Are you using the Office of Management and Budget (OMB) 2023 Compliance Supplement to prepare for your audit? If not, it’s well worth adding to your resource toolbox. The Compliance Supplement is not only a critical document used by auditors to complete single audits, but it’s also a valuable resource for auditees because it helps explain the audit process and testing requirements that you’ll be subject to. You’ll also find information that provides valuable insights into certain OMB actions and decisions. It’s like having a front-row seat into the questions and testing you may expect during a single audit.

Being familiar with the contents of the Compliance Supplement is an essential part of a best-in-class control environment to administer federal grants. The latest version — applicable for single audits of fiscal years ending June 30, 2023, and after — was released on May 2, 2023. You can access the full 2023 Compliance Supplement here, but read on for our five key considerations.

1. Build America, Buy America Act

Effective May 14, 2022, a nonfederal entity is required to ensure that all applicable federal programs comply with Section 70914 of the Build America, Buy America Act, which includes a requirement that project awards include incorporation of a domestic content procurement preference for all federal financial assistance obligated for infrastructure projects. Compliance with the act will now be included in the scope of an auditor’s single audit testing, when applicable. If you’ve been informed of these requirements, such as through the award terms and conditions, you must comply with them. Since this is a new requirement, it would be beneficial to verify your organization’s understanding and compliance. Some federal agencies, in consultation with OMB, issued waivers for all or some of these requirements. You can find more information, including waivers by agency in detail at the General Services Administration’s (GSA) Made in America website.

2. Impact of National and Public Health Emergency ending

Throughout the COVID-19 pandemic, federal agencies issued substantial guidance outside the normal regulatory process for both new and existing programs receiving COVID-19 funding. Previous versions of the Compliance Supplement incorporated much of this guidance into Part 4 for significantly impacted programs. With the National Emergency ending on April 10, 2023, and the Public Health Emergency ending on May 22, 2023, some program flexibilities ended. Grantees are responsible for understanding the timing and impact of the end of the waivers and flexibilities, which could be substantial, and complying with any changes in grant administration needed because of the end of these emergencies.

3. Programs with higher risk designation

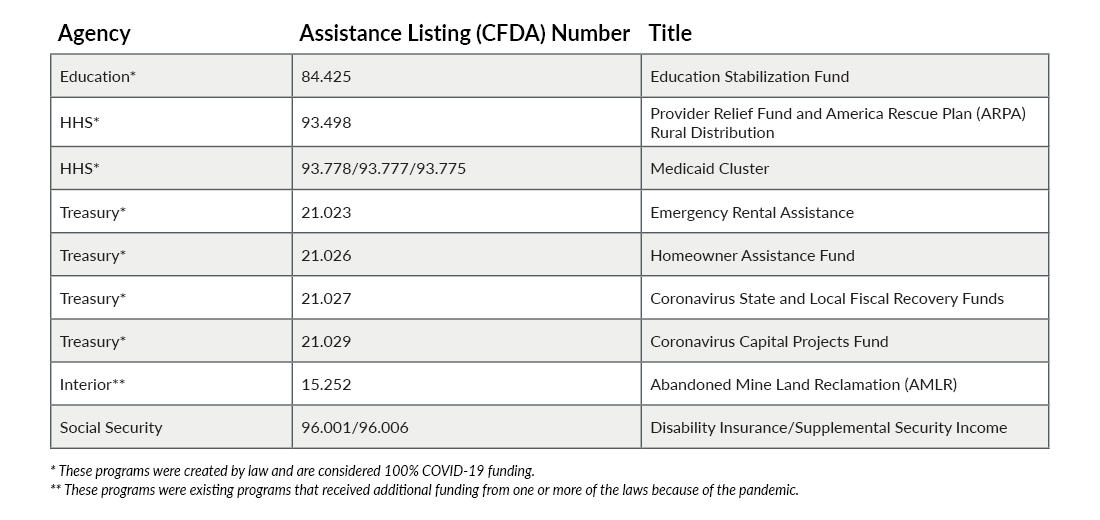

In accordance with the Uniform Guidance, the OMB has the authority to identify federal programs that are higher risk. This identification is only communicated via the Compliance Supplement. Due to the way auditors are required to select programs for testing during the single audit, be aware that programs that have been designated as higher risk will most likely be subject to detail audit procedures once the program expenditures reach a certain level. Knowing which programs these are could help you understand which ones might be selected by your auditors for testing.

The OMB has made changes to the programs that are designated as higher risk, and most continue to be associated with certain COVID-19 funding; however, there are a few new additions to the list related to non-COVID-19 programs and Infrastructure Investment and Jobs Act (IIJA) funding. These programs are shown below.

4. Federal Audit Clearinghouse (FAC) transition from Census to GSA

The platform for submissions of the Data Collection Form (DCF) is scheduled to transition from the Census Bureau to the GSA on Oct. 1, 2023. Accordingly, all 2023 fiscal year-end submissions must be held pending the opening of the GSA website. GSA has communicated that it expects the website to be up and running by Sept. 15, 2023. All DCFs for fiscal year-ends through Dec. 31, 2022, must be filed with the FAC on the current platform by Sept. 30, 2023. The current platform won’t be accepting submissions after Oct. 2, 2023, so it’s critical to file all DCFs for fiscal year-ends Dec. 31, 2022, and prior before this cut off. If you’ve drafted a DCF on the old site, but don’t complete it prior to the cutoff date, it won’t transfer to the new site and will need to be completely restarted using the GSA system.

5. Single audit due dates

Organizations are required to electronically submit the data collection form and the reporting package, including the auditor’s reports, within the earlier of 30 days after receipt of the auditor’s reports or nine months after the end of the audit period. Given that all DCFs for 2023 year-ends must be submitted through GSA and that portal isn’t yet available, complying with this 30-day requirement isn’t feasible. As part of the transition guidance, the 2023 Compliance Supplement includes clear instruction that all submissions with 2023 fiscal year-ends through Sept. 30, 2023, will be considered timely as long as they’re submitted within nine months of end of the fiscal period. While this may result in your organization submitting the DCF later than the timing in 2022, you should still complete your audit as planned, in time to complete the submission of the single audit and DCF when the GSA site is available.

Federal grant administration continues to evolve. Check out our 2023 Compliance Supplement and single audit update for more information to help you build a best-in-class control environment in your organization.