In June 2022, the Governmental Accounting Standards Board (GASB) issued a new standard to provide an updated framework to account for all types of compensated absences. The current standard, GASB 16, provides guidance specific to the type of leave and has become outdated. Employers currently provide leave types that weren’t contemplated when GASB 16 was originally issued, and there are many differences in the way absences are handled by individual governments.

GASB 101, Compensated Absences, replaces GASB 16, Accounting Compensated Absences. The goal of the standard is to create a more consistent model for accounting for compensated absences that can be applied to all types of compensated absence arrangements.

Calculating and recording liability

The new guidance introduces three criteria for recording a liability in financial statements prepared using the economic resources measurement focus (often referred to as a “full accrual” basis). A liability should be recognized for leave that has not been used if all of the following are true:

- The leave is attributable to services already rendered.

- The leave accumulates.

- The leave is more likely than not to be used for time off or otherwise paid in cash or settled through noncash means (likelihood of more than 50 percent).

Similar to current guidance, governments should use the rate of pay in effect as of the balance sheet date when calculating the liability. An exception would be when a compensated absence arrangement calls for a different rate of pay at the time of payment. This doesn’t require a government to estimate an employee’s future rate of pay, but rather applies when stated adjustments to an employee’s payment amount are referenced in the arrangement (e.g., sick pay being paid at 50% of the employee’s actual pay rate).

GASB 101 also carries forward the guidance from GASB 16 that states that the calculated compensated absence liability should also include salary related payments. This could include the employer’s share of payroll related taxes, required employer contributions associated with defined contribution pension, and other post-employment benefit plans.

Key differences between GASB 16 and GASB 101

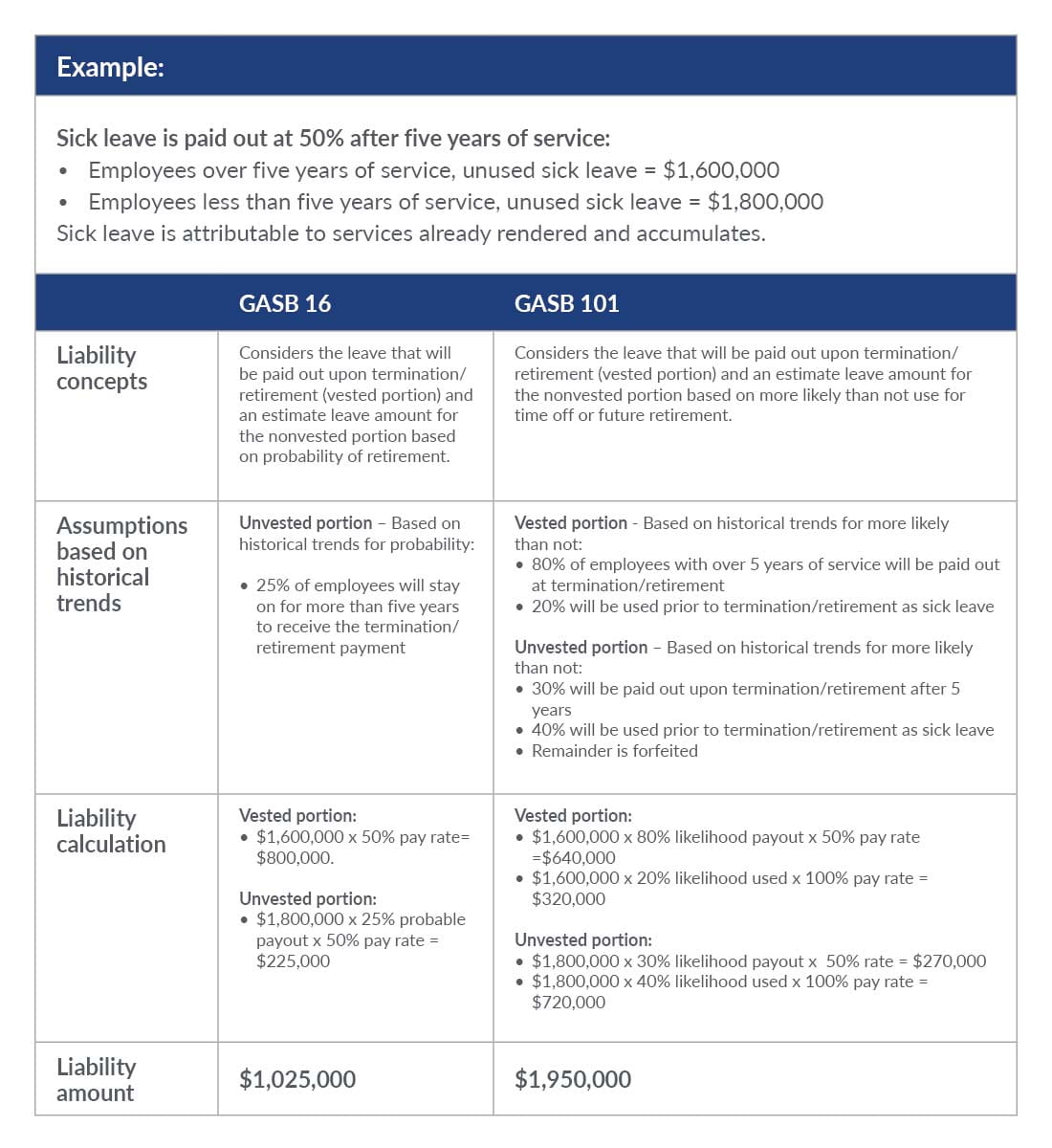

The main difference between current guidance and GASB 101 is the pivot from a rules-based approach to a conceptual framework approach. For example, under GASB 16, governments have two options in accounting for sick leave, both of which only require the government to accrue for sick time that will be paid in the form of a termination payment (but not for the future use of sick time already earned). Under GASB 101, sick leave will be calculated in the same manner as any other type of compensated absence. The following example compares the accounting for sick time under GASB 16 compared to GASB 101:

As noted in this example, the liability for sick leave increases under GASB 101. Governments are required to accrue for time that has accumulated and is likely to be used, even if the employee will never be eligible for a termination payment related to unused time. This wasn’t a requirement under GASB 16. In addition, the threshold for when to recognize a liability related to expected future payment (or use under GASB 101) decreased from “probable” (likely) to “more likely than not” (likelihood of 50% or higher).

Governments will have to make an assessment to support the percentage of employees in the nonvesting population. The assessment should include reviewing employment policies related to:

- Compensated absences.

- Historical information about leave usage patterns, payments upon termination of employment, and forfeitures of leave.

- Information about current and expected future eligibility.

The new standard also removes the current requirement to disclose both the gross additions and deductions to the liability. Instead, the entity is only required to disclose the net change. The requirement to disclose which funds are typically used to liquidate compensated absence liabilities is removed.

Start planning early

We recommend reviewing this guidance and comparing it to the government’s existing policy and current liabilities recorded. This will ensure governments understand the impact upon implementation for fiscal years beginning after Dec. 15, 2023. Early adoption is permitted.