Your business may be surviving in a post-lockdown world, but as we’ve seen, the only constant is change. In addition to pandemic- and climate- related disruptions, the invasion of Ukraine by Russia (and the sanctions that followed) are the latest disruptors impacting supply chains globally. As you navigate assured uncertainty ahead, understanding your costs and margin performance can mean the difference between success and failure.

Having an accurate picture of your costs, key drivers, and margin performance will help answer the crucial questions your company will be faced with, including:

- What can I expect in terms of margin performance and working capital requirements?

- Where are we making money and losing money?

- What’s my true cost to produce?

- Why is my organizational profit in the red, while my product level margins appear to be in the black?

- Why do we continue to attract lower volume and higher complexity business, while struggling to land higher-volume opportunities?

- How low can I go when quoting so I can keep the doors open in the short-run?

No matter what happens next, robust and flexible cost and margin data will help you make bolder, solid decisions — the kind of decisions that help you thrive despite uncertainty. Follow the guidance below to uncover opportunities and move forward with coolheaded confidence.

Know what cost and margin question you’re trying to answer

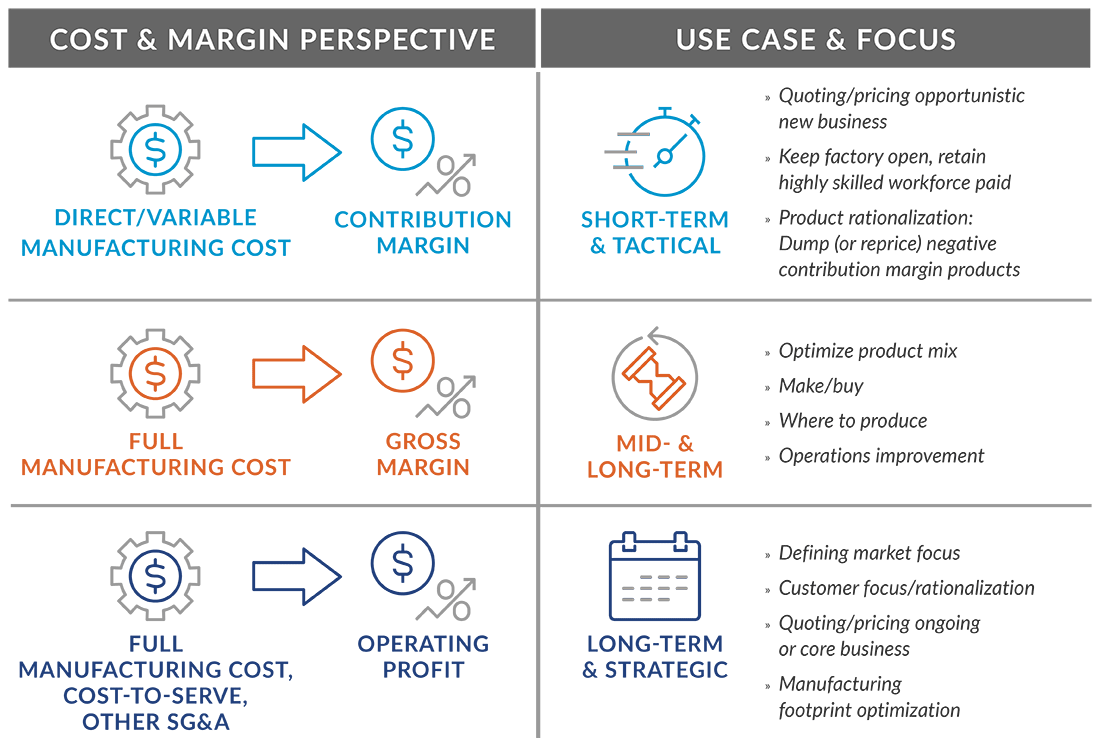

There’s more than one right answer to the question of “What’s my cost or margin?” The most empowering answer depends on the decision at hand. Is your current focus primarily short-term and more tactical? Or long-term and more strategic? Select the appropriate cost and margin perspective to address the decision at hand properly. In an economic downturn, our focus tends to shift to more short-term, tactical challenges, but we can’t ignore the longer-term strategic needs of the organization either. The following table provides some examples of the cost and margin perspective that’s typically most relevant for various use cases.

Ensure your underlying cost data is sufficiently accurate

Many companies struggle to produce timely, accurate cost information, particularly at a product level. From bills of material (BOMs) and production routings to labor productivity and overhead rates, the source data that is used to generate product cost information is often poorly maintained and improperly calculated. This data doesn’t need to be perfect, but it does need to reflect your actual operational practices and performance with reasonable accuracy. Discipline and accountability, as well as the pragmatic application of industry best practices in costing methodologies, will get you there.

Scenario planning for the aftermath

Economic downturns and disruptions will often mean making tough but critical decisions about labor and expense cost adjustments, aggressive pricing on new work, and product and customer rationalization, to name a few. Each of these decisions require an accurate understanding of costs and margins, with the ability to model and evaluate multiple scenarios. What if the economy rebounds quickly? What if we see significant spikes reflecting pent up demand in certain segments? What if it’s a long, slow recovery? What if the recovery is “lumpy,” where demand returns in fits and starts? Each of these scenarios demand different responses from management to ensure the necessary resources (cash, people, machine capacity, supply chain, and so on) are in place to optimize the company’s financial performance and market position.

Position yourself for success, no matter the turnout

As we said, your success in a disrupted world likely hinges upon your ability to ask the right questions to get the right answers. Bold thinking during a recession is tricky business, and leaders are faced with difficult choices. The good news is, you don’t have to fly blind. Accurate and relevant cost and margin information, flexible analytics, and iterative scenario modeling can help ensure your business decisions produce optimal results. Our cost and margin experts are here to guide you through economic uncertainty and disruption. Contact us to learn how we can help you take data-driven action to recover from disruption, survive the recession, and adjust to a radically changed world. Stay tuned for more articles like this one.