In spite of the ongoing social, health, and economic issues related to the COVID-19 pandemic, capital markets have proven resilient; they’ve been a bright spot over the last 12–15 months. From Jan. 1, 2020 through April 30, 2021, the S&P 500 Index gained more than 32%, and most major global equity indices were up double digits. Despite their recent pullback due to increases in long-term interest rates, bonds returned 3.5%, as represented by the Bloomberg Aggregate Index, over the same period.

Unfortunately, institutional investors and not-for-profit organizations looking back on recent investment performance may not be as happy with their results as the headline numbers would suggest. 2020 was a great reminder of the phrase, “Successful investing doesn’t have to be complicated, but that doesn’t mean it’s easy.”

Here are a few “simple, but not easy” investment principles and strategies that proved their worth once again last year.

Rules-based rebalancing

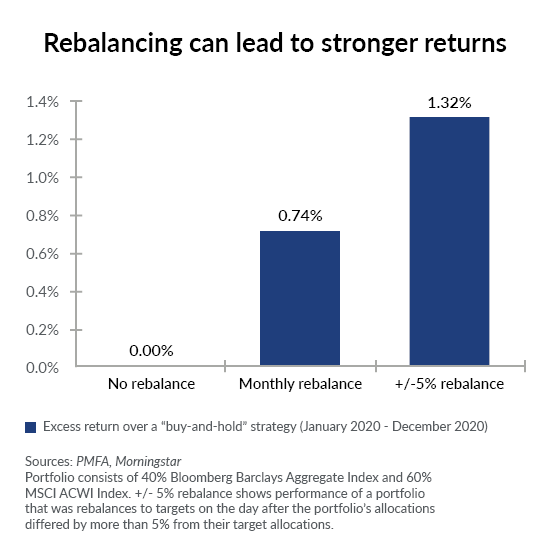

Rebalancing, or selling assets that are above their target allocations to buy assets below their targets, helps investors maintain a consistent level of risk over time. Any investment policy should have guidelines for how to rebalance and when it should be considered. One common method used is regularly rebalancing a portfolio at set intervals of time, such as monthly or annually. Research shows that regular rebalancing can lead to better investment outcomes relative to a “no-rebalancing” strategy.

Another method is rules-based rebalancing, which uses asset allocation ranges to define thresholds where rebalancing should occur. For example, let’s say you set a range of +/- 5% from the target allocations to equity, fixed income, or alternatives. As long as the portfolio stays within those ranges, there is no need to rebalance. Once an asset class deviates from its target by more than 5%, that would trigger a rebalancing opportunity.

One advantage of rules-based rebalancing is it reinforces a “buy-low, sell-high” mentality, as the thresholds are usually only met after periods of significant market performance. In 2020, investors using the example above likely would have reached their rebalancing thresholds in mid-to-late March, indicating to sell bonds and buy stocks. With the benefit of hindsight, we now know that was an excellent time to be buying into equities, which is often the case after a significant drawdown. But in the moment, when the stock market was regularly experiencing daily swings of 5% or more and much of the global economy was shutting down, it’s never easy to make that decision. Having a rules-based rebalancing policy in place can provide the discipline needed to execute on your plan during difficult times.

Avoid the temptation to time the market

As mentioned earlier, capital markets have done very well since the beginning of 2020 when looking at the year-end results and trailing performance. However, a closer look at returns reveals a number of trends and reversals that could have easily derailed many investors:

- In February and March 2020, the S&P 500 fell 20% in 22 days — the fastest “bear market” in history — ultimately resulting in a drawdown of more than 30% from peak to trough by March 23. Investors looking to avoid further losses by selling out of stocks would have then missed out on the fastest “bull market” in history, as the S&P 500 took just 16 days to gain 20% from the bottom and continued to rally through the remainder of the year.

- Growth stocks vastly outperformed value stocks during the first three quarters of 2020. That dynamic shifted meaningfully over the next two quarters as value stocks outperformed.

- Similarly, U.S. large-cap stocks performed better than small-cap stocks during the initial stages of the pandemic. This trend also reversed around the start of Q4 2020.

Like most things in investing, market leadership tends to be cyclical. It’s very difficult to see the inflection points without the benefit of hindsight. Instead of chasing returns, which more often than not can lead to disappointing results, institutional investors are better off sticking to the discipline of a long-term, diversified portfolio approach.

Know your financial risks and plan accordingly

One of the most common questions from not-for-profit organizations with unrestricted assets is “how much should I have in cash and short-term reserves vs. long-term investments?” Most organizations default to a rule of thumb, such as holding three to six months of expenses in cash, and for some, that may be a reasonable answer.

However, no rule of thumb is going to cover all situations and every organization should go through a process to determine an appropriate amount of short-term reserves. The details of this process are beyond the scope of this article, but should broadly include forecasting cash flows for a period of at least one year, assessing potential financial risks such as revenue shortfalls or cost increases, and developing an investment plan for these short-term reserves that can mitigate those risks.

For example, say you’re a not-for-profit organization that derives a majority of its revenue from one event, like an annual gala or convention, or even multiple events throughout the year. With social distancing requirements and the cancellation of nearly all public events, this would have had a significant effect on revenue during the year that may have caused financial strain without sufficient reserves on hand.

Any not-for-profit organization can implement these strategies to set up their portfolios for investment success. While establishing these plans and setting guidelines will take time and effort, the benefits of doing so tend to shine in periods of market volatility, when making investment decisions may otherwise seem difficult.

From that perspective, investing is often compared to exercising and physical fitness. Most people know what they need to do to be successful and achieve their goals, but it’s not easy to stay on track over the long run. That’s where a trusted professional — whether it’s a personal trainer or investment advisor — can provide extra support and “simple, but not easy” strategies to guide you along the way.

Feel free to contact us if you’d like to make sure your institution’s investment strategy is on track.