Ask a wealthy person what success means to them and the answer will usually go beyond business or professional achievements to include a thriving and prosperous family. But when it comes to money — the foundation of family prosperity — preparing the next generation can seem more challenging than creating the wealth in the first place.

Start early for a solid financial education

When preparing future generations to become good stewards of family wealth, one of the most frequently asked questions is, “When and how do we start talking to our kids about our money?” The answer in most cases is, “Yesterday!” You can never start too early. In fact, experience shows that the older the kids are when you start, the harder the potential challenge ahead. If the wrong behaviors are established, they can be really hard to break and future progress toward good lifetime habits is often diminished.

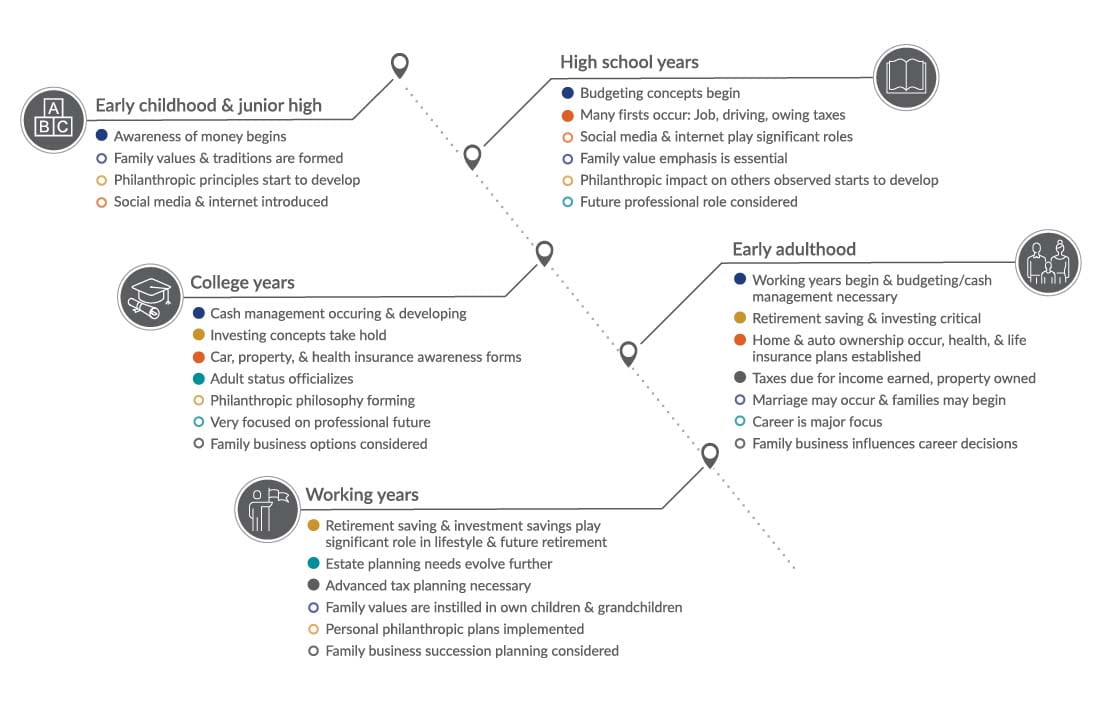

In terms of “how,” the approach to raising financially literate children is essentially the same as it was years ago — start early and introduce concepts and skills that are suitable for different stages of maturity, whether a young child, a teenager, college grad, or young working adult. There are multiple priorities at each stage, but keeping to a simple approach and keeping it relevant to their current interests will be the most effective.

The chart below identifies a timeline based on age groups with some recommended areas of focus.

When considering activities to reinforce these concepts, look for simple and straightforward ideas that make learning the principles and skills a natural part of your everyday life. For example, school-age children could collaborate on a family history project that includes a homemade family tree with old pictures and a simple timeline and present it at a family get-together. This opens the door to sharing stories from multiple perspectives and generations that demonstrate the family’s history and values.

As kids learn to handle money, “spend, save, share” is a helpful budgeting tool that encourages them to divide their funds into three buckets: one to spend, one to save, and one to share (think philanthropy — something that helps someone in need). As they get older, a “tax” bucket can be added as preparation for that first paycheck that becomes a reality for many during high school and college.

Recent college grads could prepare a plan for investing in their first 401(k)s, perhaps by pairing them with a financial advisor of a similar age to work through the aspects of long-term financial planning. This may also be a good time to introduce inheritance, estate planning concepts, and create their first will.

As the kids move into their 30s and beyond, it may be time to deepen participation in family enterprises such as a business, an investment committee, or foundation board — situations that require application of advanced decision-making and real-world financial skills.

Whatever the age, always look for opportunities to take moments with your children to have conversations about money and couple them with discussions around family history, expectations, roles, and purpose. Doing this will exponentially increase the likelihood of a flourishing family with a solid, multigenerational, financial foundation.

A proven approach for establishing good financial literacy

When teaching your kids about money, the “theory, example, and application” method is well proven. The first step is to explain the financial concept, illustrate it with an example, and then provide a real-world opportunity to apply it in some way. This “theory-to-practice” approach helps kids internalize the correct behaviors and cement good habits in place. For example, say you wanted to teach your child about saving part of their allowance. You’d first explain the concept of saving, then give the money to them and apply the lesson by taking them to the bank and completing the process of putting it away in a safe place.

Over time, this conversation will naturally expand to include the pros and cons of various spending behaviors, income, budgeting, investing, and borrowing — critical behaviors that require ongoing management when the kids come of age.

Tips for a successful financial education

It’s important to recognize that financial literacy isn’t a “check-the-box” list of providing technical information — it’s an ongoing process of values-based experiences that influence a child’s perception of wealth, risk, and responsibility. Without the values of moderation and financial prudence and discipline it won’t have the powerful outcomes that are possible. To ensure maximum success, consider the following:

- Set boundaries. No matter the age, boundaries are important. You’ve probably done this with younger children by reinforcing bedtimes and limiting consumption of sweet treats, etc. The need for boundaries is important and easily expanded to financial literacy.

- Practice delayed gratification. Parents that don’t always give in to the lollipop at the store or who require their teenager to pay for their car insurance are intentionally building character through delayed gratification. The value of limiting excess pays dividends down the road.

- Allow kids to make mistakes. Some of the most deeply felt and longest lasting lessons come from mistakes. The most successful families support and love their kids, but gently allow them to misstep and learn from the mistakes. Providing opportunities to learn, respectfully disagree, and make mistakes are all part of preparing successful children.

- Be mindful of other influences. Kids today are navigating competing messages from peers, social media, and advertising. Families with strong communication and open dialogue will create a consistent and stable voice amid all the noise.

- Model good financial behaviors. What’s the best way to create a habit or change a habit in your kids? Model it. Kids are always watching, and rest assured they’re paying attention to your behaviors around money. Model your values, moderation, and financial prudence.

Final thoughts

The key to success with financial literacy is the time and attention you commit to the process as a parent or role model. Start as early as possible with age-appropriate activities and concepts, and give children the ability to try out what they’re taught. If you haven’t begun yet, there’s always a place to start regardless of age, and the good news is you’re probably already doing a lot of things that count toward this. It takes some work now, but the lifetime payoff is potentially huge for your kids.