eligible.

- Modified rules: IRA modifications to the previous ITC and PTC — To be eligible for the initial version of the expanded credits, projects must meet both specific beginning-of-construction and placed-in-service dates. Qualifying projects must generally begin construction before Jan. 1, 2025. Those projects must also be placed in service after Dec. 31, 2022. For example, this would include a project for which construction began in November 2022, and it was placed in service in June 2023. It would also include a project for which construction begins in October 2024, which is then placed in service in August 2025. A final clarification is that certain geothermal heat pump equipment will remain eligible under the modified rules as long as construction begins prior to Jan. 1, 2035. Eligible equipment uses the ground or groundwater as a thermal energy source to heat or cool a structure.

- New rules: The “new” Section 48E ITC and Section 45Y PTC — Two new tax code sections were included in the IRA to replace the ITC and PTC moving forward. Such rules will apply to projects for which construction begins after Dec. 31, 2024. In general, the new rules are very similar to the modified rules described above. However, a key change is a shift away from a specific technology listing in favor of a focus on the production of electricity at a facility with zero-anticipated greenhouse gas emissions. Importantly, several types of projects, such as biogas, will no longer be eligible when these rules shift. Technical guidance interpreting Sections 48E and 45Y will be required but has yet to be published by the IRS.

The focus of this article is the modified rules that are currently applicable to projects in development or that will break ground before the end of 2024.

Credit amount: Does this qualify for the base credit or the increased amount?

Both the ITC and PTC have a core credit calculation, which may be increased by a multiple of five. For the ITC, the base credit is equal to 6% of the cost basis of the qualifying energy property, which may be increased to 30%. For the PTC, the base credit for 2023 was equal to 0.55 cents per kWh, which may be increased to 2.75 cents per kWh. The PTC amount is adjusted annually for inflation, and there are additional adjustments based on the technology involved.

There are two paths available for achieving the enhanced amount.

- Option 1: Smaller projects — Projects with a maximum net output of less than 1 megawatt (MW) of electrical or thermal energy are eligible for the 5x multiplier without any other conditions. For this purpose, electrical energy is measured in alternating current. Pursuant to proposed regulations, this output test is based on the “nameplate capacity” of the system. That’s the amount that the system is capable of producing on a steady-state basis and during continuous operation under standard conditions.

- Option 2: Satisfaction of prevailing wage and apprenticeship hours — Projects that exceed the 1 MW threshold are required to satisfy prevailing wage and apprenticeship hour standards. Under the prevailing wage rules, any laborers and mechanics employed by the taxpayer, a contractor, or subcontractor in the construction and repair of the energy project must be paid rates established by the Secretary of Labor. This includes an ongoing obligation to pay such rates for any alteration or repair of the project for five years after it’s placed in service. The prevailing wages by role and county are maintained by the Department of Labor on sam.gov. Similarly, the apprenticeship hour requirements are satisfied if at least 15% of the total labor hours spent on the project are completed by qualified apprentices. The apprenticeship threshold was reduced to 10 or 12.5% if construction of the project began before Jan. 1, 2023, or between Dec. 31, 2022, and Jan. 1, 2023, respectively. An exception to the apprenticeship requirements is allowed in the instance where it’s documented that a good-faith effort was made to employ apprentices, but they weren’t available. When the good-faith effort exception isn’t met, a penalty rate of $50 per apprentice hour can also be paid (increased to $500 per hour if the IRS determines the contractor intentionally avoided hiring apprentices) to satisfy the prevailing wage and apprenticeship standard.

Notably, a limited transition rule turned off the prevailing wage and apprenticeship rules for projects exceeding 1 MW but where construction of the project began before Jan. 29, 2023. The beginning of construction rules described above also apply to the determination of whether the prevailing wage and apprenticeship hour requirements must be satisfied.

Continuing the theme of varying credit amounts is a special rule relating to project financing. Specifically, the credit amounts described above are subject to a reduction of up to 15% if the project is financed by tax-exempt bonds. For example, the ITC would be reduced from 30 to 25.5% or from 6 to 5.1% in that fact pattern. Additionally, for projects financed with restricted tax-exempt grants, forgivable loans, or other tax-exempt income, the credit amount is reduced when the benefit of the grant and the tax credit exceeds the cost basis of the property.

Bonus credits: Are bonus credits available based on the location, use of domestically produced equipment, or connection to a low-income project?

The IRA also provided options for taxpayers to claim additional credit amounts as bonus credits (sometimes referred to as adders). The first two are available to all projects and are based on the source of the components used (domestic content) and the location of the project (energy community). For the ITC, those bonus amounts are each equal to 10% of the project basis (up to a maximum of 50%). For the PTC, such bonus amounts are equal to 10% multiplied by the credit amount. Additional credits can also be obtained through a competitive application program for certain ITC projects related to low-income communities. Such amount could be equal to an additional 10% or 20% of the basis of such project.

- Domestic content: To meet the domestic content bonus, a taxpayer must certify that any steel, iron, or manufactured product that’s a component of the facility was produced in the United States. This requirement is met if all steel and iron items that are structural in function are manufactured in the United States, but items such as nuts, bolts, screws, washers, clamps, etc. are exempt from this requirement as they aren’t structural in function. The taxpayer must also certify that 40% of the manufactured products used in the facility are produced or manufactured in the United States. Manufactured products are deemed to be those that are any article, material, or supply, whether manufactured or unmanufactured, that’s directly incorporated into an applicable project component.

- Energy community: The energy community bonus is met if the qualifying project is built on a brownfield site, a census tract that had either a coal mine close after 1999 or coal-fired electric generating unit retired after 2009, or a metropolitan statistical area or nonmetropolitan statistical area where at any time after 2009 the area had employment attributable to at least 25% to the extraction, processing, transport, or storage of coal, oil, or natural gas, and now has an unemployment rate at or above the national average unemployment rate for the previous year. A map is available to evaluate project eligibility for the energy community bonus.

- Low-income allocation: The low-income community bonus of 10% is only eligible for ITC projects that use wind or solar technologies and create an output of under 5mW. The project must also be in a low-income community or tribal land. Determination of whether the project is operated in a low-income community is made by referencing maps provided by the Department of Energy. Additionally, taxpayers are eligible to receive a 20% increase if the project is one that’s classified as a qualified low-income residential building project or economic benefit project. These bonus credits can only be claimed after first submitting an application with the Department of Treasury and receiving an allocation through a competitive process.

Bonus credits provide attractive incentives but may be difficult to achieve depending on the facts. For example, supply chain constraints may limit the ability to source sufficient domestic components for that bonus. The project location may also be influenced by other factors, which eliminate the ability to qualify for the energy community bonus.

Cash benefits: Who is the taxpayer, and how will the cash value of the credit be realized?

The PTC and ITC are both federal income tax credits that are claimed as general business credits under Sec. 38. In that sense, all taxpayers with federal income tax liabilities could benefit from such credits. However, the IRA also added two new credit monetization rules that dramatically increase the potential for others to benefit from these credits. The credit sale rules under Sec. 6418 allow business entities to sell the PTC and ITC to unrelated buyers in exchange for cash. Going further, the elective payment rules under Sec. 6417 allow tax-exempt entities, governmental entities, Indian tribes, and others to obtain a direct tax refund. Our monetization article and webinar expand on those options in greater detail.

The simple answer is that almost every business, organization, governmental entity, and Indian tribe has the potential to benefit from these tax credits given the expanded monetization options.

Documentation: What actions can be taken to maximize tax credit benefits?

The discussion above identifies a considerable amount of complexity. That begins with definitional questions about whether particular technologies are eligible for either or both of the ITC and PTC. The scale of the project may also trigger labor requirements related to prevailing wage and apprenticeship hours. Finally, obtaining bonus credits requires advanced planning in terms of siting the project and sourcing its components. In short, there are many items to review and document to achieve full the full ITC and PTC potential.

When considering a potential project, we recommend using the follow construct:

- Advanced planning is key. Several pitfalls await those who don’t carefully consider the technical rules in advance of a project. For example, failure to plan for apprenticeship hours may make it impossible to even satisfy even the good-faith effort exception.

- Accelerating project development may be necessary. The change in rules beginning in 2025 will render several types of ITC projects ineligible for credits unless construction begins before the end of the year. For projects currently in development, this may also require the acceleration of orders, foundation work, or similar actions.

- Develop contemporaneous documentation to avoid subsequent problems. Significant projects that trigger all of the rules will involve a corresponding need for considerable documentation. Some aspects can be documented at the conclusion of the project but others will be much more difficult (e.g., prevailing wage).

- A final credit study is key to defending against future scrutiny. Taxpayers pursuing ITC and PTC projects may generate sizable tax credits giving rise to cash refunds or proceeds from credit sales. In either case, there is expected to be a corresponding level of scrutiny from the IRS and credit buyers. To that end, a capstone credit study, which documents all aspects of eligibility is strongly recommended.