The Inflation Reduction Act (IRA), enacted in Aug. 2022, provides wide-ranging incentives supporting the clean energy transition for the U.S. economy. This included both the creation of new tax credits and significant modifications to existing tax credits and incentives. One of the significant changes involves the Section 45L New Energy-Efficient Home Credit. The enhanced version of Section 45L increases the benefits of the credit and provides additional flexibility to the developers and contractors wishing to claim it.

The basics of the Section 45L tax credit

The Section 45L New Energy-Efficient Home Credit allows a federal tax credit to eligible contractors that build new residential units in the United States that meet certain criteria. To claim the credit, eligible contractors must construct a qualified energy-efficient home and sell or lease it for use as a residence. Generally, eligible contractors that meet these requirements are then eligible to claim a one-time, per-unit credit in the tax year the residence is sold or leased. For the purposes of Section 45L, an eligible contractor includes the person who constructs the home or manufactures the manufactured home.

Qualified units include apartments, condominiums, assisted living facilities, student housing, townhomes, and single-family homes. The credit is available for new construction and for buildings that have undergone “substantial reconstruction and rehabilitation.”

A fundamental aspect of Section 45L is energy efficiency, so qualifying homes must satisfy specific energy savings standards. As such, contractors who want to claim the credit need to follow specified procedures to certify the units in question. Once these hurdles are cleared, the credit can result in significant savings for businesses, especially those that develop multiple units during the year.

What changes were made to Section 45L?

The IRA made the following changes to Section 45L, which are applicable to dwelling units acquired after Dec. 31, 2022:

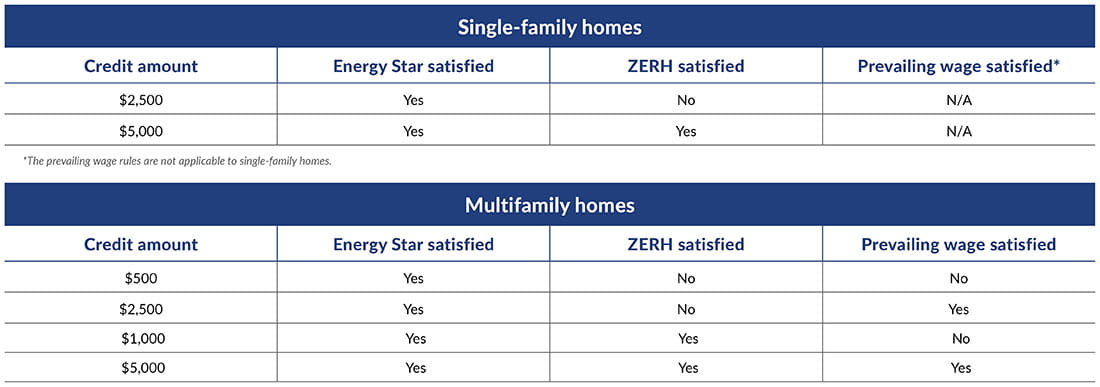

- Increased Section 45L credit amount: Prior to 2023, eligible contractors could receive a one-time per-unit credit of either $1,000 or $2,000, depending on the applicable energy standards. Starting in 2023, there are four types of per-unit credit amounts – $500, $1,000, $2,500, or $5,000 – that turn on the type of home and the requirements that are satisfied. New single-family homes certified under the ENERGY STAR standards will be eligible for a $2,500 tax credit. That amount will jump to a $5,000 credit per home if the single-family units are also certified under the Zero Energy Ready Homes (ZERH) Program. On the other hand, the credit for multi-family homes is subject to a 5x multiplier depending on whether the eligible contractor meets certain prevailing wage (PW) requirements. Multi-family homes that meet ENERGY STAR requirements will receive a credit of $500, jumping up to $2,500 when the PW requirements are met. Similarly, multi-family homes that meet the ENERGY STAR and ZERH requirements will receive a credit of $1,000 that is increased to $5,000 when the PW requirements are met.

- Modified energy savings requirements: Prior to the enactment of the IRA, qualified new energy-efficient homes were generally required to demonstrate reduced energy consumption as compared to international standards (2006 International Energy Conservation Code). The modified version of Section 45L now relies upon ENERGY STAR and ZERH programs to establish the required levels of energy efficiency. While the standards differ between programs, the general goal of both standards is to construct homes that are energy-efficient in nature.

- Prevailing wage requirements: Essential to an increased Section 45L credit for multi-family homes is the satisfaction of prevailing wage requirements. Under such rules, any laborers and mechanics employed by the taxpayer or any contractor or subcontractor in the construction of any qualified home must be compensated at minimum hourly wages established by the Secretary of Labor. Prevailing wages are defined as “rates not less than the prevailing rates for construction, alteration, or repair of a similar character in the locality in which such facility is located.” This standard must be met by all contractors and subcontractors involved in a project. Note however, unlike similar credits included in the IRA, satisfaction of additional apprenticeship rules is not required for an enhanced credit under Section 45L. The IRS has released initial guidance interpreting these rules in Notice 2022-61, and the specific wage data is maintained by the Department of Labor.

- Mid/high-rise projects: Prior to the IRA, multi-family homes in buildings that were over three stories were ineligible for the Section 45L credit. Under the modified rules, structures are allowed to be over three stories, thus qualifying mid-rise and high-rise structures for the credit.

- Coordination with other tax credits and incentives: The IRA made changes for energy-efficient home credits that allow coordination with other tax credits and incentives. For example, in some circumstances the Section 45L tax credit can now be combined with the Section 179D energy efficient commercial building deduction. Additionally, taxpayers will not be barred from claiming other tax credits under the new rules, such as low-income housing tax credits and other similar credits.

How to take advantage of the modified Section 45L rules

The modified Section 45L rules are expected to increase interest from taxpayers in claiming the credit for years to come. As such, eligible contractors should consider several key issues as they navigate the construction of energy-efficient homes.

- Certification: To qualify for the credit, an eligible contractor must engage an “eligible certifier” that’s not related to the contractor and is accredited or otherwise authorized by the Residential Energy Services Network or an equivalent rating network. The certifier completes on-site testing and uses IRS-approved software to create a computer model that verifies the energy-efficient properties of the construction. The certifier then prepares a package that declares under penalties of perjury the certifier’s belief that the facts presented in the certification are true, correct, and complete.

Consequently, certification can be a costly and timely process. From start to finish, a full certification can require many inspections and significant coordination with the eligible certifier. Therefore, eligible contractors looking to claim the Section 45L credit should consider the cost-benefit analysis of completing the certification in comparison to the ultimate Section 45L benefit.

- Documentation: The IRA generally includes many tax opportunities for a wide spectrum of individuals and organizations. Given the potentially lucrative nature of these benefits, we anticipate a corresponding level of IRS scrutiny in the future. As such, eligible contractors should ensure proper documentation and substantiation of all tax positions relating to Section 45L. To ensure proper compliance, all related construction information, certifications, and other appropriate records should be maintained. This can be especially true when considering enhanced credits under the prevailing wage rules.

- Who can claim the Section 45L credit? Historically, taxpayers have raised questions around who may be considered an "eligible contractor” for purposes of Section 45L. The question is often considered in the context of whether a contractor or developer is eligible for the credit when both are involved in the construction of an otherwise eligible home. The statutory language of Section 45L states that an eligible contractor is the person who constructed the qualified new energy efficient home. Further, the rules provide that in order to claim the credit, eligible contractors must construct the home and sell or lease it to another party. A developer is more likely to satisfy this standard since it will often be the party that sells or leases the home to the resident. However, not all fact patterns are clear-cut.

- Section 45L guidance: Recently, the IRS published Notice 2023-65, which outlines the rules associated with the modified Section 45L credit. This includes guidance about the documentation and certification rules required for full compliance with Section 45L. Furthermore, it makes clear that energy saving benchmarks must be met at both the local and national level. As taxpayers work to generate and claim this credit, it will be imperative to follow and stay up to date on the strict guidelines set forth in this guidance.

- Claiming the Section 45L Credit: One of the most anticipated pieces of the IRA legislation involves the options available to taxpayers to monetize the various energy related tax credits. To that point, the IRA generally includes three options for monetization of tax credits through 1) a general business tax credit, 2) elective/ direct payment, and 3) through the sale of credits. Unfortunately, the Section 45L credit is one of the few credits included in the IRA that only allows for one monetization option. Namely, taxpayers must claim the credit as a general business-related credit under Section 38. Therefore, eligible contractors looking to claim a Section 45L credit must have a tax liability for the tax year in question and are required to claim the credit on Form 3800.

To learn more about how you might qualify for the Section 45L new energy-efficient home credit, please contact your Plante Moran advisor. Have additional questions on how IRA tax credits, incentives, and monetization options could impact your organization? Explore more from our tax leaders as they track the latest developments.